Pi Coin Price Rise May Slow Down As Investors’ Bullishness Saturates

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation. This shift suggests that the strong buying activity supporting the rally may slow in the near

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation.

This shift suggests that the strong buying activity supporting the rally may slow in the near term.

Pi Coin Faces Slight Bearishness

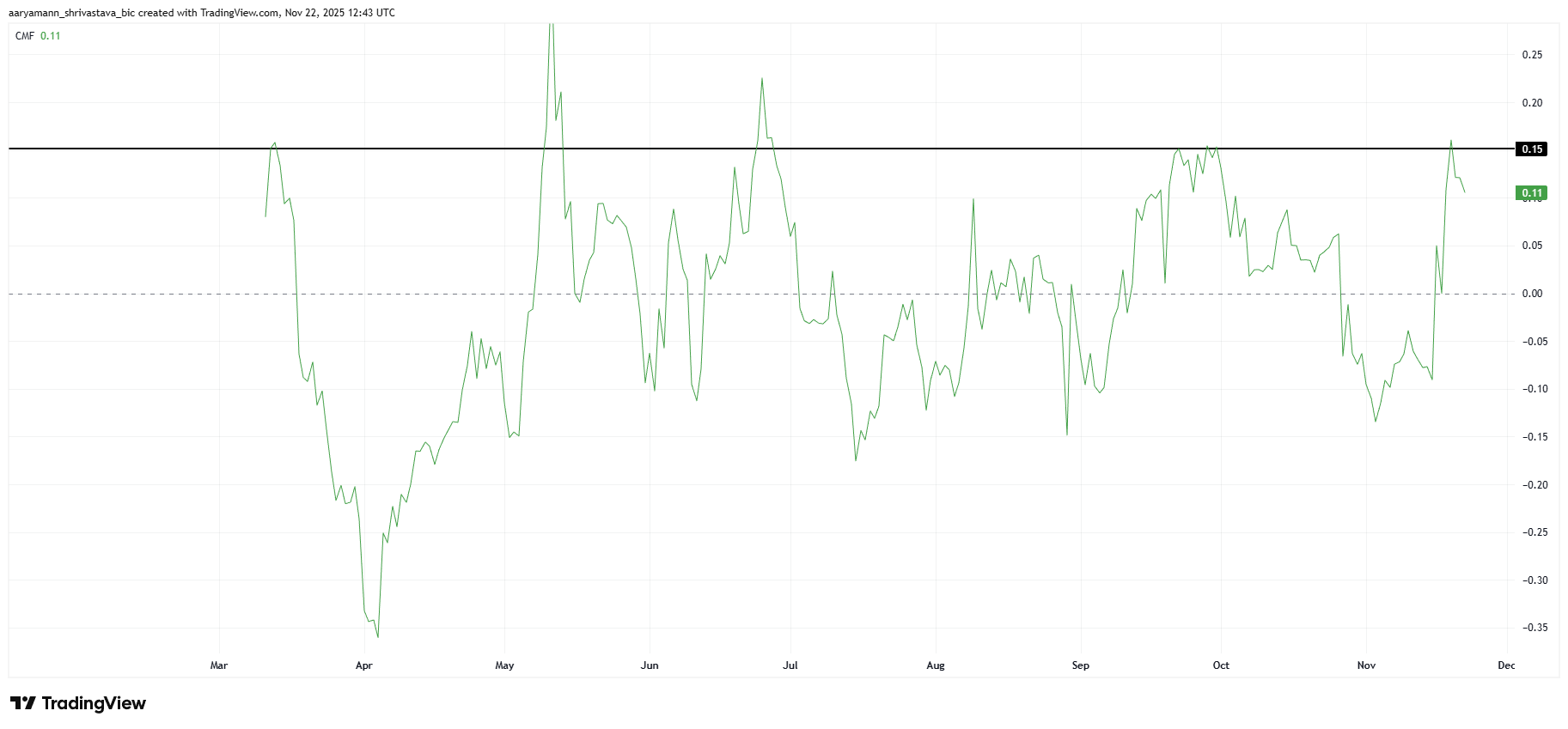

The Chaikin Money Flow is slipping after touching the 0.15 level, signaling weakening capital inflows.

CMF tracks money entering and exiting an asset, and while 0.20 is typically viewed as a saturation point, Pi Coin’s threshold appears lower. Historically, a move above 0.15 has often led to both price reversals and netflow declines.

This pattern may repeat, as Pi Coin has struggled to maintain inflows once CMF breaks above this zone.

A renewed drop in capital could pull the price lower in the coming sessions, creating short-term bearish pressure.

Want more token insights like this? Sign upa for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin CMF. Source:

Pi Coin CMF. Source:

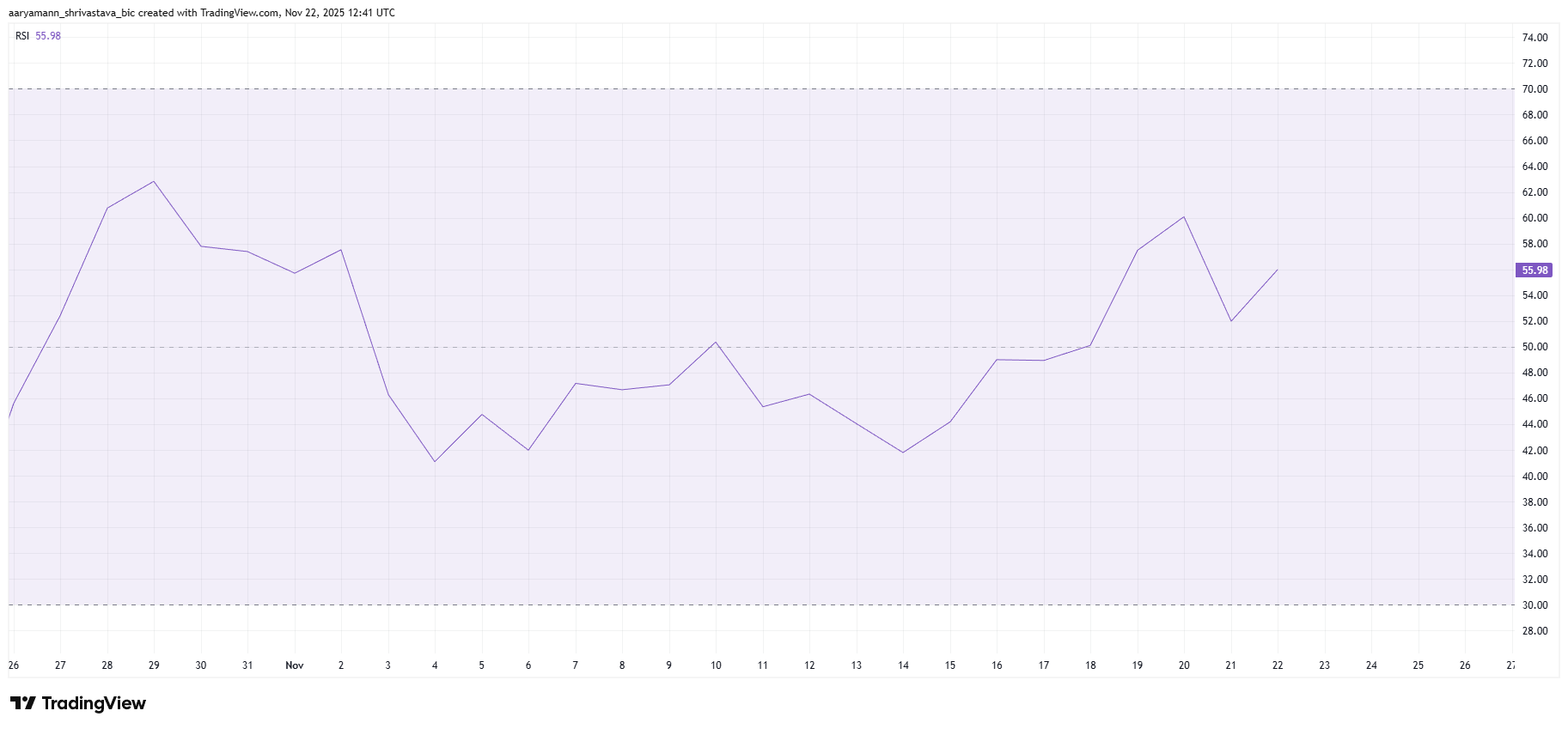

Despite the slip in sentiment, macro indicators still show pockets of strength. The Relative Strength Index remains in bullish territory above the neutral line.

This means Pi Coin is managing to sustain buying interest even as broader market sentiment trends bearish. Strong RSI readings often imply underlying resilience.

One contributing factor is Pi Coin’s negative correlation with Bitcoin.

As BTC weakens, Pi Coin has avoided following the typical market trend, allowing it to maintain upward movement independently. This divergence continues to support the asset, even with inflows softening.

Pi Coin RSI. Source:

Pi Coin RSI. Source:

PI Price Is Finding Its Footing

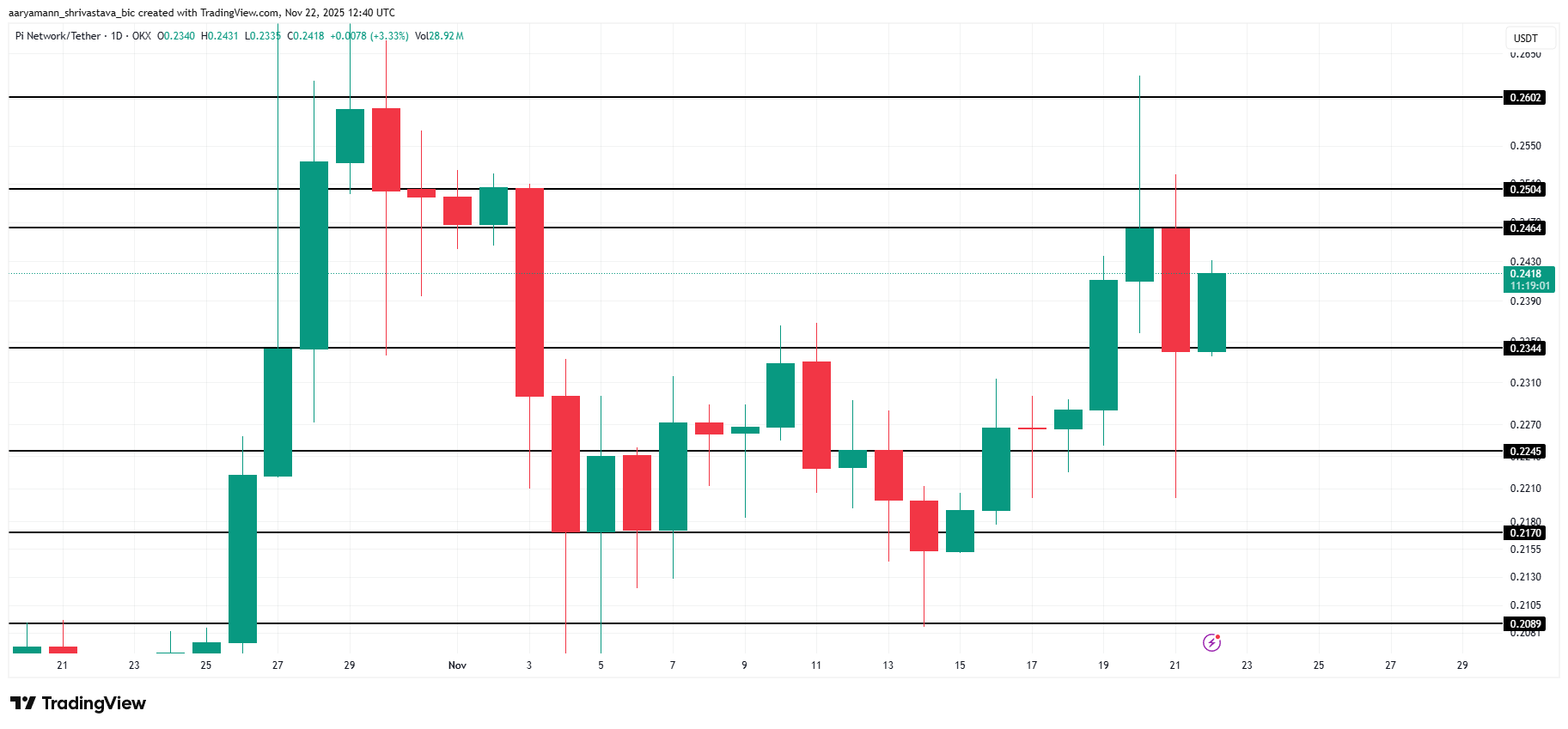

Pi Coin is trading at $0.241, sitting just below the $0.246 resistance level. The altcoin’s 5% drop yesterday reflects short-term bearish pressure. This has eased but not disappeared entirely. Price action suggests a cautious environment as traders wait for stronger signals.

If buying strength continues to fade, Pi Coin could slip below the $0.234 support or remain range-bound between $0.234 and $0.246.

Consolidation appears likely unless inflows strengthen again, which historically has taken time once CMF retreats.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if capital inflows rise again, Pi Coin may break above the $0.246 resistance.

A successful move could lift the price to $0.250 and potentially to $0.260. This would invalidate the bearish outlook and restore short-term bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ECB Advocates for Digital Euro While Bitcoin's Decline Faces Regulatory Barriers

- ECB President Lagarde reaffirmed Bitcoin's "worth nothing" stance, rejecting its inclusion in central bank reserves due to safety and regulatory risks. - Bitcoin fell below $90,000 (32% from October 2025 peak), mirroring April 2025's correction amid U.S. rate uncertainty and large holder sell-offs. - ECB prioritizes digital euro development, aiming for 2027 pilot and 2029 launch to enhance privacy and reduce reliance on foreign payment systems. - Despite short-term Bitcoin rebound (3.64% in 24 hours), an

Ethereum News Update: Altcoins Face Critical Juncture—December Turning Point May Spark Market Recovery or Downturn

- Altcoins like ETH, XRP , and ICP trade near critical technical levels as institutional investors monitor potential inflection points ahead of a possible December market rebound or collapse. - Ethereum remains fragile below key moving averages with RSI near oversold territory, while XRP faces a $2.07–$2.10 support test that could trigger further declines if broken. - Smaller-cap tokens show speculative activity amid consolidation, with ICP's $4.97 resistance and Bitcoin's $88,000 support level serving as

Fed's Battle Between Inflation and Jobs Drops Chances of December Rate Cut to 33%

- Fed's December rate cut odds dropped to 33% due to internal divisions and delayed labor market data. - October/November jobs reports delayed until post-Dec 9-10 meeting, removing key policy input. - 10-2 October voting split and cautious officials like Collins highlight policy uncertainty. - Bitcoin fell 20% while gold dipped below $4,000 as markets react to reduced cut expectations. - Analysts warn prolonged indecision risks volatility, with December outcome hinging on incoming data.

ICP Caffeine AI: Is This the Next Game-Changer for the AI-Powered Web3 Landscape?

- ICP Caffeine AI-DFINITY introduces a "chain-of-chains" blockchain architecture enabling on-chain AI tasks like image processing and facial recognition. - The platform integrates Microsoft Azure and Google Cloud to reduce AI inference costs by 20-40%, targeting enterprise scalability while maintaining decentralization. - Despite a 56% ICP token price surge, dApp activity dropped 22.4% in Q3 2025, raising concerns about no-code workflow viability and SEC regulatory scrutiny. - Competitors like C3.ai and CU