XRPL Foundation Board Director Explains Why XRP Price Is Down Despite ETF Launch

The XRP community continues to discuss why XRP’s price failed to rally following the launch of the highly anticipated Canary Capital XRP ETF (XRPC).

While the fund posted one of the strongest ETF debuts of 2025, pulling in $245 million on day one, XRP’s price continued drifting lower.

Now, Fabio Marzella, Founding and Board Director of the XRPL Foundation, has stepped in to explain what’s really happening beneath the surface.

“ETF Trading Happens on the Stock Market, Not Crypto Exchanges”

In a post on X, Marzella noted that many people expected the price to shoot up as soon as XRPC began trading. But the structure of ETF settlement explains why that didn’t happen.

According to him, ETF trades occur on the stock market, not on crypto exchanges, where spot XRP is bought and sold.

Due to the T+1 settlement system, when someone buys an XRP ETF share, the issuer does not receive the cash immediately. The money settles the next business day, and only then can the provider begin purchasing the actual XRP needed to back the fund.

This delay means early inflows don’t immediately translate into spot market demand. Essentially, Marzella stressed that an ETF does not pump the price on day one. The real impact comes later, sometimes quietly at first, then all at once.

Strong ETF Debut, Weak Price Reaction

After XRPC’s debut , the ETF recorded $26 million in trading volume in its first 30 minutes and $58.5 million by market close. Additionally, it logged $245 million in net inflows on the first day.

These numbers made XRPC the top ETF debut of the year, surpassing even the Bitwise Solana ETF. It also placed the XRP fund among the best-performing ETF launches out of more than 900 issued in 2025.

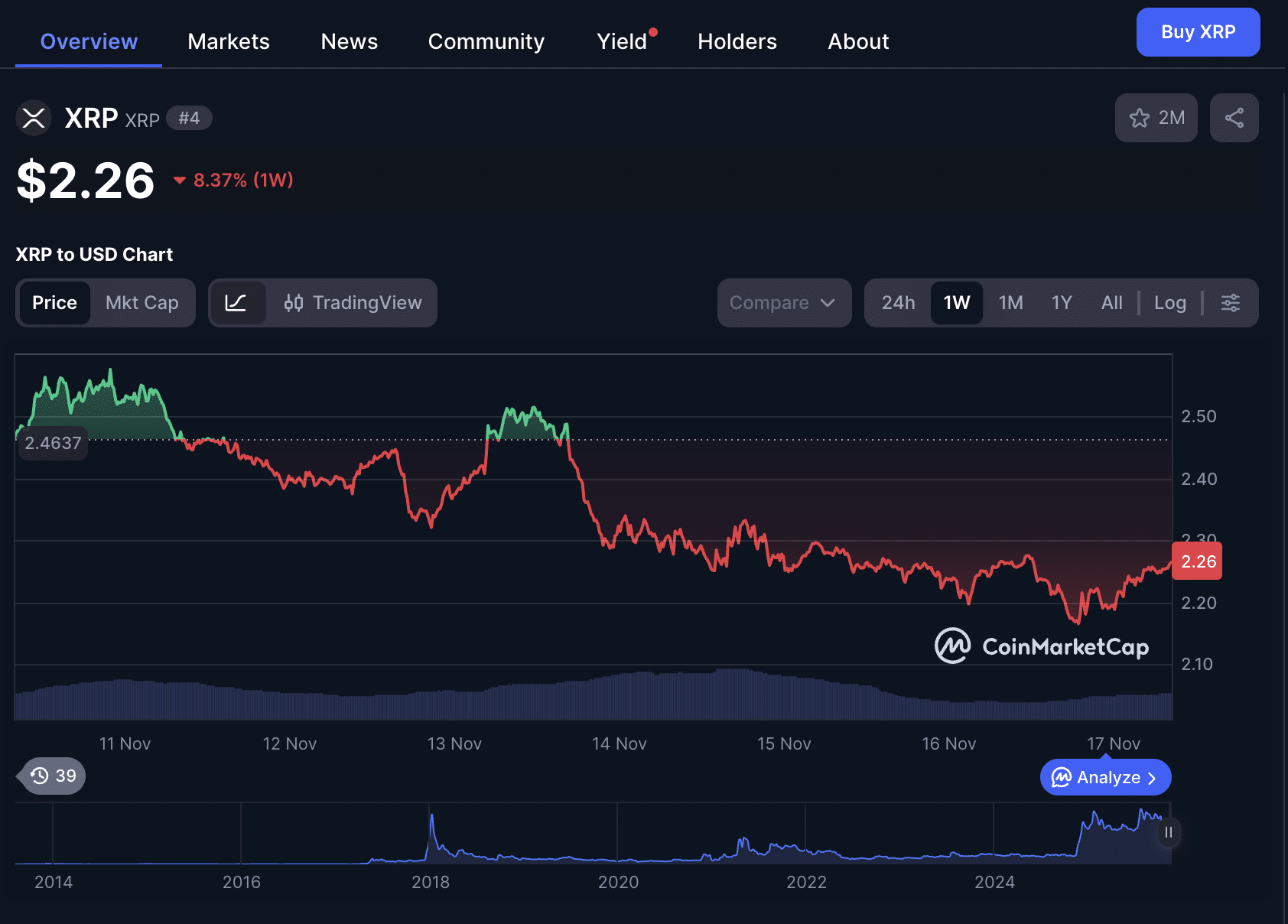

Yet despite this momentum, XRP fell from $2.52 to around $2.28. Since the ETF launch, XRP’s price has dropped to $2.16 before slightly recovering to $2.25 at press time. At this price, the coin is down 8.63% over the past week.

XRP chart CoinMarketCap

XRP chart CoinMarketCap

Bearish Market Dampened the Effect

Marzella also highlighted a second factor behind XRP’s decline: the entire crypto market is bearish.

Bitcoin lost the $100,000 support last Friday and has since fallen to $92,900. This bearish Bitcoin performance dragged the rest of the market down with it. In other words, as major altcoins corrected, XRP followed the trend.

Nick from The Web Alert pointed out that inflows worth tens or even hundreds of millions are still too small to overpower market selling pressure—especially considering XRP’s large supply. Any selling by major holders can offset upward pressure.

OTC Purchases May Hide the Real Buying Activity

Another reason the price impact hasn’t appeared yet is the way ETFs acquire their underlying assets. Even after settlement, issuers rarely buy directly from public exchanges. Large funds like Canary Capital often source assets from over-the-counter liquidity providers, meaning the purchases are not visible on spot price charts.

Marzella ended his explanation with a message of patience. ETF-driven price effects typically lag behind launch-day hype, as seen with Bitcoin’s own ETF debut in January 2024, which initially showed little price reaction before kicking off a major rally weeks later.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC drops 10.72% over 24 hours as significant short positions are liquidated and trading volume increases

- ZEC fell 10.72% in 24 hours but surged 23.62% in 7 days, driven by massive short liquidations and rising trading volume. - High-profile short positions lost $3.28M (Roobet/Stake.com) and $21.75M (Hyperliquid), as ZEC's price broke $700 and hit $11.3B market cap. - Institutional confidence grows with BitMEX's Arthur Hayes holding ZEC as second-largest asset, while analysts warn of overbought conditions and potential pullbacks.

R25's rcUSD+ Seeks to Connect DeFi and TradFi, Addressing the $55 Trillion Yield Disparity

- R25 launches rcUSD+, a yield-bearing stablecoin on Polygon, bridging DeFi and traditional finance with 1:1 USD peg and low-risk asset returns. - The token differentiates itself by generating income from institutional-grade assets like money market funds, offering DeFi users transparent yield opportunities. - Market growth sees $36B in tokenized RWAs and $300B in stablecoins, but rcUSD+ faces scrutiny over missing audit details and verification gaps. - Competing with USDY and Centrifuge, R25's Ant Financi

Dogecoin News Today: Dogecoin Faces Key Support Challenge While EV2 Presale Attracts Growing Investor Confidence

- Dogecoin (DOGE) tests critical $0.115–$0.125 support, with a breakdown risking a $0.08–$0.09 decline amid weakening technical indicators. - EV2’s $0.01 presale has raised $400K+ for a Web3 shooter game, attracting investors seeking utility-driven crypto projects. - Grayscale’s DOGE ETF launch and institutional interest contrast with bearish market sentiment and regulatory uncertainties. - CleanCore’s 78% stock drop highlights risks of Dogecoin treasury bets as holdings erode below $0.238 average purchase

Ethereum Updates Today: AI Trends and Meme Craze Drive Crypto's Dramatic Rally Despite Bubble Concerns

- Datavault AI (DVLT) announced a meme coin airdrop for shareholders, boosting shares 4.91% pre-market. - Mutuum Finance (MUTM) raised $18.8M in presale, with 800M tokens sold and potential 500% returns for early buyers. - BitMine Immersion (BMNR) holds 3.6M ETH, citing Ethereum tokenization and regulatory progress as growth drivers. - Digi Power X (DGXX) raised price target to $5, planning 55MW HPC deployment and AI infrastructure shift. - J.P. Morgan warned of AI-driven market bubbles, while Sampo's buyb