MicroStrategy Faces $9 Billion Outflow Risk as Index Providers Eye Bitcoin Holdings

MicroStrategy confronts a critical test as leading index providers consider rules that could strip the company of nearly $9 billion in passive investment flows. MSCI is consulting on new criteria that would exclude firms with digital asset holdings exceeding 50% of total assets. Index Exclusion Threatens Core Strategy MicroStrategy, recently renamed Strategy Inc., holds 649,870

MicroStrategy confronts a critical test as leading index providers consider rules that could strip the company of nearly $9 billion in passive investment flows.

MSCI is consulting on new criteria that would exclude firms with digital asset holdings exceeding 50% of total assets.

Index Exclusion Threatens Core Strategy

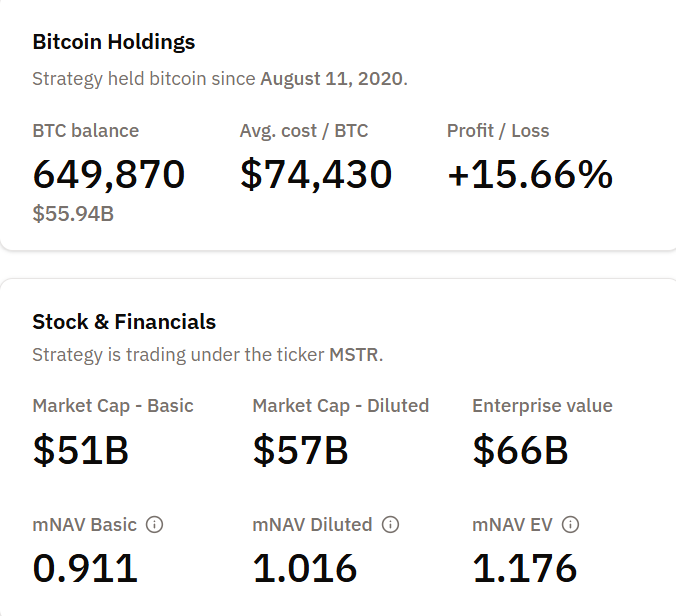

MicroStrategy, recently renamed Strategy Inc., holds 649,870 Bitcoin as of this writing, with an average cost of $74,430 per coin. The company’s break-even price matches this purchase point, leaving little margin as Bitcoin trades under pressure.

MicroStrategy BTC Holdings. Source:

Bitcoin Treasuries

MicroStrategy BTC Holdings. Source:

Bitcoin Treasuries

Its market capitalization is $51 billion on a basic share count and $57 billion fully diluted, while enterprise value is $66 billion.

MSCI began a formal consultation in September 2025 on how to treat digital-asset treasury companies (DATs).

According to MSCI’s official consultation documents, the proposed rule would exclude firms where digital assets comprise 50% or more of total assets and represent the main business activity.

Some clients argue that these companies resemble investment funds rather than eligible operating companies for equity indexes.

The risks extend further than MSCI. Strategy’s stock, MSTR, is listed in several key benchmarks, including the Nasdaq 100, CRSP US Total Market Index, and various Russell indexes.

Analysis from JPMorgan suggests that MSCI exclusion alone could result in $2.8 billion in passive fund sales. If other providers make similar changes, the total outflows could reach $8.8 billion.

The potential removal from benchmarks such as the MSCI USA and Nasdaq 100 presents the biggest challenge yet to Michael Saylor’s Bitcoin accumulation approach. A final decision is expected by January 15, 2026.

Valuation Premium Collapses Amid Bitcoin Downturn

Timing makes these issues more serious. Strategy’s shares have fallen 60% from recent highs, eroding the valuation premium that fueled its capital raise-and-buy strategy.

Its multiple to net asset value (mNAV) has compressed toward parity, reflecting reduced investor confidence in Saylor’s “sell stock, buy Bitcoin, repeat” flywheel.

This premium is crucial because Strategy’s model depends on it. The company issues equity and convertible debt to fund Bitcoin purchases, hoping shares will trade above the value of its Bitcoin holdings.

If that premium is lost, the business case weakens since investors can simply buy Bitcoin directly.

Meanwhile, funding costs have increased. Strategy issued convertible notes earlier in 2025 at higher terms. With Bitcoin underperforming, the firm faces squeezed profitability.

Its Bitcoin holdings show a 15.81% profit as of mid-November, but that margin shrinks if prices fall near the $74,430 break-even.

Market Divided on Index Classification

Not all market participants agree with the proposed exclusion. Matthew Sigel, VanEck’s head of digital assets research, pointed out on X that JPMorgan’s report reflects client feedback shaping index rules, rather than an explicit call for exclusion.

This highlights the issue as being about process, rather than just fundamental company characteristics.

The consultation exposes uncertainty around how finance should classify Bitcoin treasury companies. MSCI’s rules typically separate operating firms from investment vehicles.

Strategy runs analytics software, but gains most attention from its Bitcoin holdings, creating a hybrid identity that complicates classification.

Other companies also face review. MARA Holdings, Metaplanet Inc., and Bitcoin Standard Treasury Company all hold sizable digital assets.

Yet, Strategy’s scale and prominence make it a test case. If removed, it will set a precedent for how indexes treat public firms using Bitcoin as a reserve.

The January 15, 2026, decision date is critical. Strategy has to manage its Bitcoin position, funding costs, and meet shareholder expectations during this period.

The outcome will show whether Bitcoin treasury companies can maintain access to passive capital or risk reclassification and exclusion from major indexes. For Saylor’s model, the stakes are high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global authorities tighten oversight on cryptocurrencies as the yen’s decline highlights underlying economic vulnerabilities

- Bitcoin prices dropped globally as the yen hit a 10-month low, contrasting Canada's stablecoin regulatory advances with Asia's economic fragility. - Japan faces pressure to raise interest rates amid yen depreciation, while a ¥21.3 trillion stimulus aims to balance inflation and growth risks. - Canada's Bank of Canada will oversee stablecoin reserves, aligning with U.S. crypto regulations and signaling global tightening of crypto oversight. - UK's "Operation Destabilise" uncovered a $1B Russian-linked lau

XRP News Today: WPAHash Provides Consistent XRP Returns Despite Fluctuating Crypto Markets

- WPAHash, a London-based firm, launched an XRP-powered cloud hashing platform in November 2025 to generate passive income for crypto holders without technical expertise or hardware. - The platform combines XRP’s fast payments with distributed mining, offering 24/7 dynamic hash allocation, global data centers, and military-grade security for stable returns. - Tiered contracts ($100–$8,000) provide daily yields up to $128, with transparent dashboards tracking earnings and reinvestment data across 120 countr

Crypto Drives Change: IPSI’s Insurance Arm Adopts Instant Blockchain-Based Payments

- Innovative Payment Solutions (OTC: IPSI) formed Astria Insurance Solutions, a subsidiary integrating crypto-based premium payments with fintech and insurance services. - Astria uses IPSI's blockchain infrastructure for real-time settlements and digital wallets, aligning with crypto adoption trends in finance . - The subsidiary plans to secure state licenses and expand via a marketing platform, targeting digital-first consumers and commercial clients. - CEO Bill Corbett emphasized the strategic value of m

Bitcoin News Today: Bitcoin Faces Volatility Turning Point as Whale's 20x Leverage Bet Challenges $88,900 Mark

- A dormant Bitcoin whale reactivated after 18 months, opening a $31M 20x leveraged long position, signaling bullish confidence in Bitcoin's $88,900 threshold. - The position faces liquidation risks if Bitcoin dips below $88,900, amid $563M in cumulative long liquidation risks and $745M short risks across major exchanges. - Other large holders show divergent strategies: a 14-year-old miner moved $16.6M BTC amid quantum computing concerns, while a 20x short seller holds $24M in unrealized profits. - Analyst