Standard Chartered Sees Year-End Bitcoin Rally Amid Sell-Off Signals

Bitcoin’s pullback may be nearing exhaustion, with Standard Chartered expecting a year-end rally even as macro pressures and technical signals keep volatility high. Traders now watch liquidity trends and on-chain metrics to gauge the next move.

Bitcoin (BTC) is pulling back again after slipping below the $90,000 psychological level. Amid the ongoing recovery, Standard Chartered signals that the recent sell-off may have run its course.

Elsewhere, BitMine chairman Tom Lee says if the Bitcoin price manages to achieve a new all-time high this year, it would obviate the fact that there is a four-year cycle.

Bitcoin Set for Year-End Rally, Standard Chartered Says

In an email to clients, the bank’s Head of Digital Asset Research noted the recent pullback “is nothing more than a fast, painful version of the third one of the past couple of years.”

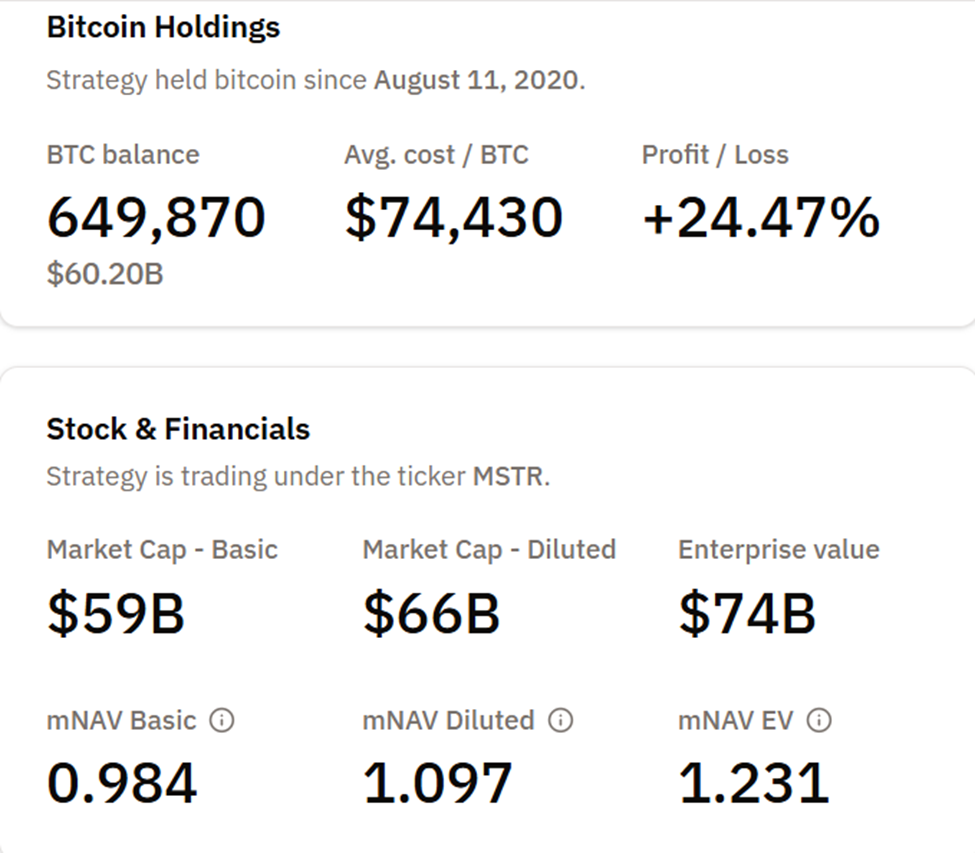

According to Geoff Kendrick, multiple on-chain metrics have reached absolute lows, including MicroStrategy’s mNAV, which is now at 1.0.

MicroStrategy mNAV. Source:

Bitcoin Treasuries

MicroStrategy mNAV. Source:

Bitcoin Treasuries

“A rally into year-end is my base case,” Kendrick said in the email.

On-chain analyst Ali highlighted that Bitcoin’s realized loss margin currently stands at -16%, which is below the -12% threshold historically associated with rebounds.

Bitcoin $BTC usually rebounds when traders’ realized loss margin falls below -12%. It’s now sitting at -16%.

— Ali

Additionally, the SuperTrend indicator on the weekly chart, which has consistently flagged major trend shifts since 2014, recently flipped to sell mode. Past signals have resulted in declines averaging 61%, indicating potential near-term volatility.

“Applying that average to the current market structure points to a potential move toward $40,000,” the analyst stated.

These mixed signals reflect a market caught between historical corrective patterns and bullish expectations from major financial institutions.

Macro Context: Liquidity vs. Opportunity Cost

Despite a $7 trillion increase in global M2 money supply since late 2024, Bitcoin has struggled to capitalize on the liquidity surge fully. EndGame Macro explained that, while the global liquidity pool remains historically high, much of the capital is being absorbed by government debt issuance and short-term instruments that pay yields of 4–5%.

“The way I see it, liquidity is being taxed,” the analyst noted.

With risk-free alternatives yielding tangible returns, speculative assets like Bitcoin face a higher opportunity cost.

This dynamic has contributed to choppy trading, with sharp bounces when shorts get crowded and sudden drops triggered by macro jitters. This reflects a more cautious investor environment.

Bullish commentators argue Bitcoin’s current price reflects undervaluation, suggesting the cryptocurrency could reach $150,000 amid ongoing monetary expansion. Meanwhile, Skeptics say that the correlation between liquidity and BTC price is no longer straightforward, citing competing market forces and regulatory nudges toward safer assets.

Traders and investors should brace for continued volatility as leverage unwinds and macro positioning adjusts.

Standard Chartered’s forecast of a year-end rally hinges on the assumption that the sell-off has exhausted its momentum. Still, risks remain in the form of potential corrections or policy-induced market swings.

On-chain metrics, including realized loss margins and SuperTrend signals, will likely remain key indicators for timing entries and exits.

As 2025 draws to a close, Bitcoin could either rebound in line with institutional forecasts or continue trading as a volatile, non-yielding asset, amid a macro environment that increasingly rewards caution.

Investors must conduct their own research and watch both liquidity flows and policy signals to gauge the next leg of price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Centralized Domain Systems Undermine DeFi Confidence Following Aerodrome DNS Compromise

- Aerodrome Finance, a Base network DEX, suffered DNS hijacking attacks forcing users to switch to decentralized ENS domains after phishing risks compromised centralized domains like aerodrome.finance. - The breach exploited centralized domain vulnerabilities to redirect traffic to fake sites, echoing a 2023 incident that caused $300,000 in losses, despite secure smart contracts protecting user funds. - Amid a merger with Velodrome DEX to create a unified "Aero" ecosystem, AERO token dipped 3% to $0.80 des

Bitcoin Updates: Treasury Balances Trade Disputes and Cryptocurrency Market Fluctuations

- U.S. Treasury balances trade tensions with China and crypto market volatility as Bitcoin prices drop 21% amid ETF outflows and regulatory shifts. - Bessent's Bitcoin bar visit sparks speculation about crypto policy while trade talks aim to de-escalate tariffs impacting global markets and crypto adoption in Latin America. - Institutional investors maintain Bitcoin holdings despite downturn, with Tether and JPMorgan highlighting stablecoin growth and regulatory clarity in Europe's MiCA framework. - Treasur

Bitcoin Leverage Liquidations Spike at End of 2025: An Urgent Reminder for Effective Risk Control in Cryptocurrency Trading

- Bitcoin's 2025 price crash triggered $2B in leveraged liquidations, marking crypto's worst crisis as $126k→$82k swings exposed systemic risks. - 392,000 traders lost $960M in 24 hours due to 10x leverage products, thin liquidity, and algorithmic selling during the November 20-21 collapse. - Experts now recommend 3-5x leverage caps, diversified positions, and hedging tools like options to mitigate risks after the crisis revealed crypto-traditional market interdependencies. - Regulatory scrutiny intensifie

Chainlink's cross-chain bridges drive a $35 billion boom in tokenized finance

- Grayscale files to convert its $29M Chainlink Trust into a staking-enabled ETF (GLNK), positioning LINK as crypto infrastructure. - Chainlink's CCIP bridges traditional finance and blockchain via cross-chain interoperability, recently collaborating with J.P. Morgan and Ondo Finance. - The tokenized assets market is projected to grow to $35B, with Chainlink addressing compliance and data transfer challenges in decentralized finance. - Strategic integrations with S&P Global and Bittensor's AI networks high