Pi Coin Holds Gains in a Red Market — Another Breakout At 6.5%?

Pi Coin is one of the few assets holding green while much of the crypto market stays red this month. Bitcoin is down about 20% and Ethereum has dropped nearly 27% month-on-month. Pi Coin price, once seen as a weaker project, is still up almost 18% in the same period. Even after today’s 5% dip,

Pi Coin is one of the few assets holding green while much of the crypto market stays red this month. Bitcoin is down about 20% and Ethereum has dropped nearly 27% month-on-month. Pi Coin price, once seen as a weaker project, is still up almost 18% in the same period.

Even after today’s 5% dip, its monthly trend remains positive. This unusual strength now puts Pi Coin (PI) only 6.5% away from a fresh breakout attempt. Here’s how!

Money Flow Strengthens The Uptrend

The first sign of strength comes from the Money Flow Index (MFI). MFI uses both price and volume to show if buyers or sellers are in control. Pi Coin broke above its MFI trend line on November 16, right as the price started rising.

Since November 14, Pi Coin has climbed almost 26%, and the MFI breakout confirmed that buyers were active early. The indicator has pulled back slightly, but it is still above its trend line. As long as it stays above it, dips are more likely to act as simple pullbacks instead of full reversals.

Dip Buying Continues:

Dip Buying Continues:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Volume flow supports this idea as well. The On-Balance Volume line (OBV) broke its trend line on November 18, two days after the MFI breakout. OBV tracks whether more volume is flowing into the asset or out of it.

A late OBV breakout usually means smaller traders joined after larger wallets took the first step. OBV is still in negative territory near –1.84 billion, a common feature of downtrends. Do note that the PI price trend still points down in the long term, as it’s down by over 30% in the last three months.

Volume Backs The PI Story:

Volume Backs The PI Story:

The upward OBV slope shows improving demand. Clearing –1.84 billion would strengthen the short-term trend.

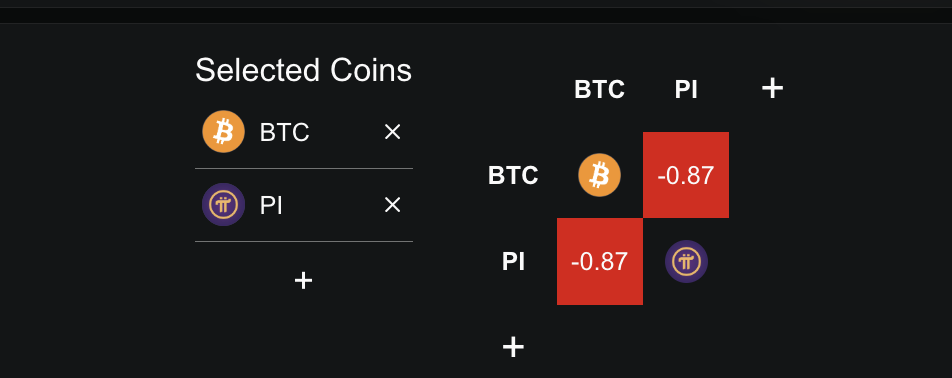

A rare detail adds more weight: PI’s seven-day correlation with Bitcoin sits near –0.87. This is the Pearson coefficient, which measures whether two assets move together. A reading close to –1 means they move in opposite directions.

PI-BTC Correlation:

PI-BTC Correlation:

That explains why Pi Coin has remained green while Bitcoin and other large caps fell. If BTC continues to correct, the Pi Coin price might see more upside, per this theory.

An Upcoming Crossover Builds a Bullish Case

The 4-hour chart adds to the bullish argument. Pi Coin trades above all major exponential moving averages. The 50-period average is moving closer to the 200-period average.

Pi Coin Could Extend Gains In The Short-Term:

Pi Coin Could Extend Gains In The Short-Term:

If the 50 crosses above the 200, the structure forms what traders call a golden crossover. It usually means short-term strength is catching up to long-term trend direction. This setup supports the idea that Pi Coin’s uptrend still has room.

Exponential moving average (EMA) gives more weight to recent price data, so it reacts faster than simple moving averages.

Pi Coin Price Levels to Watch

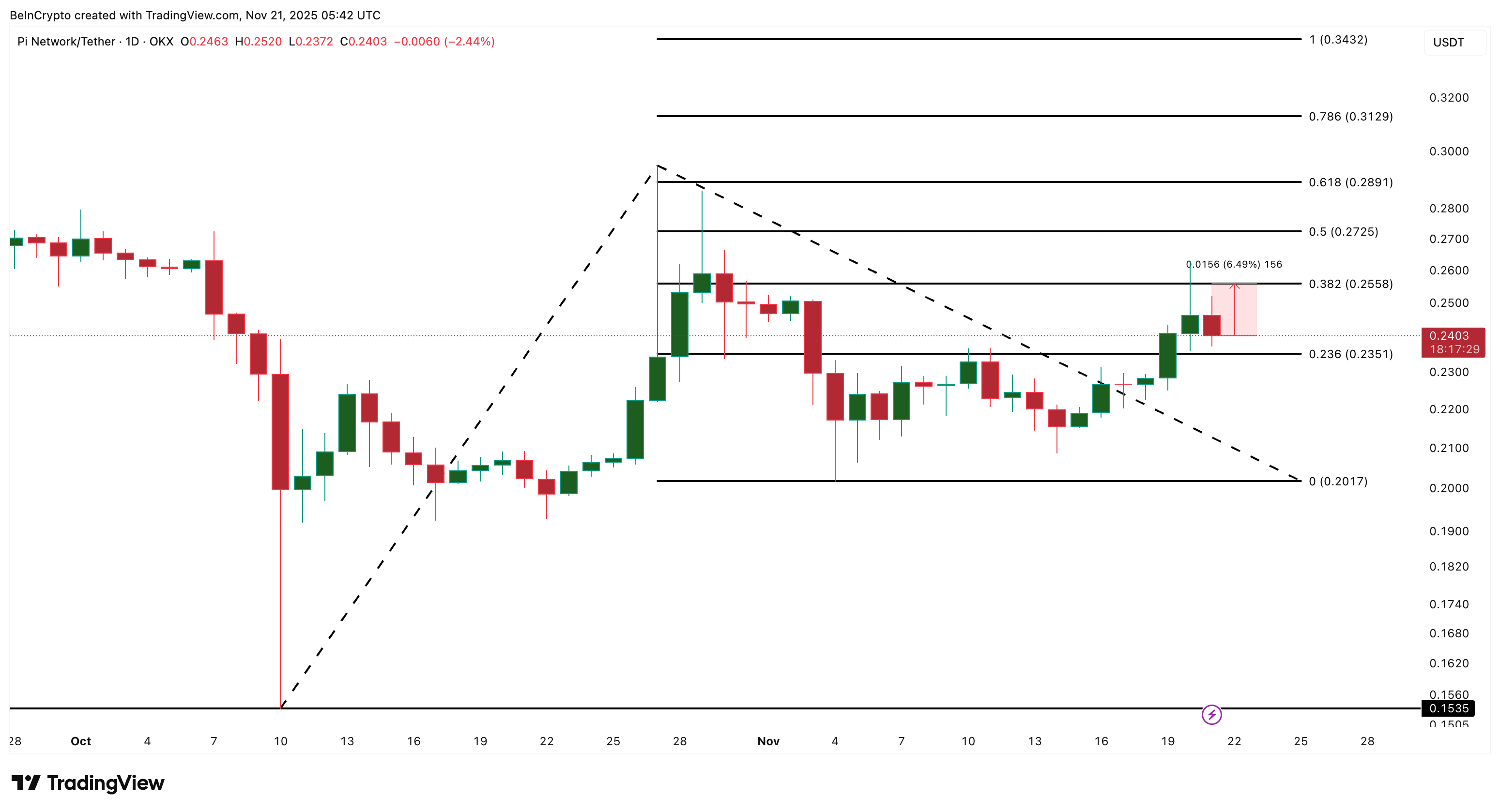

Trend-based Fibonacci extensions show the next resistance near $0.25. Pi Coin needs a clean daily close above this level to unlock the next wave higher. That requires a move of roughly 6.5% from the current price. Crossing $0.25 might allow Pi Coin’s rally to extend higher, with even $0.31 and $0.34 in contention.

On the downside, the key support sits near $0.23. Losing it on a daily close increases the risk of a drop toward $0.20, which would wipe out most of Pi Coin’s recent gains.

Pi Coin Price Analysis:

Pi Coin Price Analysis:

For now, Pi Coin remains one of the rare green assets in a red market, on a monthly timeframe. If buyers can push it 6.5% higher, another breakout attempt may be just ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC +0.3% as Unrealized Profits Tighten on Hyperliquid

- ZEC rose 0.3% in 24 hours to $518.99 despite a 14.9% 7-day drop, showing mixed short-term volatility. - Hyperliquid's $19.35M 5x leveraged ZEC long position now holds $3.5M unrealized gains, signaling consolidation near average entry price ($419.23). - ZEC's 823.33% annual surge and active large positions highlight long-term bullish fundamentals, with market watchers anticipating potential breakout after consolidation.

Centralized Domain Systems Undermine DeFi Confidence Following Aerodrome DNS Compromise

- Aerodrome Finance, a Base network DEX, suffered DNS hijacking attacks forcing users to switch to decentralized ENS domains after phishing risks compromised centralized domains like aerodrome.finance. - The breach exploited centralized domain vulnerabilities to redirect traffic to fake sites, echoing a 2023 incident that caused $300,000 in losses, despite secure smart contracts protecting user funds. - Amid a merger with Velodrome DEX to create a unified "Aero" ecosystem, AERO token dipped 3% to $0.80 des

Bitcoin Updates: Treasury Balances Trade Disputes and Cryptocurrency Market Fluctuations

- U.S. Treasury balances trade tensions with China and crypto market volatility as Bitcoin prices drop 21% amid ETF outflows and regulatory shifts. - Bessent's Bitcoin bar visit sparks speculation about crypto policy while trade talks aim to de-escalate tariffs impacting global markets and crypto adoption in Latin America. - Institutional investors maintain Bitcoin holdings despite downturn, with Tether and JPMorgan highlighting stablecoin growth and regulatory clarity in Europe's MiCA framework. - Treasur

Bitcoin Leverage Liquidations Spike at End of 2025: An Urgent Reminder for Effective Risk Control in Cryptocurrency Trading

- Bitcoin's 2025 price crash triggered $2B in leveraged liquidations, marking crypto's worst crisis as $126k→$82k swings exposed systemic risks. - 392,000 traders lost $960M in 24 hours due to 10x leverage products, thin liquidity, and algorithmic selling during the November 20-21 collapse. - Experts now recommend 3-5x leverage caps, diversified positions, and hedging tools like options to mitigate risks after the crisis revealed crypto-traditional market interdependencies. - Regulatory scrutiny intensifie