Key Market Information Discrepancy on November 17th - A Must-See! | Alpha Morning Report

1. Top News: Crypto "Bear Market" Intensifies, Bitcoin Wipes Out Year-to-Date Gains, Ethereum Teeters Near $3,000 2. Token Unlock: $ZK, $SOLV, $APE

Featured News

1.Crypto "Bear Market" Intensifies, Bitcoin Wipes Out Year-to-Date Gains, Ethereum Teeters Near $3000

2.ZEC Market Cap Surpasses $11.6 Billion, Ranks 15th in Crypto Market Cap

3.Market Awaits Fed Meeting Minutes to Reveal Interest Rate Outlook

4.DASH Surges Over 22% in 24 Hours, Currently at $96.75

5.BANANAS31 Market Cap Exceeds $37 Million, 24-Hour Gain of 54%

Articles & Threads

1. "Exclusive | BitDeer: From Bitcoin Miner to 'AI Landlord'"

Initially, no one expected that the true bottleneck of AI was not capital, not large models, but electricity. With long-term full-load training and AI inference running 24/7, a problem emerged: insufficient electricity, forcing chips to sit idle. Over the past decade, the U.S. has relatively lagged in electric grid infrastructure, with new large loads and grid connections taking 2–4 years, making "readily available electricity" a scarce commodity across the industry. Generative AI has brought to the forefront a raw and harsh reality: it's not the model that's lacking, it's electricity.

2. "Will Bitcoin Rise or Fall Next Year? Institutions and Traders in Heated Debate"

After experiencing a rapid plunge on "10.11" [October 11th] and facing consecutive blows from the November U.S. government shutdown, the crypto market has become somewhat skittish. What's even more anxiety-inducing is the serious disagreement among traders and institutions about the market's future direction. Galaxy Digital just slashed its year-end target price from $185,000 to $120,000, but JPMorgan remains steadfast: in the next 6–12 months, Bitcoin could reach $170,000.

Market Data

Daily Marketwide Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

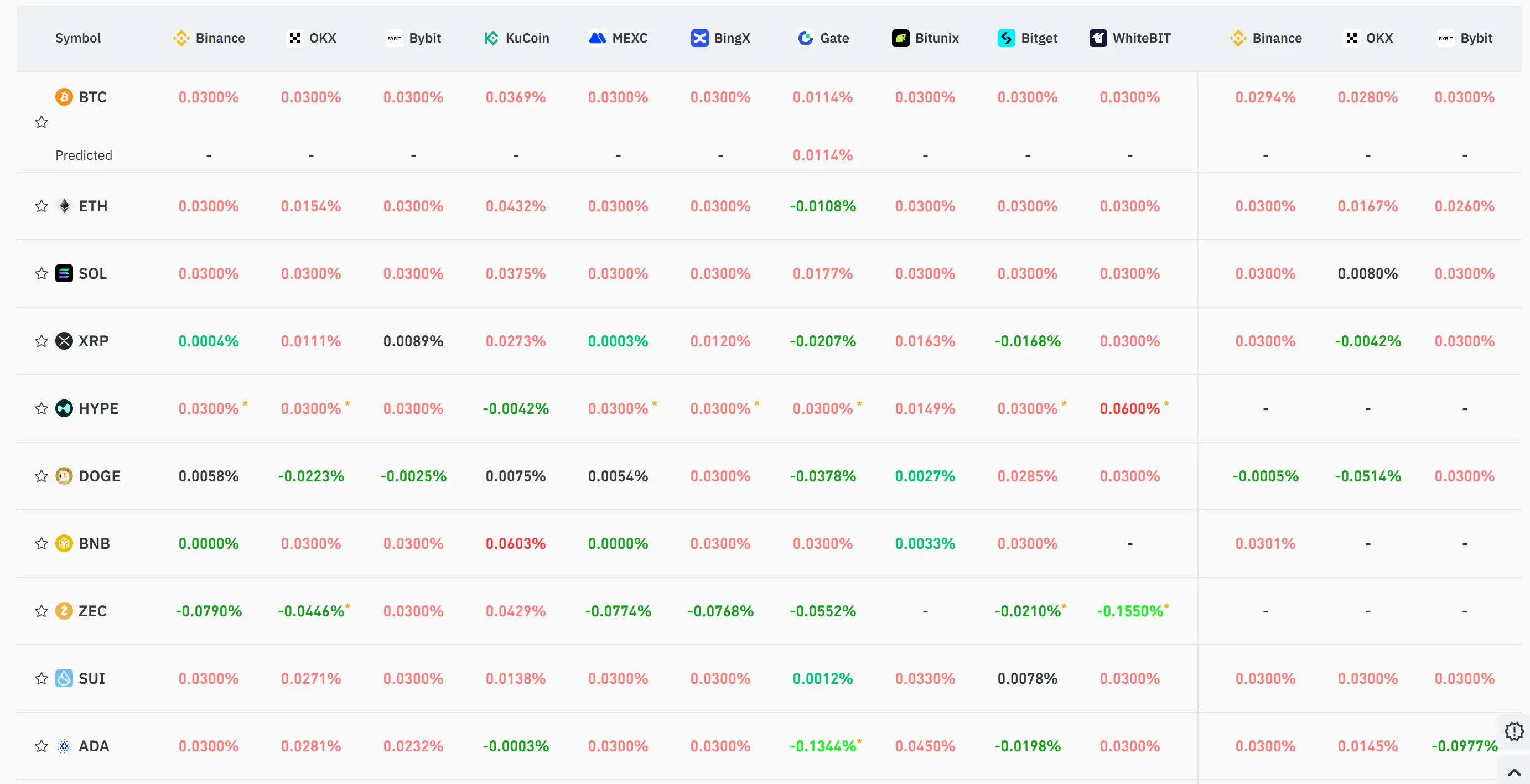

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Disciplined implementation surpasses innate ability in the 2025 business environment

- 2025 corporate success highlights disciplined execution over talent, with firms like Docebo and Allianz outperforming through operational rigor and innovation. - Docebo maintains LMS growth via AI integration and cost optimization, while SUNation Energy boosts sales through strategic diversification and cost cuts. - Allianz achieves record ROE (18.5%) via cost discipline, and Shiseido adopts AI/digitalization to address inventory challenges in declining beauty markets. - Legence gains analyst optimism de

Vitalik Buterin's Support for ZKsync: Driving Institutional Embrace of Zero-Knowledge Scaling

- Vitalik Buterin endorses ZKsync's Atlas upgrade, boosting Ethereum scalability and liquidity infrastructure. - Atlas enables 15,000 TPS, real-time Ethereum liquidity access, and 70% lower fees, driving $3.5B TVL growth. - Deutsche Bank and Sony adopt ZKsync for cross-chain solutions, while ZK token's 50% price surge reflects institutional confidence. - ZK Layer-2 market projected to grow at 60.7% CAGR to $90B by 2031, fueled by Ethereum's ZK rollup strategy and institutional adoption.

World’s Highest IQ Holder Predicts Bitcoin to Hit $220K In Next 45 Days

Cardano Holder Accidentally Loses $6M After Swapping ADA in Illiquid Pool