Date: Mon, Nov 17, 2025 | 04:40 AM GMT

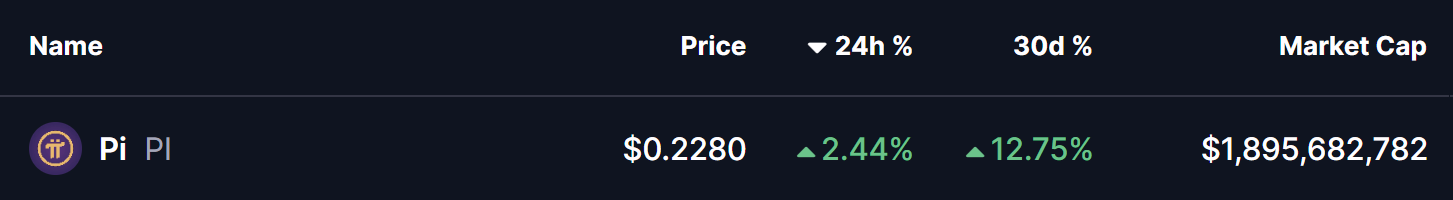

In the broader altcoin market, Pi Network (PI) has remained resilient despite heightened volatility. Over the past 30 days, Ethereum (ETH) has declined more than 17%, now trading near the $3200 mark.

Meanwhile, PI has climbed 12%, maintaining modest gains today — but the standout factor is the clear harmonic pattern taking shape, which hints that a potential upside move may be developing soon.

Source: Coinmarketcap

Source: Coinmarketcap

Bearish Bat Pattern in Play

On the 4-hour timeframe, PI appears to be forming a Bearish Bat harmonic pattern, a structure known for identifying potential reversal zones once the final leg (Point D) completes.

The pattern began at Point X near $0.2857, followed by a sharp sell-off toward Point A, a recovery into Point B, and a second corrective leg into Point C around $0.2101. From that point, PI has shown a steady recovery, now trading near $0.2282, suggesting early signs of building bullish momentum.

Pi Network (PI) 4H Chart/Coinsprobe (Source: Tradingview)

Pi Network (PI) 4H Chart/Coinsprobe (Source: Tradingview)

Adding strength to the setup, PI has successfully reclaimed its 100-hour moving average, currently hovering around $0.2277. This level now acts as a critical support zone for bulls.

What’s Next for PI?

A sustained hold above the 100-hour MA could confirm a shift in trend sentiment, potentially paving the way for higher targets.

If the Bat pattern continues to develop correctly, PI could rally toward the PRZ (Potential Reversal Zone) between: $0.2761 (0.886 Fib) & $0.2857 (1.0 Fib). This region represents an upside of roughly 25% from the current price, aligning perfectly with classic Bat harmonic completion levels.

However, if PI fails to hold the $0.22 support, the bullish structure may weaken, allowing for another short-term pullback before the next upside attempt.