Bitcoin Is Officially Oversold For The First Time In 9 Months: What This Means For Price

Bitcoin has fallen sharply over the past several days, dropping to its lowest level in six months as bearish momentum strengthens. The decline has pushed BTC below key psychological thresholds and left traders preparing for additional downside. Yet despite the weakness, several indicators suggest a potential opportunity is emerging beneath the surface. Bitcoin Could Repeat

Bitcoin has fallen sharply over the past several days, dropping to its lowest level in six months as bearish momentum strengthens. The decline has pushed BTC below key psychological thresholds and left traders preparing for additional downside.

Yet despite the weakness, several indicators suggest a potential opportunity is emerging beneath the surface.

Bitcoin Could Repeat History

The Relative Strength Index has entered the oversold zone for the first time in nine months, signaling extreme selling pressure. The last time Bitcoin was officially oversold was in February, a period that preceded a notable recovery. Oversold conditions often hint at incoming reversals, but timing remains uncertain.

During the previous oversold event, Bitcoin fell an additional 10% before the rebound began. A similar pattern now could send BTC toward $77,164 before buyers regain control. If the decline is contained and this deeper drop is avoided, Bitcoin may bounce sooner.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin RSI. Source:

TradingView

Bitcoin RSI. Source:

TradingView

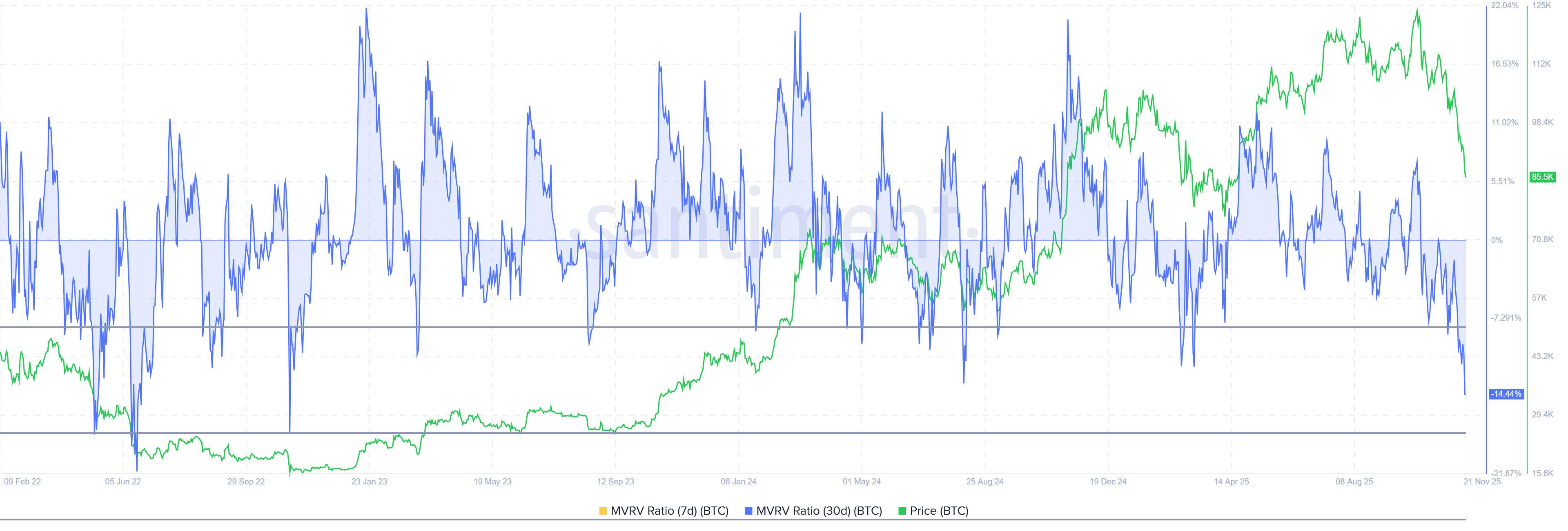

Macro momentum indicators are similarly pointing to undervaluation. Bitcoin’s MVRV Ratio sits at -14%, marking its lowest level in three years. The 30-day MVRV conveys two clear signals: holders are currently at a loss, and BTC is undervalued relative to historical norms. This environment tends to slow selling and increase accumulation.

The zone between -8% and -18% is historically known as the “opportunity zone,” a range where downside pressure typically saturates. Selling exhaustion often leads to steady accumulation, which in turn supports recovery.

Bitcoin MVRV Ratio. Source:

Santiment

Bitcoin MVRV Ratio. Source:

Santiment

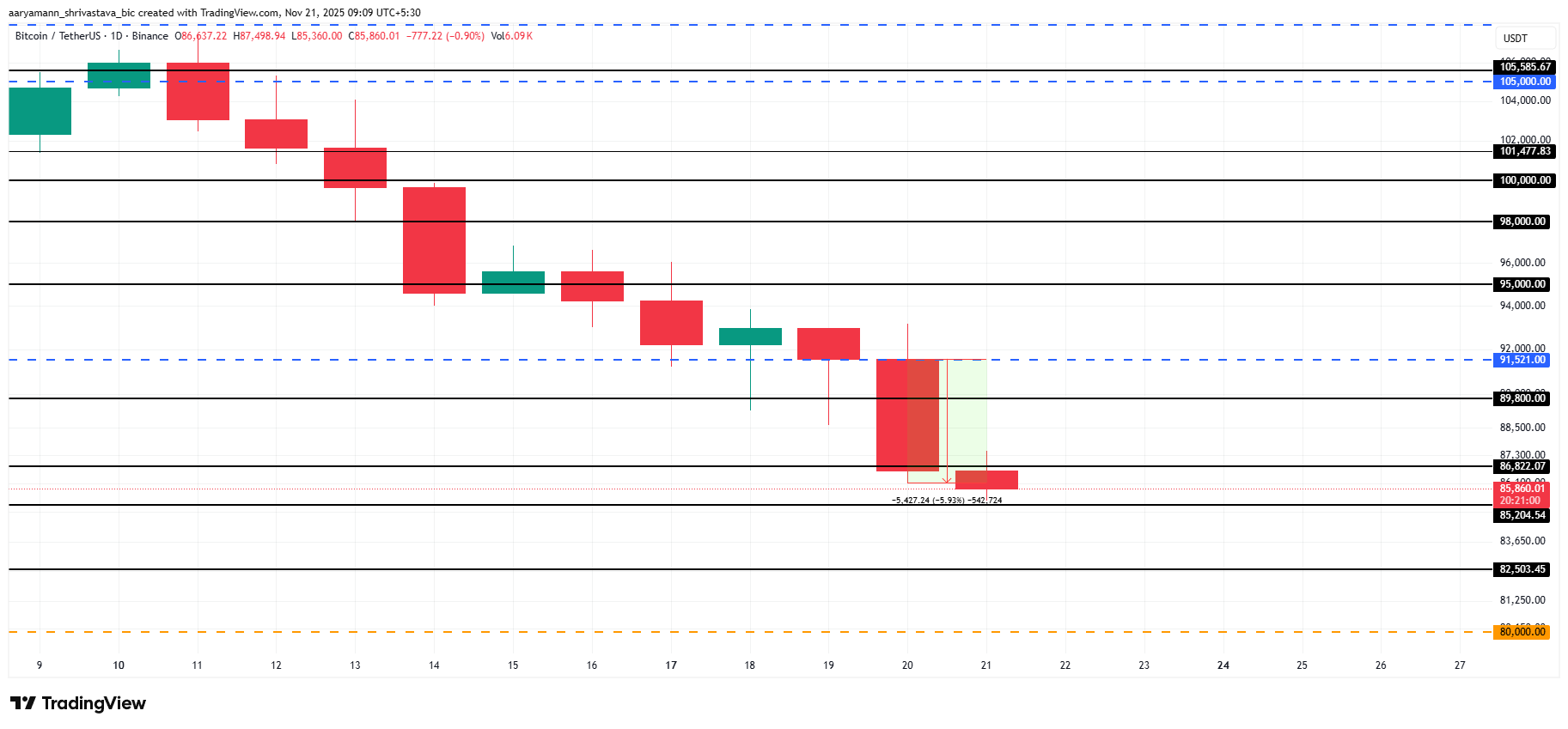

BTC Price Drops To $85,000

Bitcoin trades at $85,860 at the time of writing and is holding above the crucial $85,204 support level. Based on current indicators, BTC could experience a slight further downside before staging a rebound, especially if oversold conditions intensify.

A bearish continuation may drive Bitcoin to $77,164, aligning with the RSI’s historical pattern. Another possible scenario is a slide to $80,000 if BTC loses support at $85,204 and then $82,503. Both outcomes would reflect continued selling pressure before stabilization.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If Bitcoin manages to bounce from current levels, it could break above $86,822 and retest $89,800. A successful move higher would allow BTC to target a flip of $91,521 into support and push toward $95,000. This would invalidate the bearish outlook and signal a stronger recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Fundamental Flaws Trigger $3 Trillion Cryptocurrency Collapse During Speculative Frenzy

- Cryptocurrency markets collapsed on Nov 21, 2025, with $1.93B in liquidations erasing $3T in value as Bitcoin and Ethereum plummeted amid unexplained volatility. - Speculative panic and structural fragility drove Bitcoin below $87,000 while 391,164 traders faced losses, highlighting market instability and regulatory gaps. - UK authorities seized $33M in crypto linked to Russian sanctions evasion, while Brazilian firm Rental Coins filed bankruptcy to recover fraud-linked assets. - Analysts warned of prolo

XRP News Today: As Confidence in Altcoins Rises, Investors Shift from Bitcoin and Ethereum to XRP ETFs

- XRP ETFs gained $118M inflows as Bitcoin and Ethereum ETFs lost $1.6B in outflows amid market turmoil. - XRP's institutional adoption and new fund launches, like Canary Capital's XRPC, drove its ETF success. - Bitcoin and Ethereum price drops below key levels raised concerns over market stability and crypto-treasury risks. - SEC regulatory clarity boosted altcoin ETF approvals, shifting capital toward XRP and Solana despite volatility.

Bitcoin News Update: Bessent's Public Key Appearance: Sign of Crypto Market Rebound or Indication of Further Decline?

- U.S. Treasury Secretary Bessent's unannounced visit to Pubkey Bitcoin bar sparked mixed reactions as Bitcoin fell below $85,500 amid macroeconomic uncertainty. - Market analysts warned against overreacting to signals like Bessent's visit, noting delayed interest rate cuts and equity weakness drive Bitcoin's 28% market cap drop since October. - Institutional buying ($835M) and increased short-term holder activity suggest market resilience, though $1B+ liquidations highlight structural fragility in late 20

ZEC slips by 0.08% as institutional investors show interest and positive fundamentals come to light

- Zcash (ZEC) surged 61.91% in a month despite a 6.29% 7-day drop, driven by institutional buying and privacy demand. - Cypherpunk Technologies , backed by Winklevoss twins, boosted ZEC holdings to $150M, now owning 1.43% of total supply. - A $19M short squeeze on Nov 20 triggered by whale liquidations pushed ZEC above $680, signaling bullish momentum. - Analysts project $800–$1,000 price targets if ZEC breaks $700, citing institutional adoption and decoupling from Bitcoin trends.