Solana Considers Cutting $3 billion in SOL Emissions in its Biggest Economic Shift Yet

The proposed Solana disinflation plan would compress staking yields and could render up to 47 validators unprofitable, raising questions about future network consolidation.

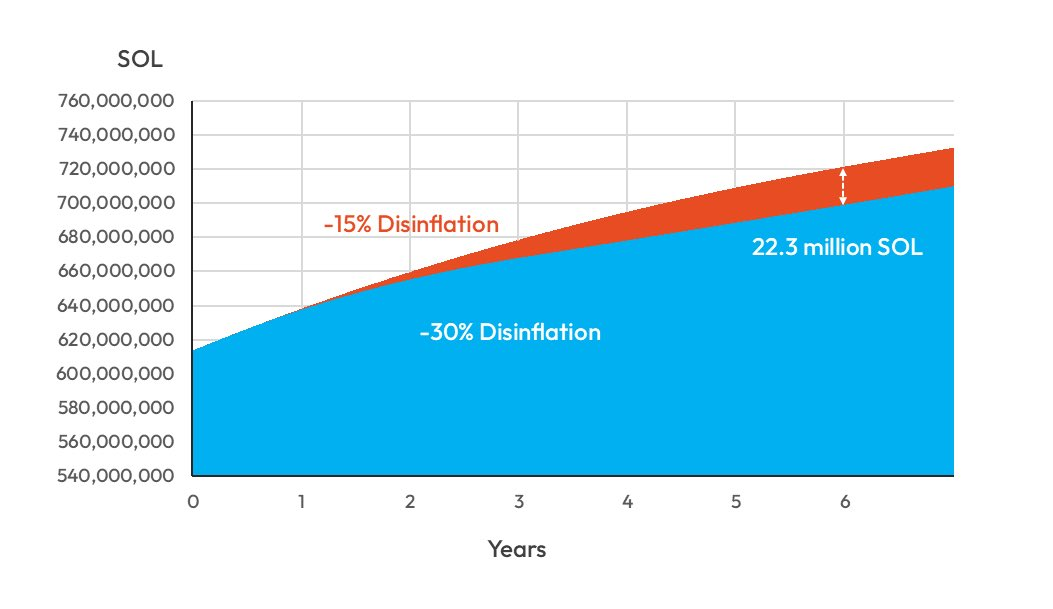

Solana is weighing a radical shift in its economic model that would eliminate approximately 22.3 million SOL ($2.9 billion) from projected emissions over the next six years.

As a result, the proposal would aggressively fast-track the transition of the blockchain to a low-inflation environment.

Solana’s Plan to Tighten Supply Risks Squeezing Nearly 50 Validators

The measure, formally titled SIMD-0411, proposes doubling the Solana network’s annual disinflation rate from 15% to 30%.

“Doubling the disinflation rate requires modifying a single parameter, making it the simplest possible protocol change that delivers a meaningful reduction in inflation. This adjustment will not consume core developer resources. It carries minimal risk of introducing bugs or unforeseen edge cases,” the authors argued.

If passed, Solana would hit its “terminal” inflation target of 1.5% in roughly three years, ie, by 2029. Notably, that milestone was originally scheduled for 2032.

Proponents describe the current emissions schedule as a “leaky bucket” that continually dilutes holders and creates persistent sell pressure.

By tightening supply, the network hopes to emulate the scarcity mechanics that have historically benefited Bitcoin and Ethereum.

“Our modeling indicates that, over the next 6 years, total supply would be approximately 3.2% lower (a reduction of 22.3 million SOL) than under the current inflation schedule. At today’s SOL price, this equates to roughly $2.9 billion in reduced emissions. Excessive emissions create persistent downward price pressure, distorting market signals and hindering fair price comparison,” they wrote.

Solana’s Disinflation Proposal. Source: Solana Floor

Solana’s Disinflation Proposal. Source: Solana Floor

Beyond price support, the plan seeks to overhaul the incentive structure for decentralized finance (DeFi).

Moreover, the proposal argues that high inflation mirrors high interest rates in traditional finance, raising the “risk-free” benchmark and discouraging borrowing.

Considering this, Solana aims to push capital out of passive validation and into active liquidity provision by compressing nominal staking yields. Those yields are projected to fall from 6.41% to 2.42% by the third year.

Solana’s Staking Reward and Inflation Rate. Source:

Staking Rewards

Solana’s Staking Reward and Inflation Rate. Source:

Staking Rewards

However, this “hard money” pivot carries operational risks.

The reduction in subsidies will inevitably squeeze validator margins.

The proposal estimates that up to 47 validators could become unprofitable within three years as rewards dry up. However, the authors describe this level of churn as minimal.

Still, it raises questions about whether the network will consolidate around larger, better-capitalized operators that can survive on transaction fees alone.

Despite these concerns, early backing from key ecosystem players suggests Solana is prepared to trade subsidized growth for greater stability. The shift reflects a move toward positioning the network as a more mature, scarcity-driven asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Is Crypto’s Intense Fear Signaling a Market Bottom or Just a Misleading Decline?

- Crypto Fear & Greed Index fell to 24, with Bitcoin consolidating between $103,000-$115,000 amid prolonged market anxiety. - Extended fear periods historically precede market bottoms, but traders warn the index often lags and misfires in volatile conditions. - Coinbase aims to stabilize markets with 24/7 altcoin futures, yet regulatory clarity and persistent ETF outflows remain critical factors.

Bitcoin News Update: Bitcoin ETFs See $2.96 Billion Outflow as November Optimism Wanes

- BlackRock's Bitcoin ETFs lost $523M in single-day outflows on Nov 17, marking fifth consecutive net redemptions totaling $2.96B for November. - Despite November's historical 41.22% Bitcoin price surge, ETF redemptions signal cooling institutional/retail demand with average investor cost basis at $89,600. - Michael Saylor's firm bought 8,178 BTC at $102k average price, while JPMorgan warned Bitcoin-heavy companies risk index delistings by 2026. - BlackRock's IBIT holds 3.1% of Bitcoin supply but NAV multi

Bitcoin Updates: ECB Advocates for Digital Euro While Bitcoin's Decline Faces Regulatory Barriers

- ECB President Lagarde reaffirmed Bitcoin's "worth nothing" stance, rejecting its inclusion in central bank reserves due to safety and regulatory risks. - Bitcoin fell below $90,000 (32% from October 2025 peak), mirroring April 2025's correction amid U.S. rate uncertainty and large holder sell-offs. - ECB prioritizes digital euro development, aiming for 2027 pilot and 2029 launch to enhance privacy and reduce reliance on foreign payment systems. - Despite short-term Bitcoin rebound (3.64% in 24 hours), an

Ethereum News Update: Altcoins Face Critical Juncture—December Turning Point May Spark Market Recovery or Downturn

- Altcoins like ETH, XRP , and ICP trade near critical technical levels as institutional investors monitor potential inflection points ahead of a possible December market rebound or collapse. - Ethereum remains fragile below key moving averages with RSI near oversold territory, while XRP faces a $2.07–$2.10 support test that could trigger further declines if broken. - Smaller-cap tokens show speculative activity amid consolidation, with ICP's $4.97 resistance and Bitcoin's $88,000 support level serving as