Grayscale’s Dogecoin and XRP ETFs Set for NYSE Debut on November 24

Grayscale's new Dogecoin and XRP ETFs debut comes as the SEC, under Chairman Paul Atkins, shifts toward faster, disclosure-focused reviews of digital asset products.

Grayscale will introduce new exchange-traded fund products tied to Dogecoin and XRP on Nov. 24 after securing approval to list both vehicles on the New York Stock Exchange.

The Grayscale Dogecoin Trust ETF (GDOG) and the Grayscale XRP Trust ETF (GXRP) will debut as spot ETPs holding their respective underlying tokens.

Grayscale Expands ETF Lineup With Dogecoin and XRP

The firm is converting its existing private trusts into fully listed ETFs, a move that represents a major liquidity event for current investors.

GXRP will enter a market that already includes spot products from Canary Capital and Bitwise.

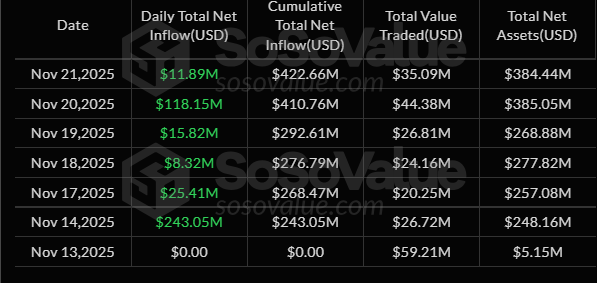

Those funds have drawn about $422 million in combined inflows during their first two weeks of trading, signaling early institutional interest in XRP-linked products.

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

On the other hand, GDOG will be one of the first Dogecoin ETF available to US investors.

Dogecoin, once a meme token, has grown into the ninth-largest cryptocurrency by market capitalization. Its deep retail following has made it one of the most frequently traded and discussed digital assets, a trend Grayscale expects will support ETF demand.

Considering this, Bloomberg Intelligence analyst Eric Balchunas said the product could attract as much as $11 million in volume on its first trading day.

Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think

— Eric Balchunas (@EricBalchunas) November 21, 2025

GDOG and GXRP’s launch broadens the mix of crypto ETFs available in the US market, extending the industry’s expansion beyond Bitcoin and Ethereum products that dominated the initial wave of approvals.

Their arrival also reflects shifting regulatory conditions in Washington.

Both approvals are part of a broader acceleration in digital asset oversight under Securities and Exchange Commission (SEC) Chairman Paul Atkins.

Since taking office, Atkins has moved the agency away from a “regulation by enforcement” approach and toward a disclosure-focused framework.

Through his “Project Crypto” initiative, he has signaled that the SEC is open to reviewing compliant digital asset products, clearing the path for issuers seeking to list new ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum Faces $3,000 Battle as ETF Withdrawals Compete with Long-Term Holder Accumulation

- Ethereum's price fell below $3,000, sparking debates on recovery sustainability amid mixed on-chain accumulation and ETF outflows. - Long-term holders accumulated 17M ETH in 2025, but bearish technical indicators and $1.5B ETF redemptions threaten further declines. - Institutional staked ETH ETFs (e.g., BlackRock's ETHA) show growing yield appetite, yet treasury sales and thin markets exacerbate downward pressure. - Privacy upgrades like Aztec's Ignition Chain and 21shares' ETP expansion counterbalance s

Bitcoin Updates: Collapse of Crypto Market Makers Sparks 8-Day Wave of Fear Amid Deepening Liquidity Crunch

- Crypto Fear & Greed Index hit 19 for 8 days, signaling extreme panic amid $420M ETF outflows and liquidity crises. - Market makers collapsed due to stablecoin mispricing, wiping 2M accounts and amplifying volatility since October. - Malaysia cracks down on $1B-loss crypto mining , while Bitfury shifts $1B to tech amid plunging mining profits. - Trump family lost $1.3B in crypto assets, including Bitcoin mining and memecoins, despite claiming volatility as opportunity. - Experts predict 6-8 week stabiliza

Ethereum News Today: Enigmatic Ethereum Wallet Accumulates $6.5M in HYPE Stakes Despite Incurring $40K Loss, Initiates $3.75M Purchase Orders

- A single Ethereum address amassed $6.585M in HYPE tokens via 24-hour accumulation, despite a $40K unrealized loss. - The wallet deployed $3.75M in limit buy orders ($28.04–$31.475), signaling intent to further accumulate if prices retrace. - Institutional players like Bitzero Holdings and BitMine are deepening crypto exposure amid volatility, leveraging staking yields and infrastructure growth. - The activity highlights strategic positioning by high-net-worth actors, though HYPE's fundamental value remai

Solana News Today: Solana's Price Swings Revealed: Major Investor Faces $2M Loss as Institutions Wager on Expansion

- Solana whale sells 32,195 tokens, incurring $2.04M loss amid market volatility. - Institutional confidence grows as Onfolio secures $300M to build Solana-focused treasury. - South Korean investors snap up Solana-linked ETFs, showing rising retail demand. - Wormhole Labs launches Sunrise gateway to boost Solana’s liquidity and ecosystem. - Solana faces price swings but gains traction with institutional bets and retail adoption.