Bitcoin News Today: Bitcoin Faces $95K Standoff: Death Cross Clashes with Bullish Optimism Amid Bear Market Battle

- Bitcoin fell to a six-month low near $94,000, with a "death cross" signaling prolonged bearish trends and triggering investor alarm. - Technical indicators show mixed signals: RSI near oversold levels and key support at $93,000–$95,000 tested, while structural resistance looms above $96,500. - Market fear intensified as the Crypto Fear & Greed Index hit 10, whale activity surged, and institutional outflows worsened amid ETF uncertainty and macroeconomic shifts. - Analysts note potential bullish signs lik

Bitcoin has dropped to its lowest value in half a year, causing concern among investors as technical signals point to a possible worsening of the bearish trend. The digital asset, which reached over $124,000 last October, is now trading close to $94,000—marking a 32% fall from its highest point—

Technical signals present a mixed outlook. The Relative Strength Index (RSI) has slipped into nearly oversold levels,

Market mood is dominated by intense fear. The Crypto Fear & Greed Index has dropped to 10, its lowest reading in months, while online discussions about

Wider economic factors further complicate the outlook. The U.S. government shutdown and

Despite the negative sentiment, some analysts see potential for a rebound.

The future direction remains unpredictable.

Bitcoin’s next significant move will likely depend on a combination of technical strength, institutional involvement, and clarity on the macroeconomic front. For now, the market is consolidating,

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

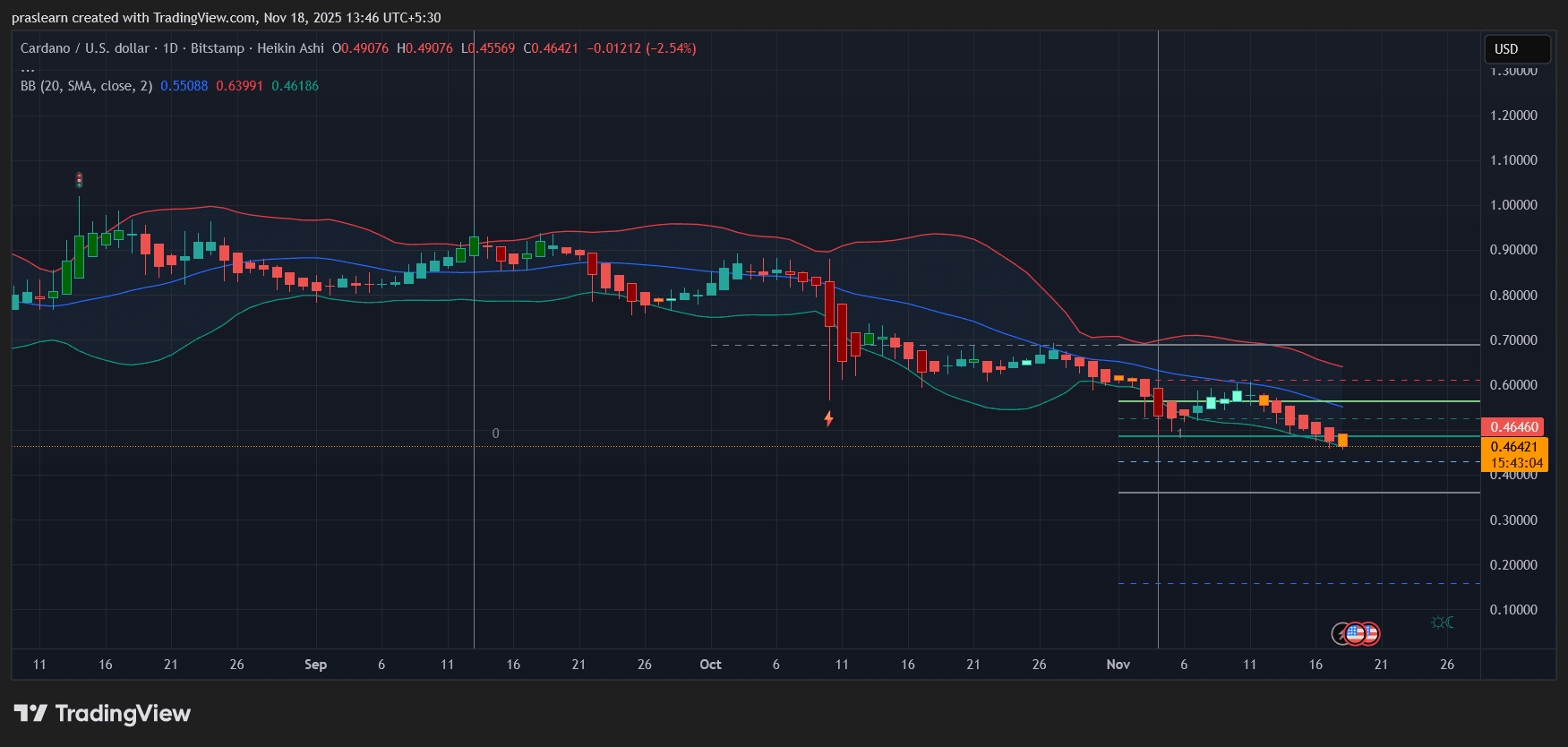

Cardano Price Crashes: Is $0.40 Next?

Bitcoin Updates: Investor’s $33M ETH Wager Withstands $1.1B Liquidation Surge While Crypto Markets Approach Bearish Levels

- A top crypto trader liquidated $7. 3M before re-entering with a $33M ETH long amid $1.1B market-wide liquidations on Nov 14, 2025. - Long positions suffered 973M losses vs 131M short liquidations, with a $44.29M BTC-USDT position marking extreme leverage use. - Bitcoin's RSI hit "massively oversold" levels and fell below its 3-year volatility band, echoing 2022 FTX-era market stress. - The crisis reignited debates over leveraged trading risks, with 246,000 traders forced to exit positions during the shar

Tokenizing Development: Trump’s Hotel Sets a New Standard for Luxury Real Estate Investment

- Trump Organization partners with Dar Global to launch world's first tokenized hotel in the Maldives, blending luxury real estate with blockchain technology. - The project tokenizes construction-phase investments, offering fractional ownership in 80 ultra-luxury villas before completion, unlike traditional post-construction models. - Eric Trump highlights the venture as a "benchmark" for redefining real estate investment, aligning with the Trump family's expanding crypto-friendly business strategy. - Mark

Fed Weighs Job Growth Against Inflation Concerns in 2026 Interest Rate Decisions

- The Fed plans two 2026 rate cuts amid weak labor markets and stubborn inflation, balancing job support with inflation risks. - Internal FOMC divisions persist, with Vice Chair Jefferson advocating caution and Governor Waller pushing for aggressive cuts, while Trump’s appointee Miran amplifies easing pressure. - Incomplete data from a government shutdown complicates decisions, and market expectations for a December cut dropped to 42.9% amid inflation concerns. - J.P. Morgan urges diversification to hedge