Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Mt. Gox just shook the crypto market again. After eight months of silence, the defunct exchange suddenly moved 10,608 Bitcoin worth almost 1 billion dollars, setting off a wave of speculation, fear, and on-chain detective work. The timing couldn’t be more dramatic: creditor repayments have already been pushed back to late 2026, leaving billions in locked-up BTC and a decade-long saga that refuses to end. The question now is simple. Was this just a routine shuffle, or a warning shot that more turbulence is coming?

What Triggered the Panic?

Mt. Gox suddenly shifted 10,608 BTC worth about 953 million dollars into a fresh wallet. This is the exchange’s biggest move in eight months, and the first transfer over the million-dollar mark since March. The crypto market wasn’t expecting any activity right now, especially because the exchange has once again pushed back creditor repayments to October 2026.

Why Is Mt. Gox Still Delaying Payments?

According to the trustee, creditor paperwork is still incomplete, so the repayment deadline has been officially extended by another year. This might sound frustrating, but it actually means one thing for the market: nearly 4 billion dollars worth of Bitcoin will stay locked up until late 2026. That delay reduces the immediate fear of a giant sell-off that could crush BTC’s price.

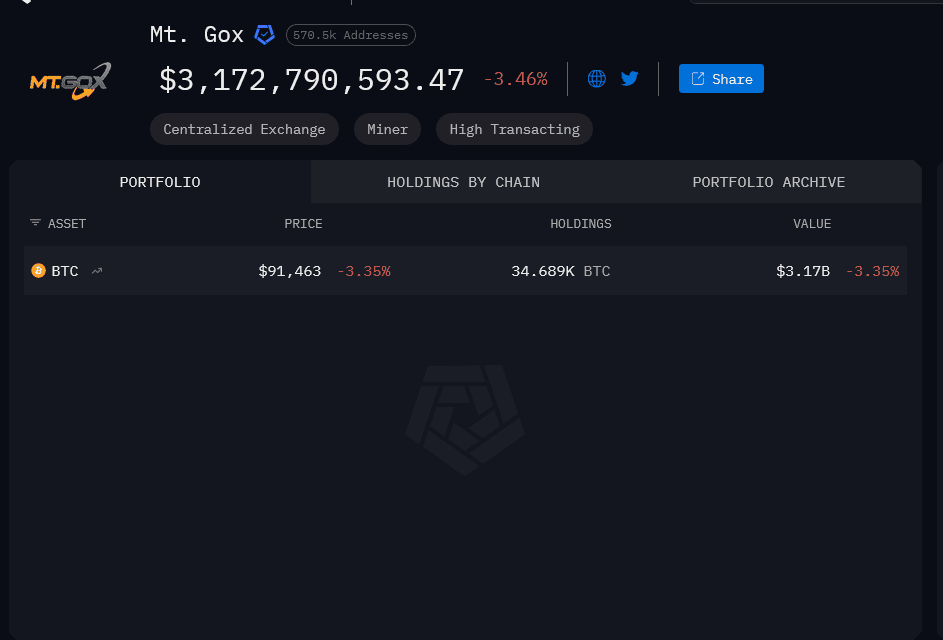

How Much Bitcoin Does Mt. Gox Still Hold?

Even after the latest transfer, Mt. Gox still controls 34,689 BTC valued at a little over 3.1 billion dollars. That stash hasn’t moved. And importantly, none of the newly transferred coins have been sent to exchanges. The receiving address labeled 1ANkD is just holding the 10,608 BTC for now, which suggests no sale is happening yet.

Is This a Sign They Are Preparing to Sell?

Some analysts think so. Jacob King from SwanDesk warned that Mt. Gox might be gearing up to dump the coins into a weak market.

This kind of speculation always shakes traders a bit, especially during corrections. But here’s the thing: on-chain data shows zero movements toward centralized exchanges. Until that happens, a sale isn’t confirmed.

Does Mt. Gox Still Affect Bitcoin’s Price?

Much less than before. Since the rehab process started releasing small batches of BTC in July 2024, Bitcoin has climbed from around 56,000 dollars to over 91,000 dollars today. Institutional buyers, corporate treasuries, and US spot ETFs are absorbing new supply far faster than Mt. Gox can release it.

Mt. Gox used to dominate the crypto world, handling more than 70 percent of all Bitcoin trades in its prime. Its collapse in 2014 after losing 850,000 BTC remains one of the largest disasters in crypto history. Since then, creditors have spent a decade waiting through endless delays, legal hurdles, and shifting repayment schedules.

The Bottom Line

Yes, the transfer grabbed headlines. Yes, people panicked. But the coins haven’t hit exchanges, and repayments are pushed to 2026, which actually keeps billions of dollars in Bitcoin off the market. For now, this is noise, not a threat. Investors should watch the wallets closely, but there’s no sign of a sell-off yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

COAI Experiences Significant Price Decline in Early November 2025: Combined Impact of Disappointing Earnings and Changing Market Sentiment

- COAI Index fell 88% YTD in 2025, sparking debates over AI/crypto AI sector revaluation vs. overreaction. - Mixed Q4 earnings: Cisco showed $14.7B revenue growth, while C3.ai reported $31.2M operating loss despite 26% revenue rise. - C3.ai's leadership crisis (CEO change, lawsuit) and governance issues amplified COAI's decline amid regulatory uncertainty. - CLARITY Act's ambiguous crypto regulations and institutional flight to stable tech stocks worsened sector sentiment. - Market re-rating of speculative

Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising

Bitcoin News Today: Bitcoin Faces $90K Challenge: Institutions Remain Wary While Whales Continue to Buy

- Bitcoin dips below $90,000 as Galaxy Digital sells 2,800 BTC, reflecting institutional caution amid $600B market value loss since October peaks. - Bearish pressure intensifies from fading Fed rate-cut hopes, inflation, and trade tensions, with ETF outflows and whale accumulation contrasting market weakness. - Analysts diverge: Galaxy cuts 2025 BTC target to $120,000 while JPMorgan/Saylor remain bullish, contrasting Bloomberg's warnings of further downside despite strong network metrics. - Retail fear nea