Numerai's Distributed AI Model Achieves 5-Fold Valuation as CEO Sets Sights on Becoming the 'Final Hedge Fund'

- Numerai, an AI-driven hedge fund, raised $30M in Series C led by university endowments, valuing it at $500M. - The funding supports expansion, following a $500M capacity commitment from JPMorgan , with AUM surging to $550M. - Its NMR token rose 40% post-announcement, aligning incentives via a decentralized model for global data scientists. - CEO aims to be "last hedge fund" using open AI, amid crypto's shift toward AI agents for autonomous trading. - Valuation discrepancies noted, but highlights Numerai'

San Francisco-based hedge fund Numerai, which utilizes artificial intelligence,

This investment comes after

Numerai’s own token,

Numerai’s recent progress aligns with

Although most outlets report

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Growing Institutional Interest in ETH Amid Rising Worries Over Decentralization

- Ethereum’s institutional adoption accelerates as Tether , BlackRock , and SGX expand crypto infrastructure and ETF strategies. - Vitalik Buterin warns of decentralization risks from concentrated ETH ownership and potential quantum computing threats by 2028. - SGX launches Bitcoin/Ethereum futures to boost institutional liquidity, while ETF outflows and bearish indicators signal market weakness.

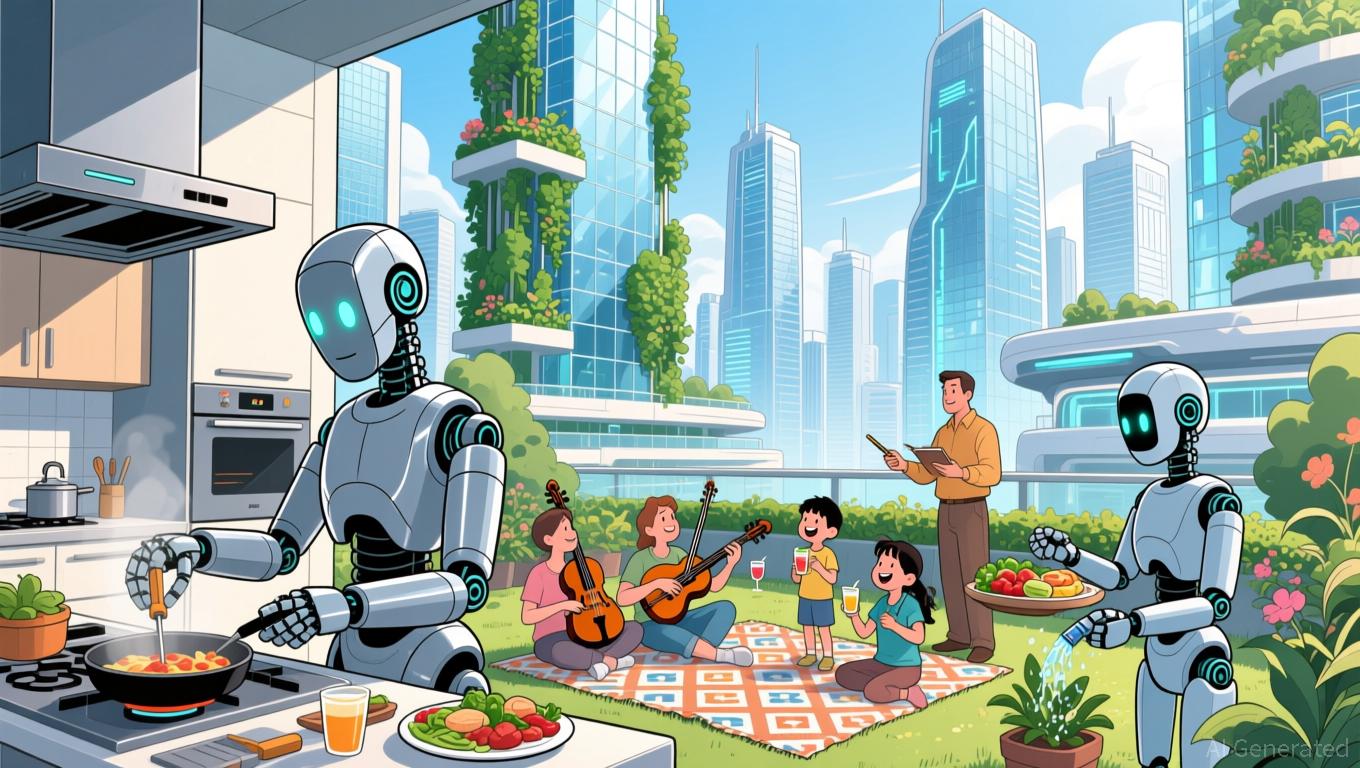

Musk's Vision of a Future Without Mandatory Work Ignites Discussions on the Practicality of AI and Social Disparities

- Elon Musk predicts work will become optional in 10-20 years as AI/robotics render traditional labor obsolete, comparing future employment to leisure activities. - Tesla aims for 80% of its value to derive from Optimus robots, while economists question scalability challenges and decreasing returns in robotics adoption. - AI-driven sectors like Energy Management Systems are projected to grow rapidly, but face high costs and integration barriers for small businesses. - Critics warn Musk's vision risks exace

Federal Reserve Decisions and Their Impact on Solana (SOL)

- Fed's 2025 rate cuts and QE pivot drive institutional capital into Solana's blockchain ecosystem, boosting staking ETFs to $550M in assets. - Regulatory alignment via GENIUS Act and Solana's U.S.-backed stablecoin enhance institutional trust in crypto compliance frameworks. - Fed policy uncertainty triggers short-term volatility (14% Solana price drop), yet 21Shares' $100M ETF inflow signals enduring institutional confidence. - Projected 2026 QE transition could amplify liquidity for Solana's DeFi infras

ICP Caffeine AI's Latest Advancement and Its Impact on the Web3 Industry Driven by Artificial Intelligence

- ICP Caffeine AI, launched by DFINITY in 2025, enables no-code dApp development via natural language prompts on the Internet Computer blockchain. - Its "chain-of-chains" architecture processes AI tasks on-chain, positioning ICP as a first "AI-native blockchain" with hybrid cloud scalability. - A reverse-gas tokenomics model drove 56% ICP price growth and $237B TVL, but dApp activity dropped 22.4% amid SEC regulatory pressures. - Strategic Chain Fusion tech enables Bitcoin/Ethereum interoperability, attrac