Crypto Markets Wiped $1Trillion, but Raoul Pal sees a Strong Bitcoin Recovery

-

Crypto market lost $1 trillion, but Raoul Pal says sharp Bitcoin recoveries are normal.

-

Raoul Pal compares current crash to past cycles where Bitcoin bounced back strongly.

-

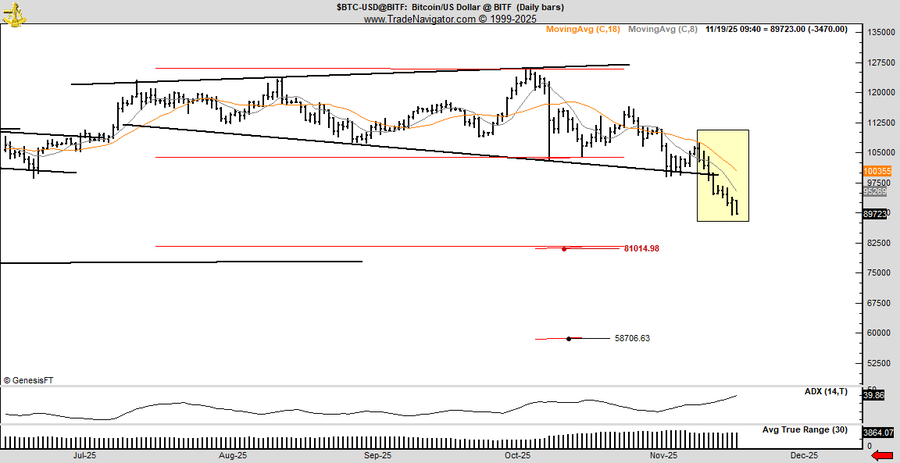

Analyst Peter Brandt warns Bitcoin could fall deeper toward $81,000 or even $58,000.

The crypto market is going through one of its toughest periods in over the past weeks, wiping out roughly $1 trillion from the market. Prices are falling fast, traders are panicking, and rumors about weakened market makers are adding more fear to the fire.

But while the drop looks scary, macro investor Raoul Pal believes this kind of heavy shake-out has happened before and often leads to strong recoveries.

Bitcoin’s Historical Pattern Repeating Again

In his post, Pal shared a striking long-term Bitcoin chart, comparing today’s drop with the shocking crash of 2021. Back then, Bitcoin fell 56% in just one month, Ethereum dropped 62%, and Solana plunged 68%.

Everyone panicked, and then the market suddenly flipped, and crypto exploded to new all-time highs.

That wasn’t the only time. From 2019 to 2020, Bitcoin fell 72% before bouncing back stronger. Between 2016 and 2017, Bitcoin saw seven drops of more than 30% each, yet the overall trend remained upward.

Each time, altcoins fell even harder. Each time, fear won in the short term, and patience won in the long term.

Pal’s View: Pain Now, Opportunity Later

Despite the chaos, Pal remains calm. He says he is adding to his positions during this drop because he sees the long-term trend as strong. However, he also reminds everyone that each person’s risk level and time horizon are different.

Pal also shared an important price point to watch. According to him, if Bitcoin can break above the $85,000 level and turn it into a strong support, the next target would be $89,326. He believes this zone could act as the next step before Bitcoin decides its bigger move.

Bitcoin Could Drop to $58K

While some analysts expect a recovery, veteran trader Peter Brandt is warning that Bitcoin could still see a deeper drop.

According to him, Bitcoin made a small breakout on November 11, but instead of building strength, the price kept falling for eight straight days, creating “lower highs.” This shows that sellers are still in control and buyers are not able to push the price up.

Based on his analysis, he sees $81,000 and $58,000 as important levels Bitcoin could revisit if the selling continues. A drop to $58,000, he said, could trigger strong panic among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Is Crypto’s Intense Fear Signaling a Market Bottom or Just a Misleading Decline?

- Crypto Fear & Greed Index fell to 24, with Bitcoin consolidating between $103,000-$115,000 amid prolonged market anxiety. - Extended fear periods historically precede market bottoms, but traders warn the index often lags and misfires in volatile conditions. - Coinbase aims to stabilize markets with 24/7 altcoin futures, yet regulatory clarity and persistent ETF outflows remain critical factors.

Bitcoin News Update: Bitcoin ETFs See $2.96 Billion Outflow as November Optimism Wanes

- BlackRock's Bitcoin ETFs lost $523M in single-day outflows on Nov 17, marking fifth consecutive net redemptions totaling $2.96B for November. - Despite November's historical 41.22% Bitcoin price surge, ETF redemptions signal cooling institutional/retail demand with average investor cost basis at $89,600. - Michael Saylor's firm bought 8,178 BTC at $102k average price, while JPMorgan warned Bitcoin-heavy companies risk index delistings by 2026. - BlackRock's IBIT holds 3.1% of Bitcoin supply but NAV multi

Bitcoin Updates: ECB Advocates for Digital Euro While Bitcoin's Decline Faces Regulatory Barriers

- ECB President Lagarde reaffirmed Bitcoin's "worth nothing" stance, rejecting its inclusion in central bank reserves due to safety and regulatory risks. - Bitcoin fell below $90,000 (32% from October 2025 peak), mirroring April 2025's correction amid U.S. rate uncertainty and large holder sell-offs. - ECB prioritizes digital euro development, aiming for 2027 pilot and 2029 launch to enhance privacy and reduce reliance on foreign payment systems. - Despite short-term Bitcoin rebound (3.64% in 24 hours), an

Ethereum News Update: Altcoins Face Critical Juncture—December Turning Point May Spark Market Recovery or Downturn

- Altcoins like ETH, XRP , and ICP trade near critical technical levels as institutional investors monitor potential inflection points ahead of a possible December market rebound or collapse. - Ethereum remains fragile below key moving averages with RSI near oversold territory, while XRP faces a $2.07–$2.10 support test that could trigger further declines if broken. - Smaller-cap tokens show speculative activity amid consolidation, with ICP's $4.97 resistance and Bitcoin's $88,000 support level serving as