India's Debt-Backed ARC Token Eyes Tentative Q1 2026 Debut, Sources Say

India's Asset Reserve Certificate (ARC), a fully collateralized stable digital asset developed by Ethereum scaling and infrastructure development giant Polygon and India-based fintech firm Anq, could go live in the first quarter of 2026, sources familiar with the matter told CoinDesk.

Sources said that each ARC token will trade 1:1 with the Indian rupee and will be minted only when issuers acquire cash or cash equivalents such as fixed deposits, government securities, or cash balances. This setup ensures transparency, safety, and compliance, addressing shortcomings often seen in foreign-backed stablecoins or speculative tokens.

Essentially, ARC is designed to prevent liquidity outflow into dollar-backed stablecoins, keeping liquidity and innovation within India’s domestic economy while simultaneously fostering demand for public debt instruments.

The proposed digital token will complement the Reserve Bank of India's (RBI) Central Bank Digital Currency (CBDC) by serving as a regulated interaction layer developed by the private sector.

In this two-tier framework, the RBI’s Central Bank Digital Currency remains the ultimate settlement layer, safeguarding monetary sovereignty and security. At the same time, the private sector operates the platform that fosters responsible innovation in payment solutions, programmable transactions, and remittance systems within a regulatory-compliant environment.

This framework ensures strong control over the monetary base by maintaining central oversight, all within the boundaries of India’s financial and regulatory system.

Sources said that the ARC will align with rupee partial convertibility: the INR is fully convertible for current account transactions such as trade, business payments, and remittances, but remains restricted for capital account transactions to protect economic stability.

The stable digital token will do so by allowing payments for business transactions without requiring full convertibility. Importantly, only business accounts will be authorised to mint ARC tokens, ensuring compliance with the Liberalised Remittance Scheme (LRS) rules governing individual foreign exchange transactions.

Additionally, ARC’s ecosystem will use Uniswap v4 protocol hooks to restrict token swaps exclusively to whitelisted addresses, reinforcing controlled access and regulatory adherence.

India’s pursuit of a sovereign stablecoin comes amid rising concerns over capital outflows from emerging markets into dollar-backed stablecoins, following the Trump administration’s pro-crypto regulatory measures.

Notably, the landmark GENIUS Stablecoin Act legalized dollar-backed stablecoins, raising alarms about significant liquidity shifts away from emerging economies.

Standard Chartered recently warned that emerging market banks could face deposit outflows of up to $1 trillion over the next three years as savers increasingly turn to dollar-backed stablecoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Weathers Extended Shutdown with Minimal Price Impact

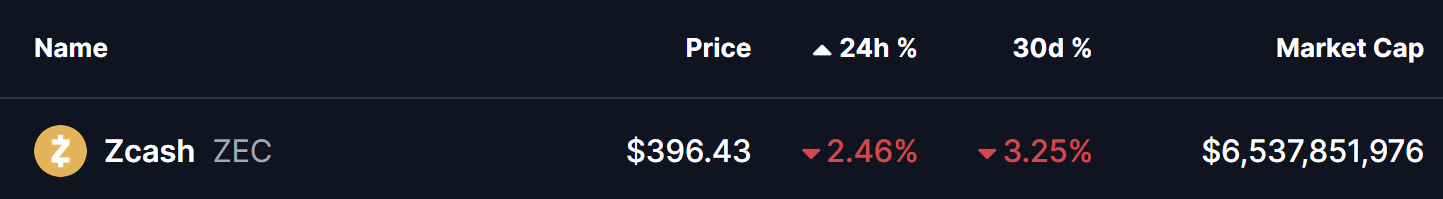

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says