Ethereum Drops Near $3,000, But On-Chain ‘Opportunity Zone’ Hints at Rebound

Ethereum price has faced sharp declines over the past few days, dropping to its lowest level in two months. ETH fell as market volatility increased and investor confidence weakened. Despite the downturn, historical patterns suggest the trend could reverse soon, offering a potential recovery path for the altcoin king. Ethereum Lands In The Opportunity Zone

Ethereum price has faced sharp declines over the past few days, dropping to its lowest level in two months. ETH fell as market volatility increased and investor confidence weakened.

Despite the downturn, historical patterns suggest the trend could reverse soon, offering a potential recovery path for the altcoin king.

Ethereum Lands In The Opportunity Zone

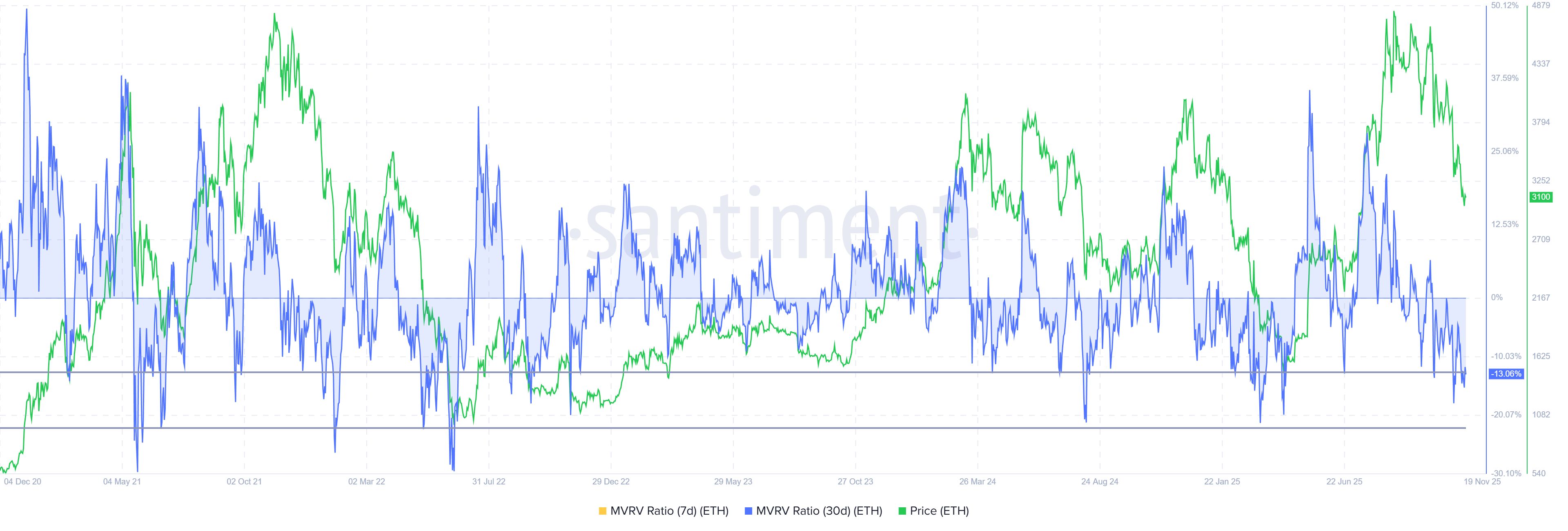

The MVRV Ratio is signaling a favorable setup for Ethereum. The metric sits at -13%, placing ETH firmly inside the opportunity zone between -12% and -22%. Historically, this range has marked points where losses reach saturation and selling pressure slows. Investors often view these levels as attractive entry points, supporting price rebounds.

As Ethereum enters this zone again, conditions resemble previous periods where strong recoveries followed. Reduced selling incentive and renewed accumulation typically help ETH stabilize.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum MVRV Ratio. Source:

Ethereum MVRV Ratio. Source:

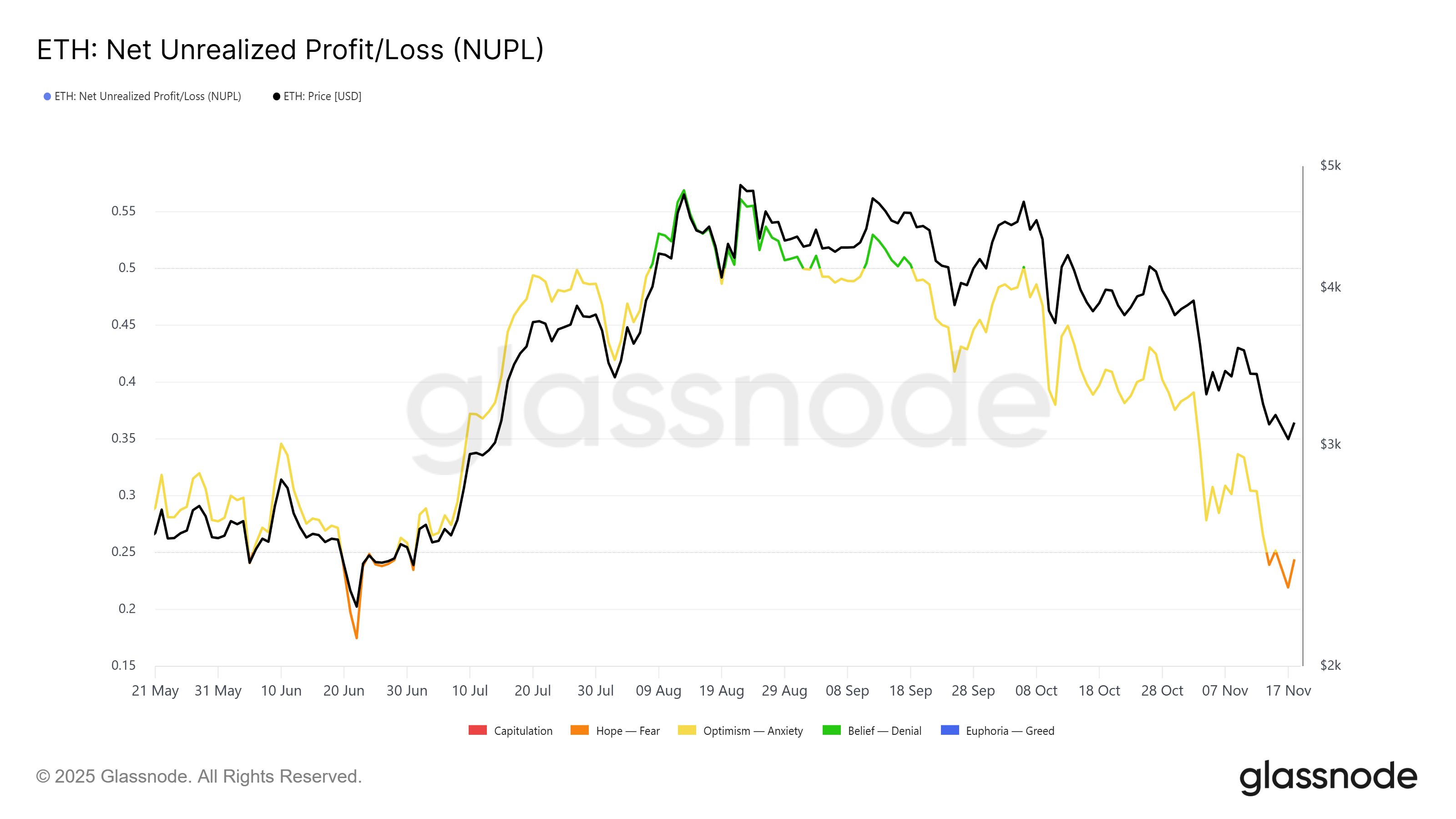

Macro momentum indicators further strengthen the case for a rebound. Ethereum’s Net Unrealized Profit/Loss, or NUPL, is slipping below the 0.25 threshold. This zone reflects rising fear among holders, a sentiment born out of the rising unrealized losses among ETH investors.

The last time this was seen, ETH bounced back into the Optimism zone. That shift marked a major reversal for the price.

A similar move now would indicate that fear-driven conditions are nearing exhaustion. If NUPL follows its historical trajectory, Ethereum could see renewed confidence and upward momentum.

Ethereum NUPL. Source:

Ethereum NUPL. Source:

ETH Price Could Bounce Back

Ethereum trades at $3,094, holding above the critical $3,000 support level after its sharp decline. This marks the first time in two months the asset has fallen this low. Maintaining support will be essential in preventing deeper losses and setting the stage for a potential recovery.

ETH is currently positioned below the $3,131 resistance level and is waiting for a catalyst to move higher. The supportive on-chain signals suggest that a push toward $3,287 is likely. If momentum strengthens, Ethereum could extend the rise and target $3,489 in the coming sessions.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

If bearish pressure increases, Ethereum could break below $3,000 and invalidate the current bullish outlook. A fall through support may expose ETH to a decline toward $2,814 as selling intensifies. This scenario would reflect broader weakness and delay any major recovery attempt.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Remains Steady While Altcoins Plunge Amid Market Sell-Off

- Bitcoin stabilizes near $93,555 amid market turmoil while altcoins hit multi-month lows due to $801M in 24-hour liquidations. - A 13-year dormant Satoshi-era wallet triggering 2% price drop and fear index hitting 14/100 heightens bearish concerns. - Cboe's perpetual-style crypto futures and global stimulus packages may reshape liquidity as Bitcoin tests $100,000 threshold. - Galaxy Digital notes algorithmic deleveraging rather than systemic weakness, with $3B in DeFi borrows signaling structural shifts.

COAI's Latest Price Decline: Market Drivers and Prospects for Investment Rebound

- ChainOpera AI (COAI) fell 88% year-to-date amid AI/crypto sector governance issues and CLARITY Act regulatory uncertainty. - Technical analysis shows oversold RSI and whale accumulation, suggesting short-term rebound potential with key resistance at $5.40-$7.33. - Analysts highlight 121% upside to $9.09 if COAI breaks resistance, but warn of further decline below $3.97 to $2.15 due to sector volatility. - Long-term recovery depends on CLARITY Act compliance clarity and AI-blockchain innovation progress,

Modern Monetary Theory and the Transformation of Cryptocurrency Value Assessments

- Modern Monetary Theory (MMT) reshapes crypto valuations by prioritizing fiscal flexibility over rigid monetary rules, altering central bank policies and market dynamics. - Central banks like the Fed adopt MMT-driven strategies (e.g., 4.00%-4.25% 2025 rate cuts), creating paradoxes for Bitcoin as low-interest environments favor traditional assets over crypto. - Institutional adoption of crypto grows (55% of hedge funds hold digital assets by 2025), but MMT-driven liquidity shifts expose vulnerabilities in

Grayscale Increases Chainlink Holdings Amid Price Drop, Shows Confidence in DeFi’s Prospects

- Grayscale surged LINK holdings to 1.3M tokens, quadrupling over two years despite 50% price drop, signaling long-term DeFi infrastructure bet. - Price decline pushed LINK to critical support level with low Exchange Supply Ratio, suggesting potential stabilization and buying opportunities. - Research highlights Chainlink's role in securing dApps and enabling tokenized assets, with major banks like UBS already adopting its infrastructure. - Grayscale filed a spot LINK ETF (GLNK) for December 2025 launch, m