Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Grayscale just secured the green light from the New York Stock Exchange to list two new ETFs tied to Dogecoin and XRP . Both products begin trading Monday, marking another step in the rapid expansion of crypto ETFs in the United States. Here’s what’s going on and why it matters.

What Exactly Did the NYSE Approve?

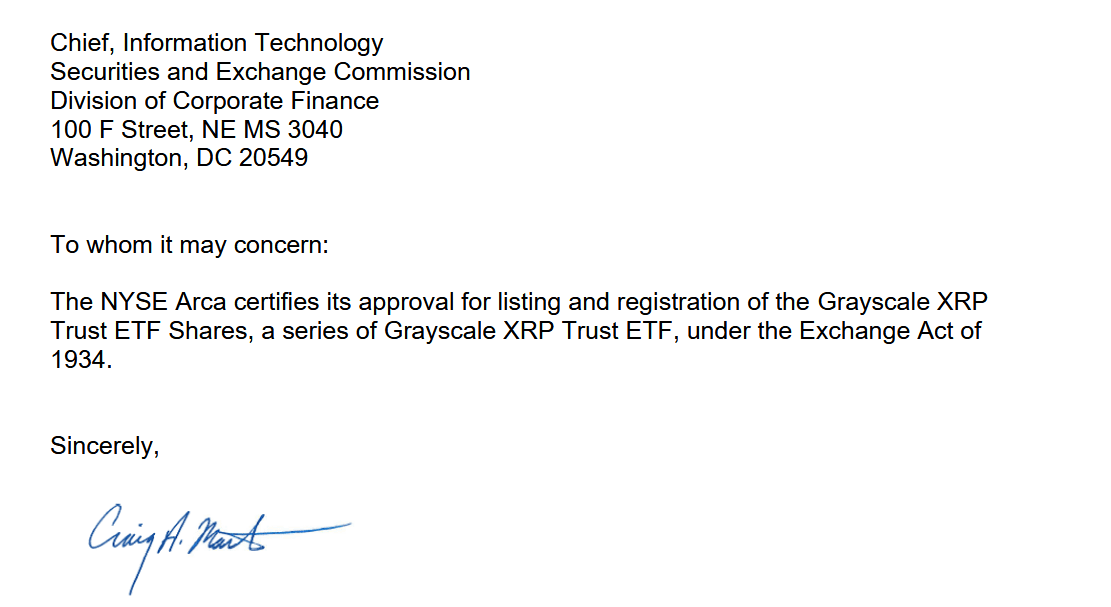

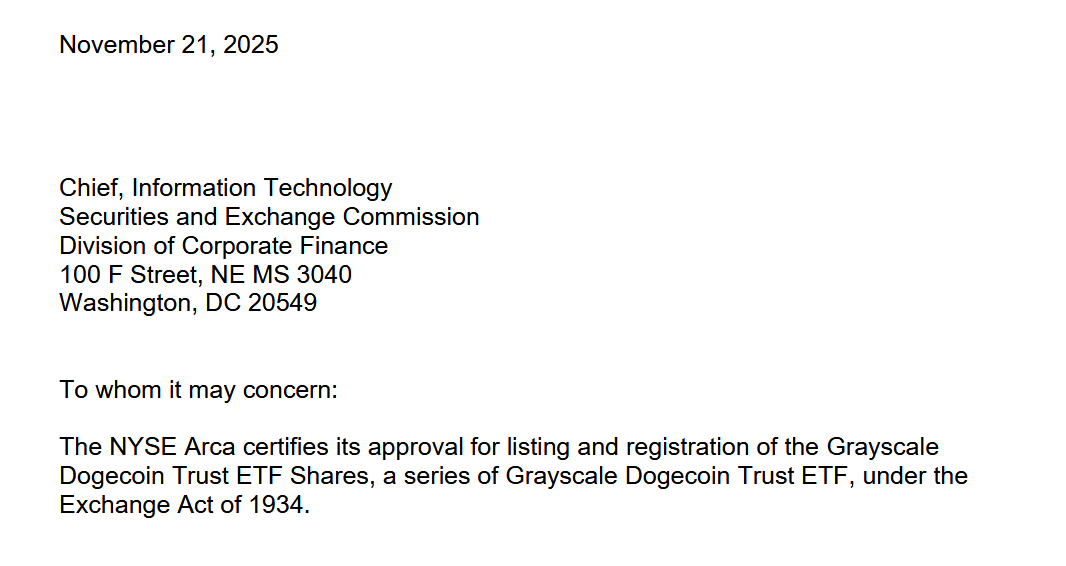

NYSE Arca certified the listing and registration of the Grayscale XRP Trust ETF Shares and the Grayscale Dogecoin Trust ETF Shares. This certification is the final administrative step that allows both products to debut on the open market.

These ETFs are not brand-new funds. They’re conversions of existing private-placement products that Grayscale has offered for years. Once they switch over into ETFs, they become easier to access for retail investors and institutions that prefer exchange-listed, regulated instruments.

Why These Two ETFs Are a Big Deal

Dogecoin isn’t just a meme coin anymore. It’s the original and largest memecoin by market value, with a community that behaves more like a movement than a fanbase. XRP, meanwhile, is one of the most established altcoins, sitting among the top assets by market cap and enjoying worldwide liquidity.

Adding both coins to Grayscale’s ETF lineup strengthens its already broad shelf, which includes bitcoin, Ethereum, Solana, and Dogecoin products. For the market, this signals something bigger: U.S. crypto ETFs are expanding beyond the usual majors and moving into a diversified multi-asset era.

Part of a Much Larger ETF Wave

These approvals didn’t happen in isolation. Over the past year, the U.S. has seen a consistent push toward altcoin-based ETFs. Litecoin, HBAR, SOL, and XRP ETFs have all appeared recently. Many of these launched during the government shutdown, when the SEC issued special guidance explaining how firms could go public without waiting for direct approval. The funds still had to meet strict listing standards, which the SEC signed off on in September.

That opened the door for Grayscale to move quickly with its own trust conversions.

Dogecoin ETF: Grayscale Joins a Small but Growing Club

Grayscale’s Dogecoin ETF will be only the second DOGE ETF to hit the U.S. market. The first was launched by REX Shares and Osprey Funds in September. Their DOGE product took a different regulatory route, listing under the Investment Company Act of 1940. That makes it more similar to an actively managed mutual fund structure, whereas Grayscale’s ETF conversion follows the traditional exchange-listed path.

The takeaway: the DOGE ETF space is small, experimental, and growing. Adding Grayscale’s scale and brand power could accelerate adoption.

Why Monday’s Launch Matters for Crypto Investors

Every time a new XRP ETF or any ETF goes live, liquidity deepens. Price discovery improves. More traditional capital flows into crypto without investors needing to self-custody or touch an exchange. With Dogecoin and XRP getting ETFs, two coins with massive communities and high global turnover suddenly get a new pipeline of institutional money.

This isn’t just another pair of products. It’s a sign that altcoin ETFs are steadily becoming a mainstream asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Sheds Light on Criminal Networks While Meme Coins Transform the Future of Cryptocurrency

- UK's NCA dismantled a £1B crypto money-laundering network linking Russian entities to drug trafficking and war funding, arresting 128 and seizing £25M in cash/crypto. - Blockchain analytics tools like Chainalysis are enabling law enforcement to track illicit crypto flows, challenging the anonymity of public blockchains in cross-border crime. - Meme coin Apeing (APEING) emerges as a 1000x contender through community-driven momentum, transparent whitelist access, and structured communication, contrasting t

Ethereum Updates Today: Bit Digital Sees 33% Revenue Surge Driven by Ethereum Staking, the "Digital Oil"

- Bit Digital's Q3 2025 revenue rose 33% to $30.5M, driven by Ethereum staking and cloud services growth. - The company shifted focus from Bitcoin mining to ETH staking, accumulating 153,547 ETH ($590.5M) amid Ethereum's proof-of-stake transition. - Analysts praised its treasury strategy as institutional ETH adoption grows, contrasting with retail investor withdrawals from crypto ETFs. - New leveraged crypto ETFs and quantum-resistant upgrades highlight Bit Digital's alignment with long-term blockchain inf

Bitcoin Updates: Institutions Wager That Bitcoin's Recent Drop Signals a Lasting Bottom During Market Downturn

- Institutions and governments are buying Bitcoin amid its 7-month low, viewing it as a long-term floor after a 23% drop. - El Salvador added 1,090 BTC to its reserve, while $1.9B in long positions were liquidated due to macroeconomic pressures. - Emerging token GeeFi (GEE) attracts speculative investment, mirroring Bitcoin's pre-halving dynamics despite unclear use cases. - Market sentiment shows cautious optimism as Bitcoin stabilizes near $91,000, contrasting with traditional assets like Global-E Online

Hip-Hop Legend's 14-Year Prison Term Highlights U.S. Efforts to Combat Overseas Election Meddling

- Fugees rapper Pras Michel was sentenced to 14 years for conspiring to channel $120M from Malaysian financier Jho Low into Obama's 2012 re-election campaign. - The case ties to the 1MDB scandal involving Goldman Sachs , with Low seeking political access through campaign funds and witness tampering charges against Michel. - Michel's defense called the punishment disproportionate, citing AI use in closing arguments and contrasting penalties with other scheme participants. - The conviction highlights U.S. en