Most institutional investors unaware of Bitcoin Core-Knots software debate

Institutional investors largely unaware of Bitcoin Core-Knots debate, Galaxy Digital survey finds

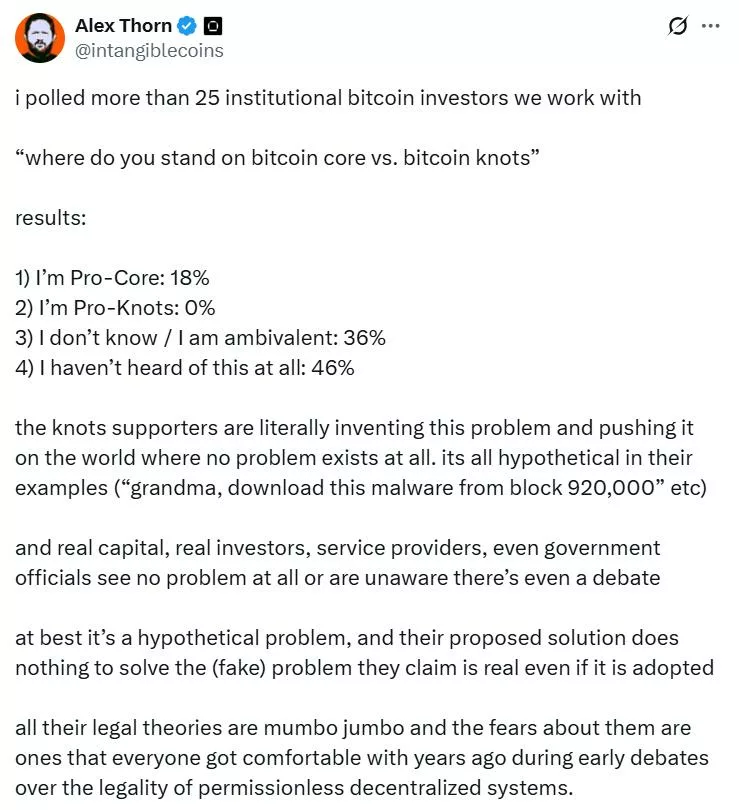

- 46% of surveyed institutional investors had no knowledge of the Bitcoin Core versus Bitcoin Knots debate

- Only 18% of respondents held strong opinions, all supporting Bitcoin Core’s approach

- Major mining operations show minimal concern about the protocol dispute, according to Galaxy Digital research

Most institutional investors in the Bitcoin ( BTC ) sector remain either uninformed or indifferent to the ongoing debate between Bitcoin Core and Bitcoin Knots, according to a survey conducted by Galaxy Digital .

Alex Thorn, head of research at Galaxy Digital, released findings showing that 46% of 25 institutional investors surveyed were not aware of the debate, while 36% reported having no clear opinion or remaining indifferent to the issue. Of the remaining 18%, all respondents expressed support for the Bitcoin Core position.

The debate centers on how the Bitcoin network should be utilized and whether non-financial transactions should be excluded from the blockchain. The discussion intensified following the release of the Bitcoin Core v30 update, which some users claim opened the door to operations considered spam on the blockchain.

Supporters of Bitcoin Knots argue that unwanted content should be filtered, citing concerns that malicious actors could insert illegal or immoral material into the blockchain. Bitcoin Core supporters maintain that any limitation could fragment the network, create user confusion, and contradict core principles of the protocol.

In a post published on social media platform X, Thorn stated that real capital, real investors, service providers, and government officials either see no problem or remain unaware of the debate. He characterized the issue as a hypothetical problem at best, according to the post.

Thorn also indicated that while miners were not included in the survey, his knowledge of major mining operations suggests minimal awareness or concern regarding the debate, according to his statement on X.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Organizations Caution: Guilty Verdict May Turn Code Expression Into a Crime

- Over 65 crypto groups urge Trump to intervene in Tornado Cash co-founder Roman Storm's legal case, arguing code should be protected speech under the First Amendment. - Storm faces charges for operating an unlicensed money transmittal service, with his defense citing recent DOJ guidance against prosecuting decentralized software developers. - Advocates demand tax clarity for crypto staking/mining and SEC safe harbor rules, aligning with Trump's "Crypto Capital" campaign promises and Zhao's pardon. - DOJ m

Fed Faces Rate Cut Uncertainty: Balancing Dovish Momentum and Prudent Restraint Amid Data Delays

- Fed Governor Waller advocates 25-basis-point rate cut in December, citing weak labor market and low inflation. - Market expectations for a cut dropped to 42.9% as of Nov 17, reflecting growing skepticism amid delayed key data. - Dovish Waller faces internal Fed caution over inflation risks (3% annual rate) despite his emphasis on labor market deterioration. - White House adviser Hassett highlights AI's potential to reduce hiring needs, complicating Fed's balancing act between weak employment and economic

"Google's AI Scam Defense in India: Safeguarding a Select Few, While Many Fall Victim to Fraud"

Ethereum Updates Today: Long-Term Investors Increase Holdings Amid Price Decline: Crypto Market Faces Growing Uncertainty

- Bitcoin and Ethereum face bearish pressure as ETF outflows persist, with Bitcoin near $95,000 and Ethereum below $3,200. - Institutional players like BitMine and FG Nexus adjust strategies amid declining hash prices and liquidity concerns. - Technical indicators like Bitcoin’s death cross and Ethereum’s oversold RSI signal prolonged weakness, with JPMorgan warning of risks for MSTR . - Coinbase’s D'Agostino sees the selloff as a buying opportunity for long-term holders, though structural buyer accumulati