Bitwise XRP ETF Goes Live, Up Next Grayscale; Yet Price Crashes 5%

XRP drops 5% despite multiple ETF launches as whales sell heavily. Can new inflows from upcoming ETFs stabilize the price?

XRP has fallen 5% this week as its ongoing decline continues despite growing institutional interest. The altcoin is struggling to recover, even with two XRP ETFs already live and two more scheduled to launch next week.

This disconnect has raised questions about why price action remains soft.

XRP Whales Are Selling

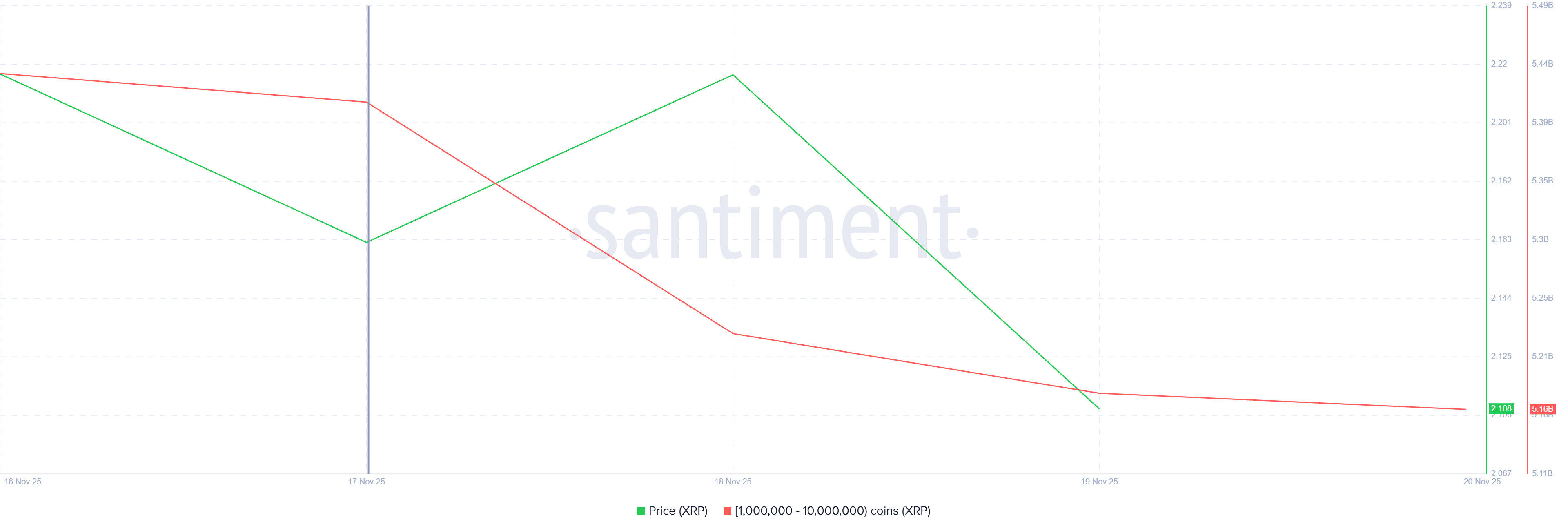

Whale activity offers the clearest explanation for the weakness. Large holders have continued selling throughout the week, adding downward pressure on XRP. In the last 48 hours alone, wallets holding between 1 million and 10 million XRP have sold more than 250 million tokens, worth over $528 million.

Whales remain highly influential due to their ability to shift liquidity and sentiment. Sustained selling from these holders signals a lack of confidence in the near-term outlook. If the selling continues, it could deepen XRP’s decline, especially as the price approaches key support levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Whale Holding. Source:

XRP Whale Holding. Source:

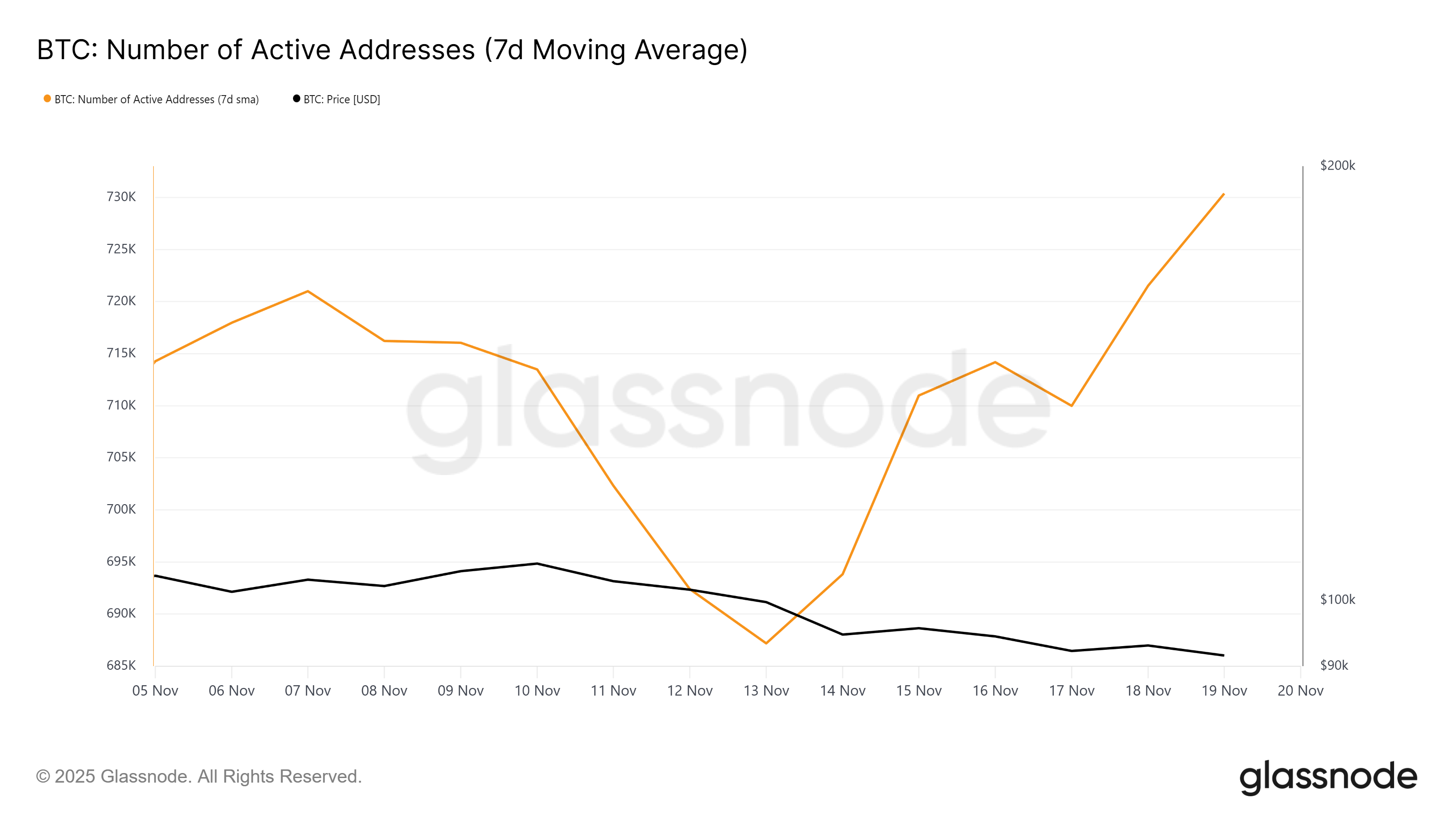

Macro momentum, however, paints a more nuanced picture. New XRP addresses have surged over the past week, climbing to a monthly high. This rise appears linked to the launch of Caanary Capital’s ETF (XRPC) and Bitwise’s ETF (XRP), both of which are driving renewed participation in the network.

Additional inflows are expected as Grayscale’s XRP Trust ETF (GXRP) and Franklin Templeton’s XRP ETF (XRPZ) go live on Monday. These launches are likely encouraging new users to enter the market, providing a counterweight to whale selling and offering potential support for future price stability.

XRP New Addresses. Source:

XRP New Addresses. Source:

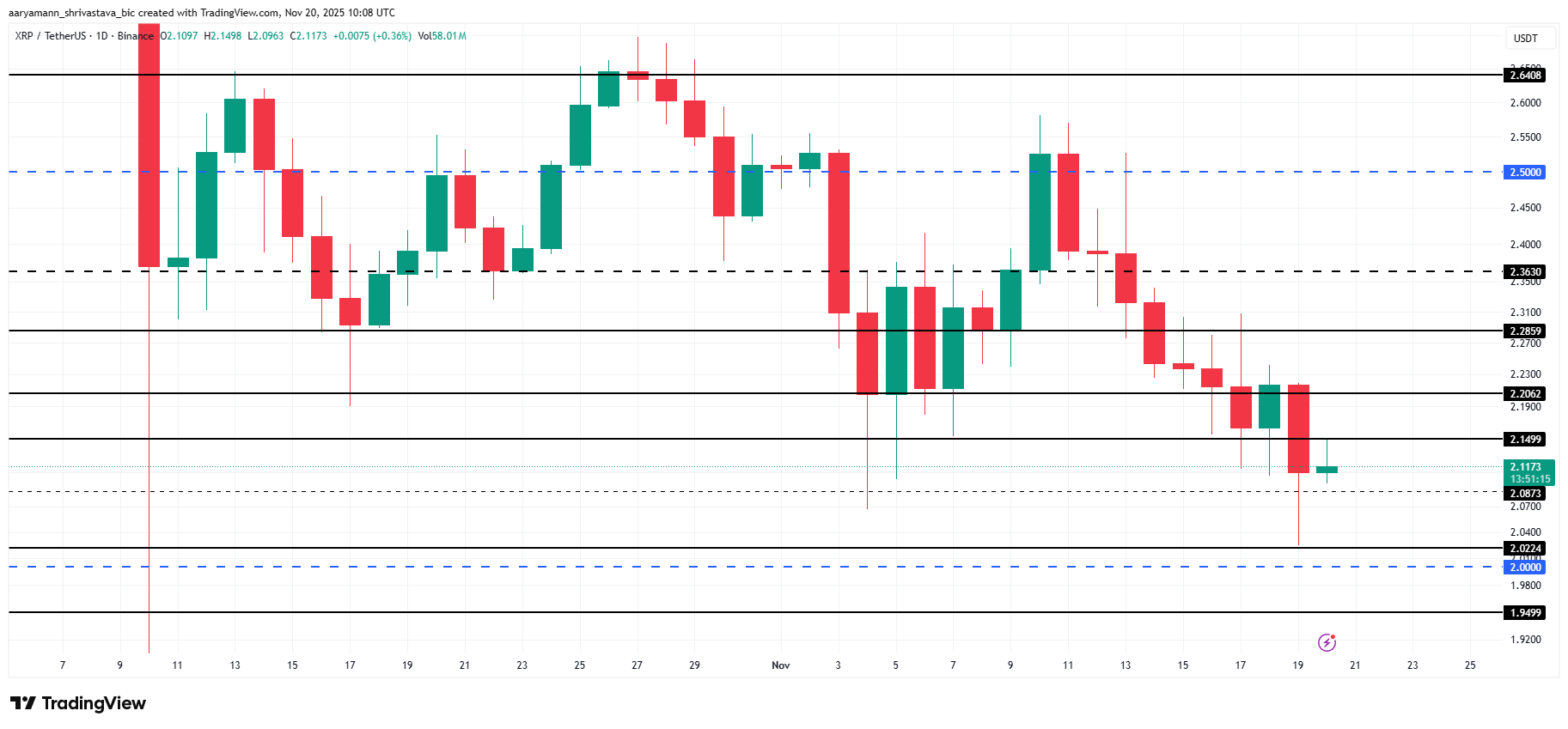

XRP Price Continues To Fall

XRP trades at $2.11 at the time of writing, maintaining support at $2.08. The asset is marking a monthly low and facing mixed sentiment due to conflicting signals from whales and new entrants. Price stability will depend on whether fresh capital outweighs ongoing sell-offs.

If inflows from new addresses continue, they may offset the recent whale selling. This could help XRP rebound above $2.20 and push toward $2.28. ETF-driven demand has the potential to restore short-term momentum and encourage accumulation.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If XRP breaks below the $2.08 support, the downside risk increases. The price could fall to $2.02 or slip below $2.00 if selling intensifies. Such a decline would invalidate the bullish thesis and reflect a deeper shift in market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK SFO's NFT Scam Case Signals Change in Crypto Regulation

- UK SFO investigates $28M NFT fraud case, arresting two men over Basis Markets scheme using false algorithmic trading promises. - Scheme combined NFT sales with hedge-fund pitches, siphoning funds into personal wallets instead of developing promised products. - Case marks first criminal prosecution centered on NFTs, signaling regulatory shift from enforcement to criminal charges in crypto fraud. - SFO highlights UK's blockchain tracking capabilities, urging victims to come forward as courts may set legal

Data Reporting Lags from Shutdown Complicate Fed's Rate Decision Amid Increase in Unemployment Claims

- U.S. jobless claims rose to 232,000 in the week ending October 18, exceeding forecasts and indicating a cooling labor market despite a recent decline in initial claims. - Continuing claims hit 1.957 million, the highest since early August, while a government shutdown delayed data releases, creating uncertainty ahead of the Fed’s December meeting. - The Fed’s rate-cut probability dropped to 30% as mixed labor market signals weakened arguments for aggressive easing, with Bitcoin and Treasury yields reactin

DASH Aster DEX Experiences On-Chain Growth: Signaling a Revival in DeFi

- DASH Aster DEX drove DeFi's 2025 revival with 330,000 new wallets and $27.7B daily trading volume via hybrid AMM-CEX model. - Platform's multi-chain AI routing engine and 1,650% ASTER token surge attracted institutional partnerships and $1.4B TVL. - Tokenomics with 5-7% annual burns and institutional credibility from Binance/YZi Labs partnerships reshaped DeFi's liquidity dynamics. - Sector-wide $181B DeFi market cap rebound reflects renewed retail/institutional demand for secure, yield-generating decent

Bitcoin News Update: Fundamental Flaws Trigger $3 Trillion Cryptocurrency Collapse During Speculative Frenzy

- Cryptocurrency markets collapsed on Nov 21, 2025, with $1.93B in liquidations erasing $3T in value as Bitcoin and Ethereum plummeted amid unexplained volatility. - Speculative panic and structural fragility drove Bitcoin below $87,000 while 391,164 traders faced losses, highlighting market instability and regulatory gaps. - UK authorities seized $33M in crypto linked to Russian sanctions evasion, while Brazilian firm Rental Coins filed bankruptcy to recover fraud-linked assets. - Analysts warned of prolo