3 Bitcoin Mining Stocks To Watch In The Third Week Of November 2025

BMNR, BTDR, and HIVE face heavy declines but oversold conditions and strong fundamentals hint at possible rebounds in the third week of November.

When we look at Bitcoin’s price, the concern extends to the altcoins as well; however, it should also extend to the companies associated with BTC-related activities.

In line with the same, BeInCrypto has analysed three Bitcoin mining companies’ stock performance and what lies ahead for them.

BitMine Immersion Technologies (BMNR)

BMNR has dropped 24% this week and trades at $30.95. Despite the decline, Bitmine has continued accumulating ETH, adding 54,156 ETH worth more than $170 million over the past seven days. This signals a strong long-term conviction from the company.

The RSI is nearing the oversold zone, which often precedes a reversal. If conditions stabilize, BMNR could rebound from the $30.88 support and climb toward $34.94 or even $37.27, offering relief after a week of heavy losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR Price Analysis. Source:

TradingView

BMNR Price Analysis. Source:

TradingView

If Bitcoin weakens further, BMNR may follow the broader downturn. A deeper decline could send the stock below $27.80, with potential downside extending to $24.64. This would invalidate the bullish outlook and signal intensified bearish momentum.

Bitdeer Technologies Group (BTDR)

Bitdeer has recorded some of the steepest losses among Bitcoin mining stocks, falling 53% over seven sessions. The share price now sits at $10.63, reflecting intense selling pressure as broader market weakness continues to weigh on mining companies.

BTDR’s RSI is deep in the oversold zone, signaling conditions that often precede a reversal. If buyers step in, the stock could rebound from $9.56 and move toward $11.92, with potential upside extending to $15.24 if momentum strengthens.

BTDR Price Analysis. Source:

TradingView

BTDR Price Analysis. Source:

TradingView

If market conditions fail to improve, BTDR could continue its decline. A breakdown below $9.56 may drive the price toward $7.96. This would invalidate the bullish outlook and signal an extended downside for the mining firm.

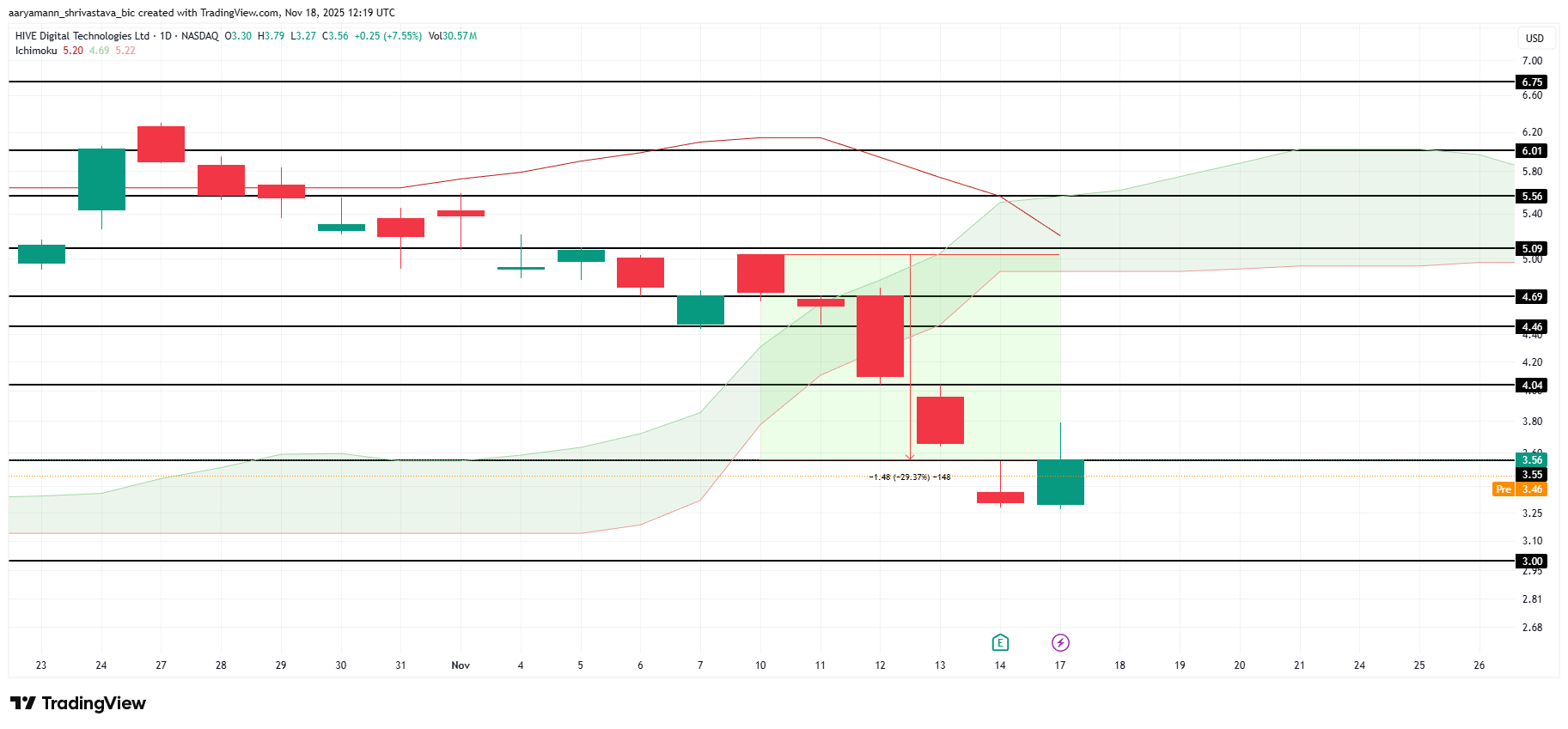

HIVE Digital Technologies Ltd. (HIVE)

Bitcoin mining company HIVE has dropped 29% over the past week but now trades at $3.56 after gaining 7.5% today. The surge follows the company’s announcement of 285% revenue growth in Q2, which has boosted investor confidence despite recent volatility.

This strong performance could fuel a broader recovery and lift HIVE toward $4.04. Restoring recent losses would require a move to $5.09. Reaching this target may take time, but it remains possible if momentum and sentiment continue improving.

HIVE Price Analysis. Source:

TradingView

HIVE Price Analysis. Source:

TradingView

If the stock fails to capitalize on the company’s earnings strength, HIVE may resume its decline. A drop toward the $3.00 support level or lower would invalidate the bullish thesis and signal renewed weakness.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: The Dangers of Leverage: Crypto Whale Suffers $26 Million Loss Amid Market Decline

- A crypto whale lost $26.348M by partially liquidating 15x leveraged BTC and 3x leveraged ETH positions amid declining prices. - The whale's $250M portfolio faces $3.734M unrealized losses if liquidated, with a $65,436 WBTC liquidation threshold. - Broader market trends show $260.66M ETH ETF outflows and ETH/BTC prices below $2,800 and $87,000, worsening leveraged traders' risks. - A HyperLiquid user lost $4.07M from a 6x ETH long position, reflecting systemic leverage challenges as macroeconomic factors

Bitcoin Updates: U.S. Market Pessimism Contrasts with Asian Confidence as Bitcoin Drops Near $85,000

- Bitcoin's price fell to $85,000 in Nov 2025, down 7% in 24 hours and 20% monthly, driven by dormant wallet sales and bearish derivatives bets. - Surging sell pressure from inactive wallets and rebalanced derivatives toward puts highlight deteriorating market structure and liquidity. - Fed rate-cut uncertainty and regional divergences—U.S. bearishness vs. Asian buying—exacerbate volatility amid $565M in liquidations. - Analysts split on recovery: some see consolidation near $85K-$100K, others warn of a po

Aave News Today: Aave’s High-Return Application Offers a Solution to Inflation’s Impact on Savings

- Aave , a top DeFi lending protocol, launched a consumer savings app offering up to 9% APY, competing with traditional banks and fintech platforms. - The app targets mainstream users with zero minimum deposits, real-time compounding, and $1M balance protection, aiming to simplify DeFi accessibility. - While outperforming traditional savings rates, Aave's insurance transparency and security history raise concerns amid crypto's volatile trust landscape. - This move reflects DeFi's neobank trend, with high-y

The PENGU USDT Sell Alert: Is This a Red Flag or Simply a Market Adjustment?

- PENGU USDT's sell signal highlights concerns over structural risks in stablecoin-backed crypto strategies amid volatility and regulatory shifts. - The token's 28.5% decline since October 27, coupled with weak technical indicators, reflects broader fragility in algorithmic stablecoins and leveraged positions. - Growing institutional adoption of asset-backed alternatives like USDC contrasts with PENGU's speculative NFT-driven model, which lacks robust collateral or compliance. - While Fed policy easing may