Ethereum News Today: ETH Holds $2,700—Will Buyers Prevent a Drop to $2,500?

- Ethereum tests $2,700–$2,850 support as bearish momentum intensifies, with breakdown risks exposing $2,450–$2,550 levels. - Long-term holders sold 58,352 ETH ($175M) in one day, while whales accumulate, signaling potential redistribution. - Fed minutes triggered a seven-month low near $2,870, aligning with historical support clusters and 2021–2022 price range midpoints. - A $2,700–$2,850 defense could target $3,050–$3,150, but sustained recovery requires breaking above $4,200 trendline.

Ethereum (ETH) is at a crucial crossroads as bearish forces grow stronger, with the cryptocurrency challenging significant support zones that may shape its short-term direction. The coin has been moving within a downward channel, and both analysts and blockchain data point to possible triggers for a bounce as well as ongoing structural issues that could extend the current decline.

Technical signals indicate

Sentiment in the market remains negative, further weighed down by broader economic uncertainty. The publication of Federal Reserve minutes in late November sparked a rapid sell-off, driving ETH to a seven-month low near $2,870

The next move depends on whether buyers can maintain the $2,700–$2,850 support. If this level holds, ETH could aim for the $3,050–$3,150 imbalance zone, but unless it convincingly breaks above the downward trendline from $4,200, any rally is likely to be corrective in nature

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Crypto Is Crashing Today: Analysts Warn BTC Could Break Below $80K After Global Market Panic

Altcoins Hold Strong as Bitcoin Falls 24% in November

Avoid These Domains! Aerodrome Finance Warns Users After Front-End Breach

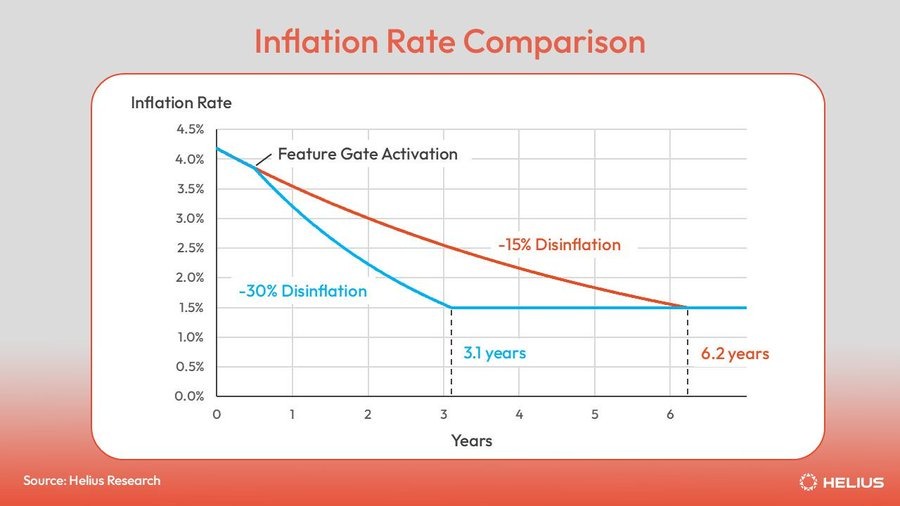

Solana Is About to Get Scarce, Biggest Update Yet!