Tether Dominance Hits 6% in November – Why This Is a Worrying Signal

In November 2025, the Tether Dominance index (USDT.D) — the share of USDT’s market cap relative to the total crypto market cap — officially surpassed 6%. It also broke above a descending trendline that had remained intact since 2022. Analysts have expressed concern as USDT.D breaks a long-term resistance level. The move often signals the

In November 2025, the Tether Dominance index (USDT.D) — the share of USDT’s market cap relative to the total crypto market cap — officially surpassed 6%. It also broke above a descending trendline that had remained intact since 2022.

Analysts have expressed concern as USDT.D breaks a long-term resistance level. The move often signals the beginning of a major correction or even an extended bear market for the entire crypto market.

How Significant Is the Rise of USDT.D in the Market Context of November?

TradingView data shows that USDT.D reached 6.1% on November 18 before pulling back to 5.9%.

Earlier in the month, this metric sat below 5%. The increase reflects heightened caution among investors. Many have rotated capital into the most liquid stablecoin instead of deploying funds to buy deeply discounted altcoins.

USDT.D vs. Total Market Cap. Source:

TradingView

USDT.D vs. Total Market Cap. Source:

TradingView

Historical data indicate a strong inverse correlation between USDT.D and total market capitalization. Therefore, USDT.D breaking above a trendline that has held for nearly four years may signal deeper market-wide declines ahead.

Several analysts expect USDT.D to climb toward 8% by the end of the year, implicitly suggesting that a bear market may be forming in November. This projection has merit because fear continues to grow and shows no signs of easing.

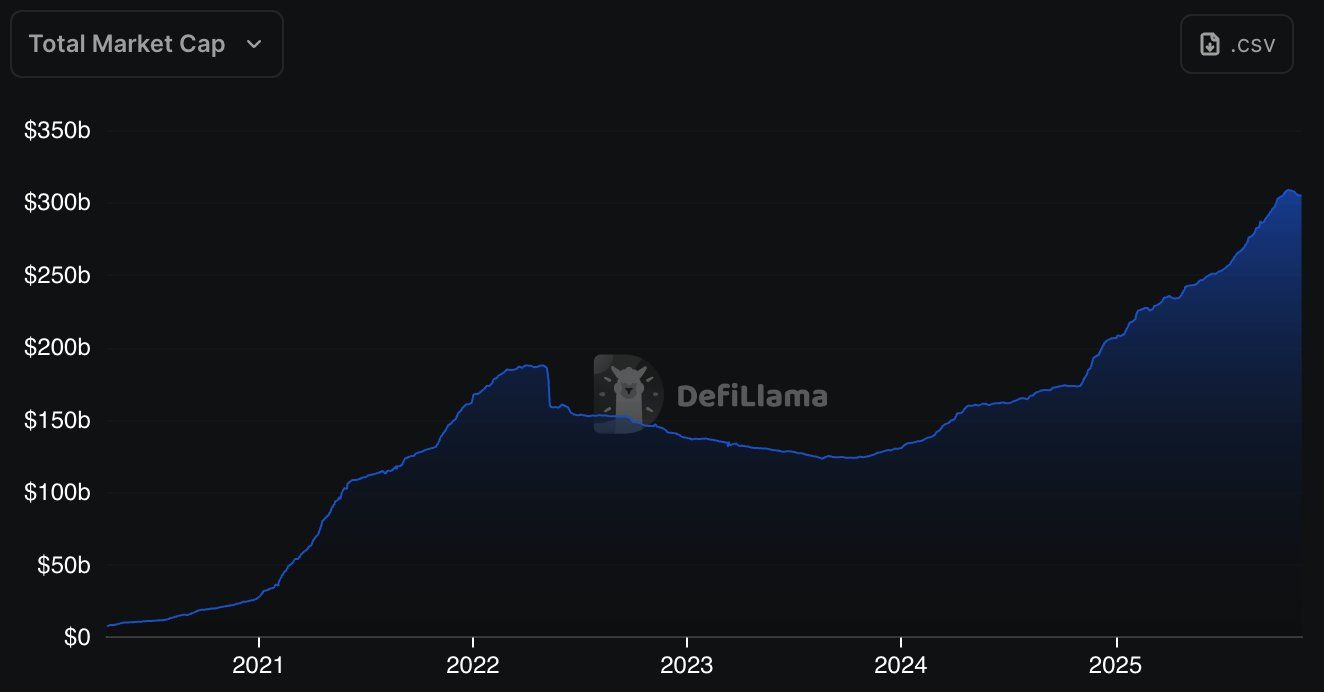

In addition, the well-known analyst Milk Road highlights a notable shift in the stablecoin market. DefiLlama data shows that the total stablecoin market cap fell from $309 billion at the end of October to $303.5 billion in November.

Stablecoin Market Cap. Source:

DefiLlama

Stablecoin Market Cap. Source:

DefiLlama

The stablecoin market has shed approximately $5.5 billion in less than a month. This marks the first significant decline since the 2022 bear market. The DefiLlama chart reveals that, after four years of continuous growth, the curve has flattened and is starting to turn downward.

The combination of a shrinking stablecoin market cap and a rising USDT.D suggests a broader trend. Investors appear not only to be selling altcoins into stablecoins but also withdrawing stablecoins from the market entirely.

“Expanding supply means fresh liquidity entering the system. When it flattens or reverses, it signals that the inflows powering the rally have cooled,” Milk Road said.

However, Milk Road still sees a glimmer of optimism in the current landscape. He argues that the situation does not necessarily indicate a crisis. Instead, the market is operating with less “fuel” for the first time in years, and such shifts often precede price changes.

Furthermore, a recent BeInCrypto report notes a contrasting trend. Despite the declining market cap, the amount of stablecoins held on exchanges has increased in November. This suggests that some investors view the downturn as an opportunity to position themselves for the end of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFI's $22M Token Destruction: Will Trump-Endorsed Cryptocurrency Restore Confidence?

- WLFI burned 166.667 million tokens ($22.14M) from hacked wallets, reallocating them to secure recovery addresses via emergency transactions. - The breach stemmed from phishing and third-party lapses, not smart contract flaws, with frozen wallets tested for months before reallocation. - The burn-and-reallocate mechanism, designed for lost access or attacks, highlights WLFI's focus on compliance and fund protection during recovery. - The incident intensifies scrutiny over WLFI's regulatory compliance and t

Uniswap News Update: UNI Rallies Amid Fee Switch Optimism, Yet Large Holder Sell-Offs Raise Concerns

- Uniswap's UNI token surged 18.14% in a week, driven by the Fee Switch Proposal and whale activity, reaching $7.33 on November 17. - The rally outperformed a broader crypto market downturn, with 24-hour trading volume jumping 47.59% to $682 million amid bullish technical indicators. - Arthur Hayes' sale of 1,500 ETH and reduced UNI holdings raised caution, contrasting with analysts' $8+ price projections if volume sustains above $650 million. - The Fee Switch Proposal could institutionalize buybacks, redu

Fed Halts $6.6 Trillion Balance Sheet to Steady Markets as Crypto Fluctuates and Earnings Vary

- The Fed halted its $6.6T QT program on Nov 19, 2025, to stabilize markets amid shifting economic conditions and maintain balance sheet size. - Corporate earnings showed divergence: Quorum's Q3 EBITDA fell 14%, while crypto exchange Bullish reported $18.5M net profit via U.S. trading expansion. - Uniswap's UNIfication token allocation plan sparked debate, contrasting with Bullish's $1B crypto options volume success in Q3. - Critics warn Fed's regulatory easing risks central bank independence, as liquidity

Uniswap News Today: Uniswap’s $1.16B Drives DeFi’s Move Toward Greater Accessibility

- Uniswap Foundation's Q3 2025 report shows $54.4M cash, 1.166B in UNI/ETH holdings, and $32.6M reserves for 2027 sustainability. - $1.083B allocated for grants/incentives, with $92.4M earmarked for 2025-2026 ecosystem development and decentralized governance support. - Foundation emphasizes DeFi's potential to redirect $30B annually from institutional fees to low-income households through reduced intermediation costs. - Despite strong liquidity, challenges include UNI price volatility and regulatory scrut