Dogecoin Is Overvalued, But Monday Could Flip the Script

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG). This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG).

This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin Investors Provide Support

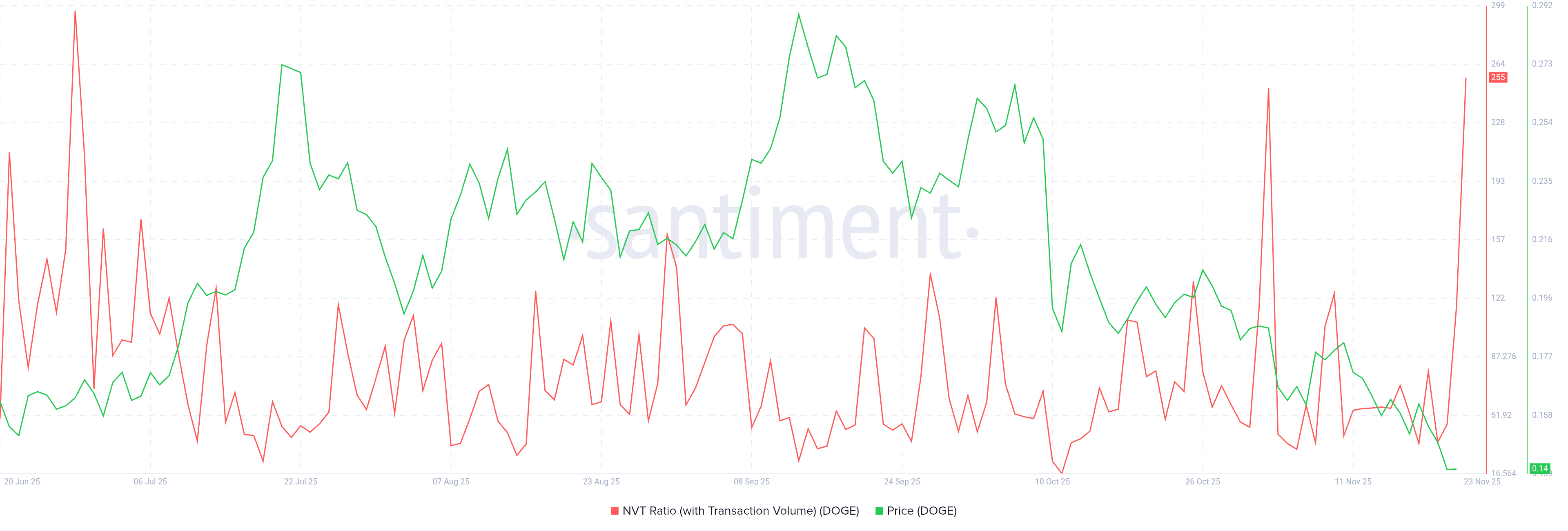

Dogecoin’s NVT Ratio is spiking sharply, signaling a disconnect between valuation and on-chain activity.

The ratio compares market capitalization with transaction volume, and a surge typically indicates limited transactional utility relative to price. While DOGE is attracting strong social attention and broad support, its actual transaction levels are not keeping pace.

This mismatch can often lead to overvaluation, which in bearish conditions may trigger a drop.

However, the timing of this spike aligns with the anticipated launch of Grayscale’s Dogecoin ETF. The ETF is expected to draw notable capital inflows, which could reset the NVT Ratio and restore balance between price and on-chain activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

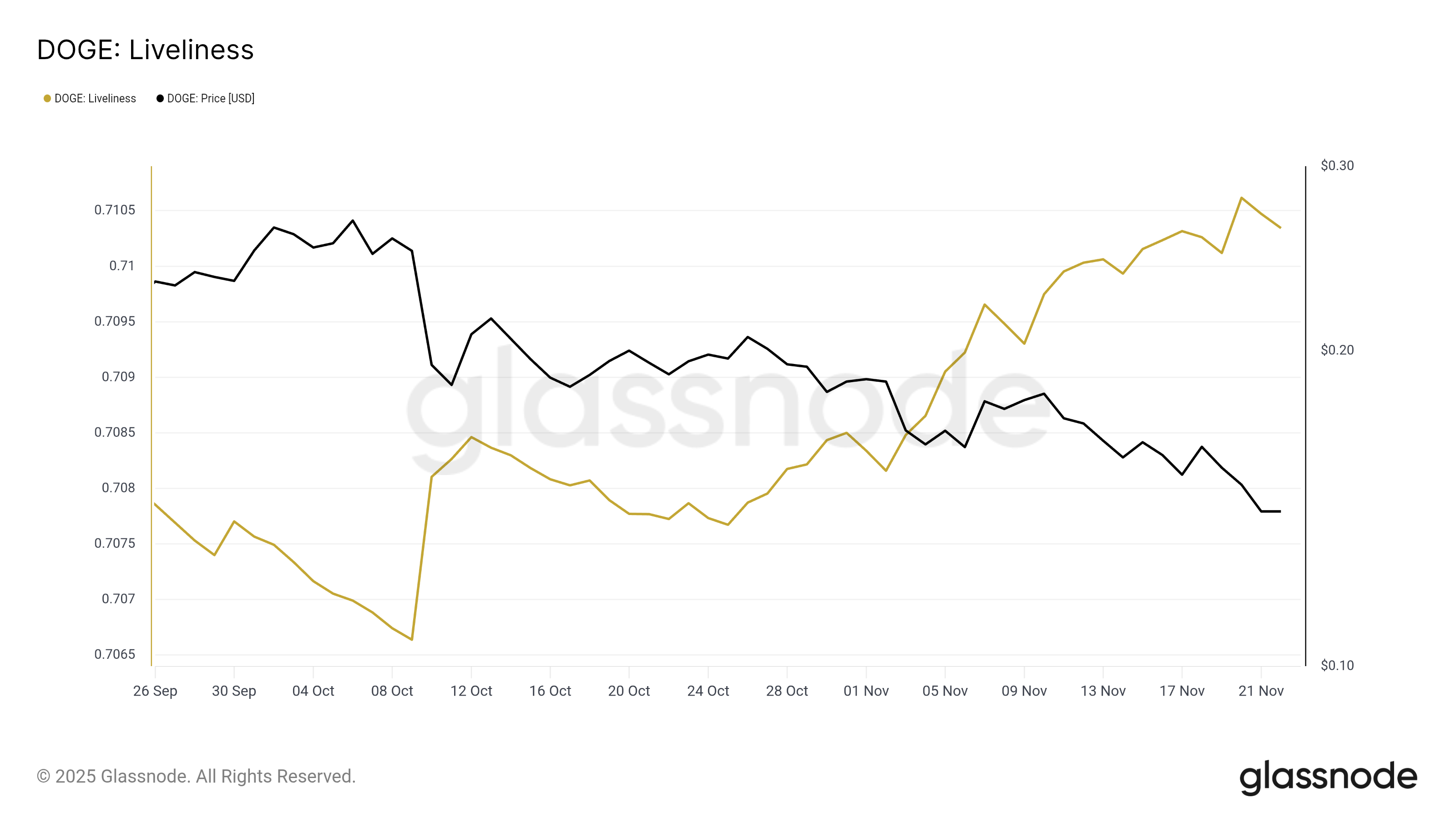

Macro indicators also paint an encouraging picture. Dogecoin’s Liveliness metric has been rising for several days, indicating increased HODLing behavior among long-term holders.

Liveliness rises when coins remain dormant for longer periods rather than being spent, suggesting that key holders are protecting their positions.

This trend is particularly important during downturns. Long-term holders often act as the backbone of price stability, resisting volatility caused by short-term traders.

Their continued conviction reduces the risk of abrupt sell-offs and shows confidence in Dogecoin’s ability to recover once market conditions shift.

Dogecoin Liveliness. Source:

Glassnode

Dogecoin Liveliness. Source:

Glassnode

DOGE Price Could Shoot Up

Dogecoin is trading at $0.143 and holding near the $0.142 support level. The meme coin remains trapped under a month-long downtrend that it has repeatedly failed to break. Current bearish conditions make recovery difficult without a significant catalyst.

The launch of the DOGE ETF could provide that catalyst. A successful debut may lift DOGE above $0.151, opening the path toward $0.165. A move of this scale would invalidate the downtrend and signal a shift in momentum supported by new inflows.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If the ETF hype fails to translate into buying pressure, Dogecoin could extend its decline. A drop toward $0.130 remains possible.

But if DOGE does not face a drop this sharp, it may continue struggling beneath the $0.151 resistance, prolonging the ongoing downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum Faces $3,000 Battle as ETF Withdrawals Compete with Long-Term Holder Accumulation

- Ethereum's price fell below $3,000, sparking debates on recovery sustainability amid mixed on-chain accumulation and ETF outflows. - Long-term holders accumulated 17M ETH in 2025, but bearish technical indicators and $1.5B ETF redemptions threaten further declines. - Institutional staked ETH ETFs (e.g., BlackRock's ETHA) show growing yield appetite, yet treasury sales and thin markets exacerbate downward pressure. - Privacy upgrades like Aztec's Ignition Chain and 21shares' ETP expansion counterbalance s

Bitcoin Updates: Collapse of Crypto Market Makers Sparks 8-Day Wave of Fear Amid Deepening Liquidity Crunch

- Crypto Fear & Greed Index hit 19 for 8 days, signaling extreme panic amid $420M ETF outflows and liquidity crises. - Market makers collapsed due to stablecoin mispricing, wiping 2M accounts and amplifying volatility since October. - Malaysia cracks down on $1B-loss crypto mining , while Bitfury shifts $1B to tech amid plunging mining profits. - Trump family lost $1.3B in crypto assets, including Bitcoin mining and memecoins, despite claiming volatility as opportunity. - Experts predict 6-8 week stabiliza

Ethereum News Today: Enigmatic Ethereum Wallet Accumulates $6.5M in HYPE Stakes Despite Incurring $40K Loss, Initiates $3.75M Purchase Orders

- A single Ethereum address amassed $6.585M in HYPE tokens via 24-hour accumulation, despite a $40K unrealized loss. - The wallet deployed $3.75M in limit buy orders ($28.04–$31.475), signaling intent to further accumulate if prices retrace. - Institutional players like Bitzero Holdings and BitMine are deepening crypto exposure amid volatility, leveraging staking yields and infrastructure growth. - The activity highlights strategic positioning by high-net-worth actors, though HYPE's fundamental value remai

Solana News Today: Solana's Price Swings Revealed: Major Investor Faces $2M Loss as Institutions Wager on Expansion

- Solana whale sells 32,195 tokens, incurring $2.04M loss amid market volatility. - Institutional confidence grows as Onfolio secures $300M to build Solana-focused treasury. - South Korean investors snap up Solana-linked ETFs, showing rising retail demand. - Wormhole Labs launches Sunrise gateway to boost Solana’s liquidity and ecosystem. - Solana faces price swings but gains traction with institutional bets and retail adoption.