As the year 2025 draws to a close, crypto investors are looking for projects that have the potential to turn regular investments into fortunes. While established market leaders such as Solana (SOL) and Chainlink (LINK) continue to impress, Ozak AI is emerging as a blockchain project with notable growth potential.

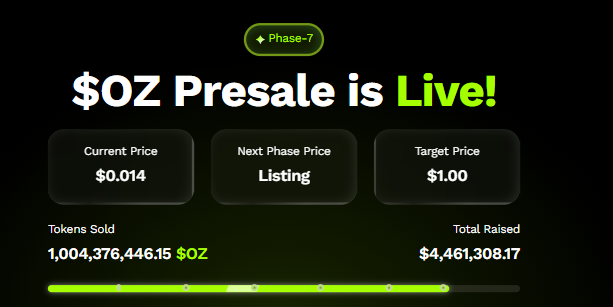

At just $0.014, this AI-powered blockchain initiative provides an opportunity for early investors to ride the next big surge, possibly transforming small stakes into life-changing rewards, making Ozak AI a notable option for those interested in promising cryptocurrency investments.

Ozak AI: Growth Potential in the Crypto Space

Apart from these monetary benefits, Ozak AI’s core value is in its AI platform, which offers predictive analytics for all financial market conditions. This would analyze the real-time data with historical patterns and aims to offer reasonable predictions to traders.

It also offers custom prediction agents for investors' own trading purposes, private data vaults to store personal data, and performance-based rewards in $OZ, demonstrating next-gen utility that highlights the Ozak AI token's potential as a noteworthy crypto asset.

Solana (SOL) & Chainlink (LINK): Established Crypto Contenders

Solana (SOL) is now trading at $156.58, with a market capitalization of $86.42 billion and a 24-hour trading volume of $11.48 billion, up 14.75%. Analysts say SOL's strong network activity and rapid acceptance make it a good entry point for investors seeking explosive gains as the price rises.

Chainlink (LINK) is presently trading at $14.88, up 1.24% in the last 24 hours. Its 24-hour trading volume has increased by 18.52% to $1.61 billion, with a market value of $10.73 billion. Analysts note the important support level is around $14.20 and resistance near $15.50, If it breaks above this barrier, setting out a positive upward trend. Which indicates that LINK is well-positioned for future price advances, where investors may discover massive potentials,

Conclusion

Ozak AI stands out as a notable cryptocurrency option, with each token priced at only $0.014, providing early investors with the opportunity for significant rewards. Alongside established contenders like Solana and Chainlink, it combines high growth potential with AI utility.