Bitcoin Looks More Bullish Than Ethereum as $4 Billion Options Expire Today

Over $3.9 billion in Bitcoin and Ethereum options contracts will expire today at 8:00 UTC on Deribit, with traders maintaining a bullish stance despite sharp price declines earlier in the week. The major expiry event on Deribit will feature a call-heavy positioning for both assets, signaling cautious optimism amid volatile market conditions. Bitcoin Options Show

Over $3.9 billion in Bitcoin and Ethereum options contracts will expire today at 8:00 UTC on Deribit, with traders maintaining a bullish stance despite sharp price declines earlier in the week.

The major expiry event on Deribit will feature a call-heavy positioning for both assets, signaling cautious optimism amid volatile market conditions.

Bitcoin Options Show Strong Call Bias Despite Price Weakness

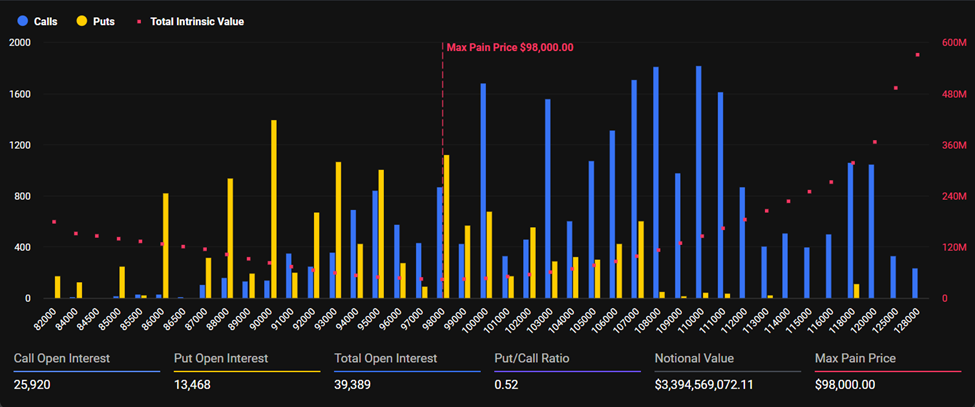

Bitcoin traded at $86,195 as of this writing, reflecting a 7.02% decline over 24 hours. Meanwhile, as the options near expiry, 39,389 BTC contracts (total open interest) worth $3.39 billion in notional value will expire, with open interest heavily skewed toward calls.

Bitcoin Expiring Options. Source:

Deribit

Bitcoin Expiring Options. Source:

Deribit

According to Deribit data, calls reached 25,920 contracts, while puts stood at 13,468, yielding a put-call ratio of 0.52. This ratio indicates that traders held nearly twice as many call (purchase) options as puts (sells) before expiry, reflecting expectations of upside potential despite the recent selloff.

The max pain price for Bitcoin was $98,000, about 14% above the current trading level. Max pain marks the strike price at which most options become worthless, thereby maximizing the loss for holders.

The pronounced gap indicates that many call holders could see significant losses at expiry, directly proportional to how much the price draws toward this $98,000 strike price.

Bitcoin reached a record high of $126,080 on October 6, 2025, before entering a correction. The drop aligns with broader market headwinds. Previously, the Fear and Greed Index soared to an extreme greed value of 93 in late 2024.

Ethereum Traders Maintain Focus on Mid-to-Upper Strike Calls

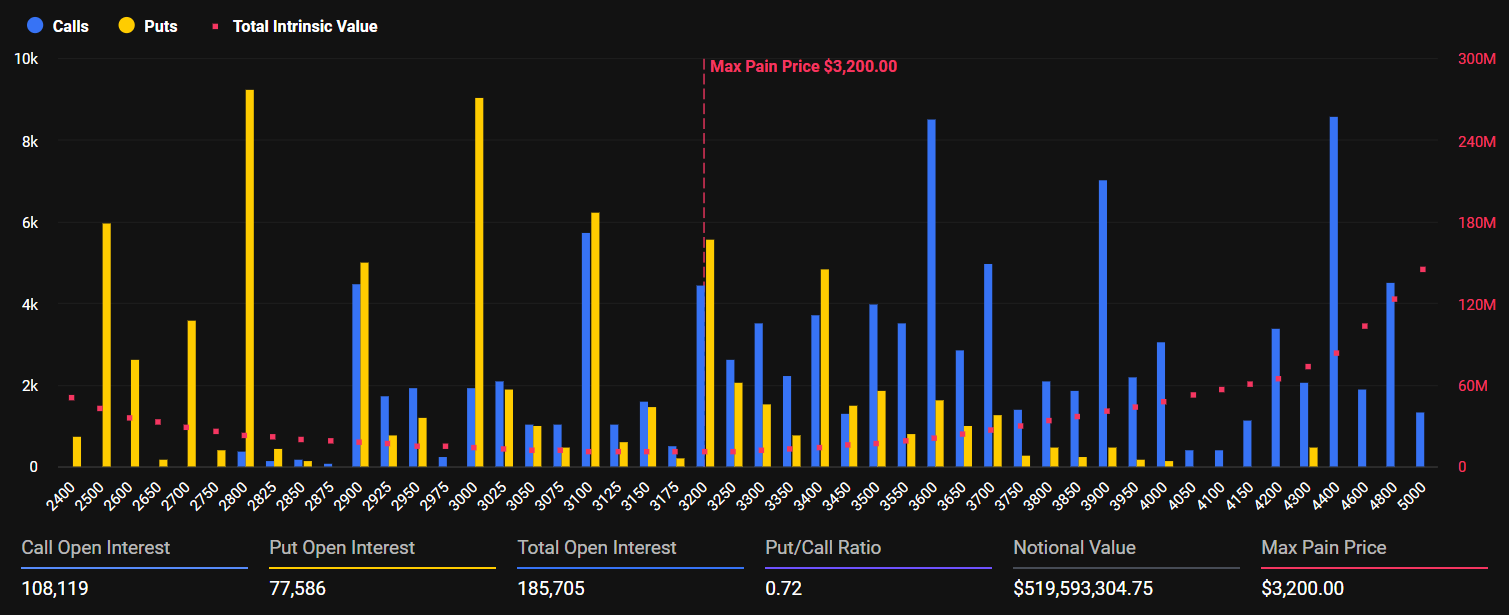

Ethereum experienced similar pressure, trading at $2,822 after a 6.98% decline over 24 hours. The expiry covered 185,730 ETH contracts valued at $524 million notional, with 108,166 calls and 77,564 puts.

Ethereum Expiring Options. Source:

Deribit

Ethereum Expiring Options. Source:

Deribit

The put-call ratio for Ethereum was 0.72, showing less bullishness than Bitcoin, yet a preference for calls persisted.

Based on the Ethereum expiring options chart above, trading focused on December 2025 expiry at 2,900 and 3,100 strikes, suggesting hopes for a rebound to those levels.

Ethereum’s max pain was at $3,200, roughly 13% above its current price, mirroring Bitcoin’s profile. Many options thus could expire out of the money. Still, persistent call exposure suggests that traders are holding onto a bullish outlook.

Market Signals Show Cautious Optimism Amid Volatility

The derivatives market structure reveals nuanced investor sentiment as today’s options expiry approaches. Although prices for both assets dropped sharply earlier, traders maintained considerable call exposure rather than increasing protection with puts or fully closing their positions.

“Flows lean toward calls across the upper strikes while downside hedging remains light… Positioning is not signaling a major risk-off move, but traders remain cautious after this week’s sharp drop,” wrote analysts at Deribit.

Light downside hedging suggests many traders view this dip as a regular correction rather than the start of a lasting bear market. Still, the presence of caution shows that volatility could persist.

For Ethereum, Deribit observed that traders leaving call exposure open through expiry indicates confidence endures. This differs from typical risk-off scenarios, where participants quickly hedge or exit bullish trades when prices fall before expiry.

The combination of strong call positioning, high open interest, and light downside protection may result in pronounced market moves. If prices recover toward max pain levels, short-dated call buyers could find relief.

Should markets drop further, additional selling pressure could arise as bullish bets face higher losses. Upcoming sessions will show whether this cautious optimism is sustainable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin ETFs See $1.9B Outflow While Competing Altcoins Draw $420M in Just 16 Days

- U.S. Bitcoin ETFs saw $1.9B in 4-day outflows as prices fell below $90,000 amid macroeconomic uncertainty. - BlackRock's IBIT lost $1.43B in 5 days, reflecting institutional risk aversion ahead of potential Fed policy shifts. - Altcoin ETFs attracted $420M in 16 days, with XRP and Solana funds gaining traction through staking yields and regulatory clarity. - Analysts warn sustained outflows could push Bitcoin toward $85,000, highlighting diverging investor priorities between blue-chip and emerging crypto

Connecting Firepower and Blockchain: RTX Corp's Two-Pronged International Approach

- RTX Corp secures $92M U.S. arms sale to India and $105M Patriot system sustainment deal for Ukraine, expanding global defense contracts. - Subsidiary Remittix raises $28.1M via RTX token presale to launch PayFi, a blockchain-powered cross-border payment app supporting 60+ countries. - Collins Aerospace partners with Netherlands for F-35/CH-47F avionics center (2026) and expands commercial aviation with Ethiopian Airlines seating contracts. - Dual-track strategy leverages military contract revenues to fun

Bitcoin’s Rapid Uptake by Institutions in November 2025: Key Opportunities for Retail Investors in the Face of Favorable Macroeconomic Trends

- 2025年比特币机构采用加速,监管明确(如现货ETF获批)和基础设施完善(如BlackRock IBIT、JPMorgan托管服务)推动资本流入。 - 美联储转向量化宽松及降息至3.75%-4%,叠加政府停摆结束带来的流动性,强化比特币作为风险资产的吸引力。 - 技术指标显示比特币RSI超卖(30.52)且MACD趋平,机构ETF资金流出现反弹(如IBIT单日流入7547万美元),暗示短期修正可能。 - 散户投资者可关注9万美元关键支撑位及ETF资金流向,结合宏观宽松与机构动向把握战略入场时机,但需警惕HODL/FBTC等基金的持续看空信号。

Stellar News Today: Established Market Prefers Altcoins with Practical Use Cases Rather Than Pure Speculation

- MoonBull (MOONBULL) raised $600,000 in funding, highlighting growing institutional interest in utility-driven altcoins with DeFi infrastructure and staking rewards. - Crypto.com's CRO token maintains stability through expanded merchant partnerships and AI-driven tools, positioning it as a "safe haven" amid market volatility. - Stellar's XLM sees renewed adoption via cross-border payment partnerships, with 20% higher transaction volumes reflecting demand for low-cost solutions in emerging markets. - Marke