Global trade barriers and increasing expenses lead to Japan's initial economic downturn after six consecutive quarters of growth

- Japan's Q3 2025 economy contracted 1.8% annually, first decline in six quarters, driven by 0.4% GDP drop and weak private consumption amid global trade tensions and domestic cost pressures. - Nexon Co. defied downturn with ¥118.7B revenue and 61% growth in MapleStory, showcasing digital innovation's resilience despite broader economic headwinds. - BOJ faces balancing act as growth wanes, with U.S. tariffs and rising energy/food costs constraining domestic demand while capital spending remains supported b

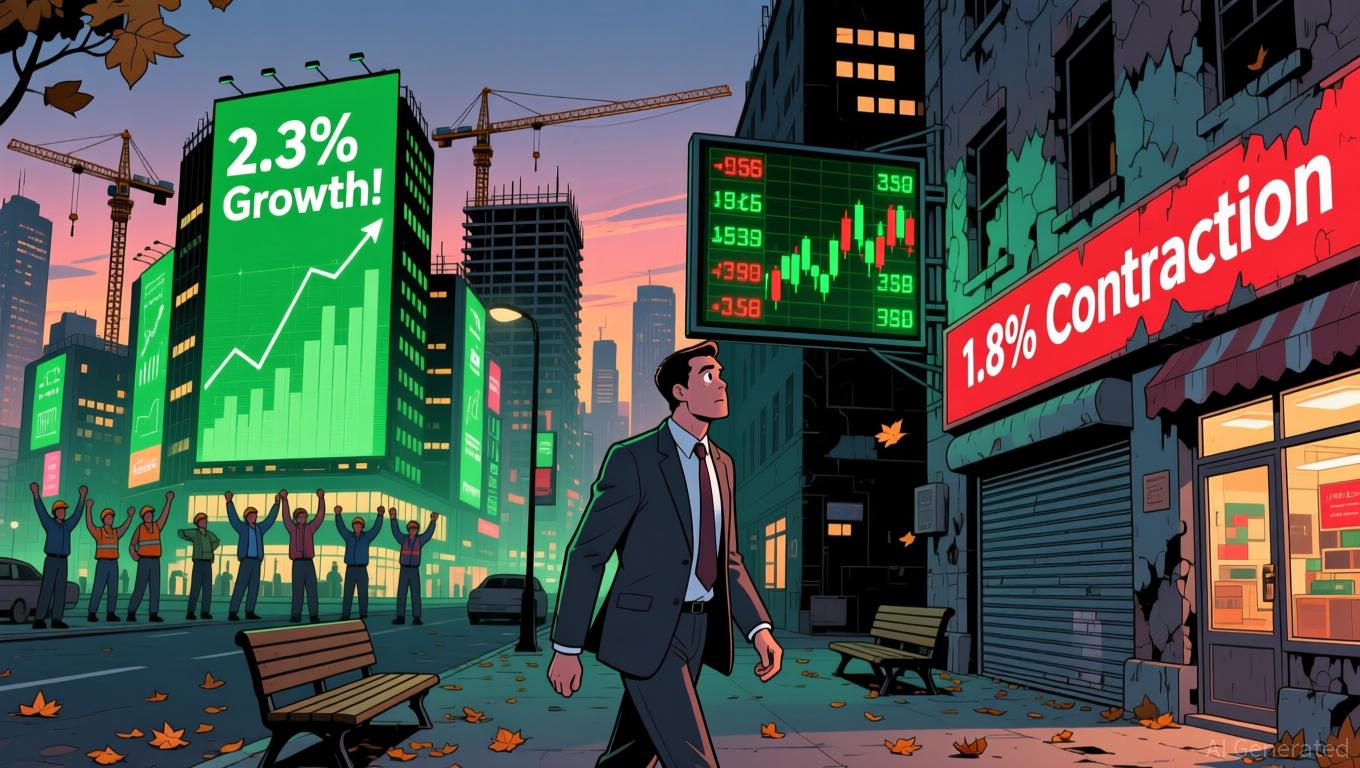

Japan's economy shrank by 1.8% on an annualized basis in the third quarter of 2025, ending a streak of six consecutive quarters of growth. This downturn highlights increasing threats to the country's recovery as it faces both international trade disputes and rising domestic costs

The economic contraction stands in contrast to the results of some Japanese companies. Nexon Co., a major player in the online gaming industry,

Experts caution that the GDP contraction could make it harder for Japan to achieve sustainable growth. The nation’s heavy dependence on exports leaves it exposed to shifts in global trade,

The BOJ’s future policy decisions may depend on whether this downturn proves to be a short-term issue or points to more fundamental problems. While the 1.8% annualized decrease in Q3 was less severe than some had feared, the government’s recent stimulus actions—including rice subsidies and energy price support—might need to be broadened to prevent a deeper slump.

Currently, attention is centered on

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fosun's Visionary Move: Digital Assets Propel Insurance Toward a Technology-Enabled Tomorrow

- Fosun Finance's Minsheng Life Insurance launched a virtual asset-linked insurance product, expanding into alternative assets via regulatory-approved "Finance + Technology" integration. - The product secures upfront regulatory approval to mitigate risks, contrasting with India's strict virtual compliance requirements and positioning Fosun to lead digital finance innovation. - Competitors like Hillhouse Capital and Axis Max Life Insurance pursue traditional equity strategies, while Fosun's blockchain-drive

Legal Team Portrays Pardon as Protective Measure Amid 'Crypto Crackdown'

- Binance founder CZ's legal team denied "pay-to-play" claims, asserting his 2025 pardon followed standard procedures and regulatory review. - Attorney Teresa Guillén rejected ties to Trump's crypto ventures, calling allegations "false" and emphasizing Zhao's case was regulatory, not criminal. - Critics like Sen. Warren accused Trump of corruption over World Liberty Financial ties, while the White House defended the pardon as routine presidential authority. - Legal scholars called the pardon "unprecedented

Cardano News Update: DeFi Faces $6M Setback as Low-Liquidity Pools Consume Major ADA Trade

- A dormant Cardano wallet lost $6M via extreme slippage in an illiquid USDA stablecoin pool, spiking its price to $1.26. - The trade exposed risks of large swaps in underfunded pools, flagged by on-chain investigator ZachXBT as a "textbook" liquidity trap. - USDA's $10.6M market cap couldn't absorb the 14.4M ADA swap, costing traders $8 per token and wiping $6.05M in value. - The incident highlights DeFi's slippage risks, with analysts urging better safeguards for high-risk trades on decentralized exchang

Bitcoin News Today: Bitcoin Faces Crucial $94K Threshold: Will It Hold Steady or Plunge Further?

- Bitcoin tests critical support near $94,000 as technical indicators signal bearish momentum amid Fed policy uncertainty and liquidity strains. - Record $463M BlackRock ETF outflows and $1.1B total redemptions highlight worsening market sentiment and institutional distress. - Analysts split between bear market forecasts through 2026 and potential stabilization near $94,000 tied to 6-12 month holder cost bases. - Key resistance at $103,000 remains pivotal - a sustained break could reignite bullish trends w