BitMine Faces Over $4 Billion in Unrealized Loss as Digital Asset Treasury Model Faces Scrutiny

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings. The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model. BitMine’s Mounting Losses Create ‘Hotel California’ Scenario In a recent

BitMine Immersion Technologies, the world’s largest corporate Ethereum (ETH) holder, is now facing over $4 billion in unrealized losses on its ETH holdings.

The firm’s drawdown reflects wider turmoil for digital asset treasury (DAT) companies, prompting new questions about the sustainability of this business model.

BitMine’s Mounting Losses Create ‘Hotel California’ Scenario

In a recent disclosure released earlier this week, BitMine revealed that it held nearly 3.6 million ETH, equivalent to approximately 2.97% of Ethereum’s supply. The company is steadily approaching its long-stated goal of accumulating 5% of all ETH.

However, its treasury is increasingly feeling the strain from the asset’s sharp price decline. Ethereum has dropped 27.4% over the past month, now trading below $3,000. Concurrently, BitMine’s balance sheet has reflected that drop.

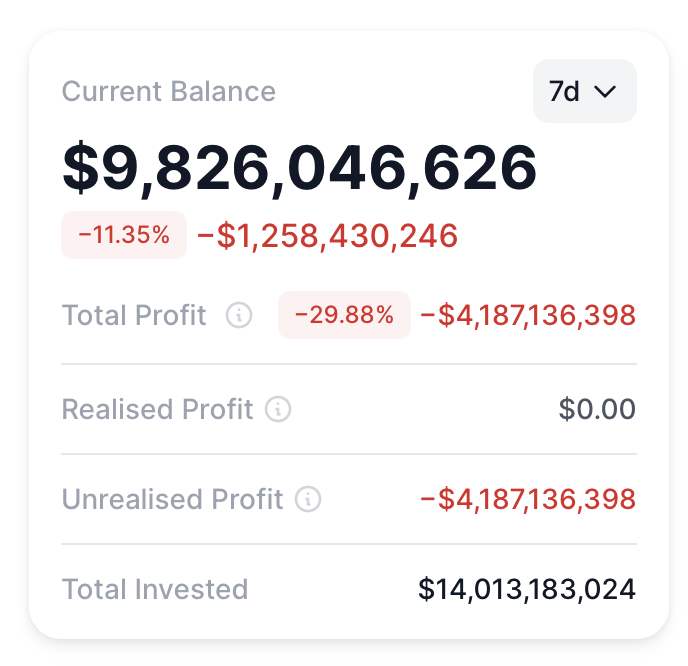

The latest figures show that the firm’s ETH stack is now worth just under $10 billion, placing BitMine’s unrealized losses at around $4.18 billion.

BitMine Unrealized Losses. Source:

BitMine Unrealized Losses. Source:

According to BitmineTracker data, the company’s basic market-to-net-asset-value (mNAV) ratio stands at 0.73, while its diluted mNAV is 0.88. Research firm 10x Research highlighted the implications in a recent post on X (formerly Twitter).

The post emphasized that shifts in NAV tend to reward long-term shareholders when the metric rises, but can amplify losses when it declines — a pattern that many investors in digital-asset vehicles still overlook.

“Treasury companies will face a hard reality: attracting new retail investors becomes nearly impossible when existing shareholders are sitting on billions in losses. When the premium inevitably shrinks to zero, as it is doing now, investors find themselves trapped in the structure, unable to get out without significant damage, a true Hotel California scenario,” 10x Research wrote.

The strain is equally visible in the company’s stock performance. Google Finance data shows that BMNR’s monthly dip is nearly twice that of ETH, with the share price dropping 49.8% over the same period.

This divergence is not unique to BMNR. Several Bitcoin-oriented treasuries have displayed the same pattern, registering declines that exceed BTC’s own downturn.

BitMine (BMNR) Stock Performance. Source:

BitMine (BMNR) Stock Performance. Source:

Meanwhile, BitMine is not alone in these challenges. Sharplink Gaming, the second-largest corporate holder of ETH, faces over half a billion dollars in unrealized losses. It owns 859,853 ETH valued at $2.4 billion at current market prices. The firm’s stock, SBET, is down 35.15% over the past month.

Despite this, on-chain data reveals BitMine is still actively buying ETH. Earlier this month, the firm bought 110,288 ETH. OnchainLens also reported a recent purchase of 17,242 ETH, valued at $49.07 million, from FalconX and BitGo.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Crypto Market Balances Optimism for Rate Reductions Against Concerns Over Continued Tight Monetary Policy

- U.S. nonfarm payrolls data triggered crypto volatility as Bitcoin fluctuated between $87,000 and $92,000 amid Fed rate-cut uncertainty. - Fed officials' divided inflation views reduced December rate-cut odds to 33%, exacerbating $900M in crypto liquidations within 24 hours. - Bitcoin miners face cash-burning operations while projects like Bitcoin Munari (SPL) emerge as alternatives with fixed-supply models and Layer 1 infrastructure. - Market remains split between hopes for rate cuts and fears of prolong

Bitcoin News Today: November Sees Unprecedented Bitcoin Withdrawals from ETFs Despite 41% Traditional Rally Pattern

- BlackRock's IBIT led November's record $2.47B ETF outflows, accounting for 63% of total Bitcoin fund redemptions amid falling prices. - Bitcoin dropped 27% from October highs as macroeconomic uncertainty and profit-taking drove $3.79B in monthly ETF withdrawals. - November's $3.79B outflows shattered February's record, defying historical 41% rally trends as institutional investors shifted to equities. - Analysts warn of prolonged downturn risks after BTC broke below 50-week averages, with bearish bets ri

Bitcoin News Update: Bitcoin's 2029 Projection: Brandt Views Correction as a Driver for Expansion

- Peter Brandt revises Bitcoin's price target to $200k by Q3 2029, lagging peers' 2025 forecasts. - Current 20% price drop and historic institutional selling underscore market correction. - Contrasts with Armstrong/Wood's $1M 2030 projections; emphasizes structural reset necessity. - Bessent's Pubkey DC visit seen as institutional openness, but analysts doubt immediate impact. - Brandt remains long-term bullish, viewing correction as prerequisite for sustainable growth.

Ethereum News Update: Overleveraging and Retail Hype May Lead to a 50% Cryptocurrency Plunge

- Alliance DAO co-founder QwQiao warns next crypto bear market could see 50% drawdown due to excessive leverage and inexperienced investors flooding spot assets and ETFs. - DATs (decentralized autonomous tokens) face sharp reversal risks as inflows plummet 82% to $1.93B in October, while BlackRock's IBIT ETF sheds $2.47B amid record outflows. - Market fractures as critics argue "dumb money" rhetoric oversimplifies maturing crypto adoption, while Ethereum's price struggles and Japan's $135B stimulus fail to