Ethereum’s Recovery to $3,000 Could Be Challenged by New Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment. That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move. Ethereum Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment.

That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move.

Ethereum Holders Have Mixed Feelings

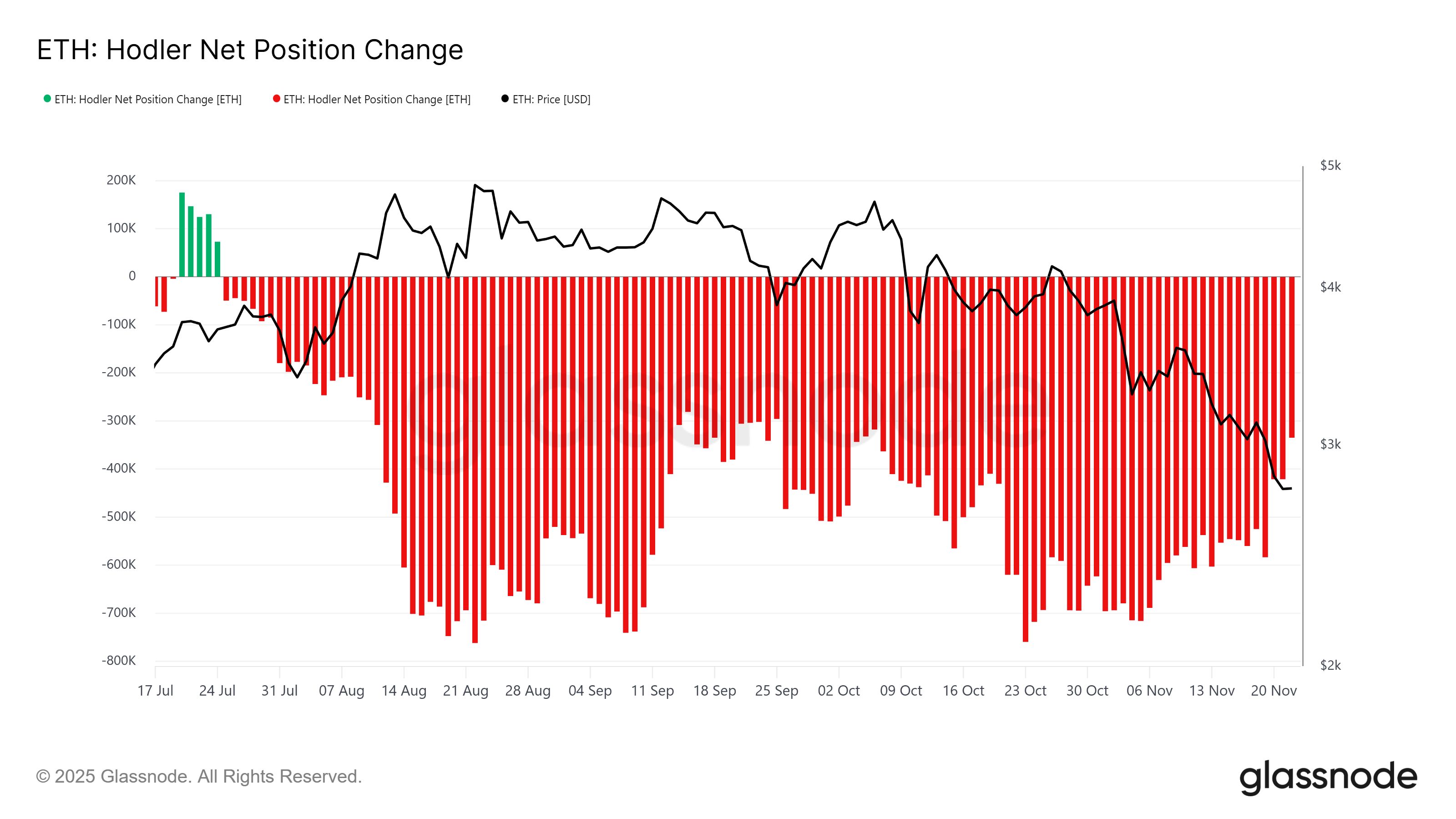

The HODLer Net Position Change indicator is showing a steady incline, signaling improving confidence among long-term holders. This metric measures the movement of ETH within LTH wallets, and the current rise from the negative zone suggests that outflows are slowing. Historically, a shift like this often precedes renewed accumulation.

As long-term holders reduce selling, the market gains stability. Their conviction in Ethereum’s recovery strengthens the asset’s foundation even during volatile conditions.

If this trend continues, LTHs may soon transition from holding to accumulating, providing meaningful support for ETH’s next upward push.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum HODLer Net Position Change. Source:

Glassnode

Ethereum HODLer Net Position Change. Source:

Glassnode

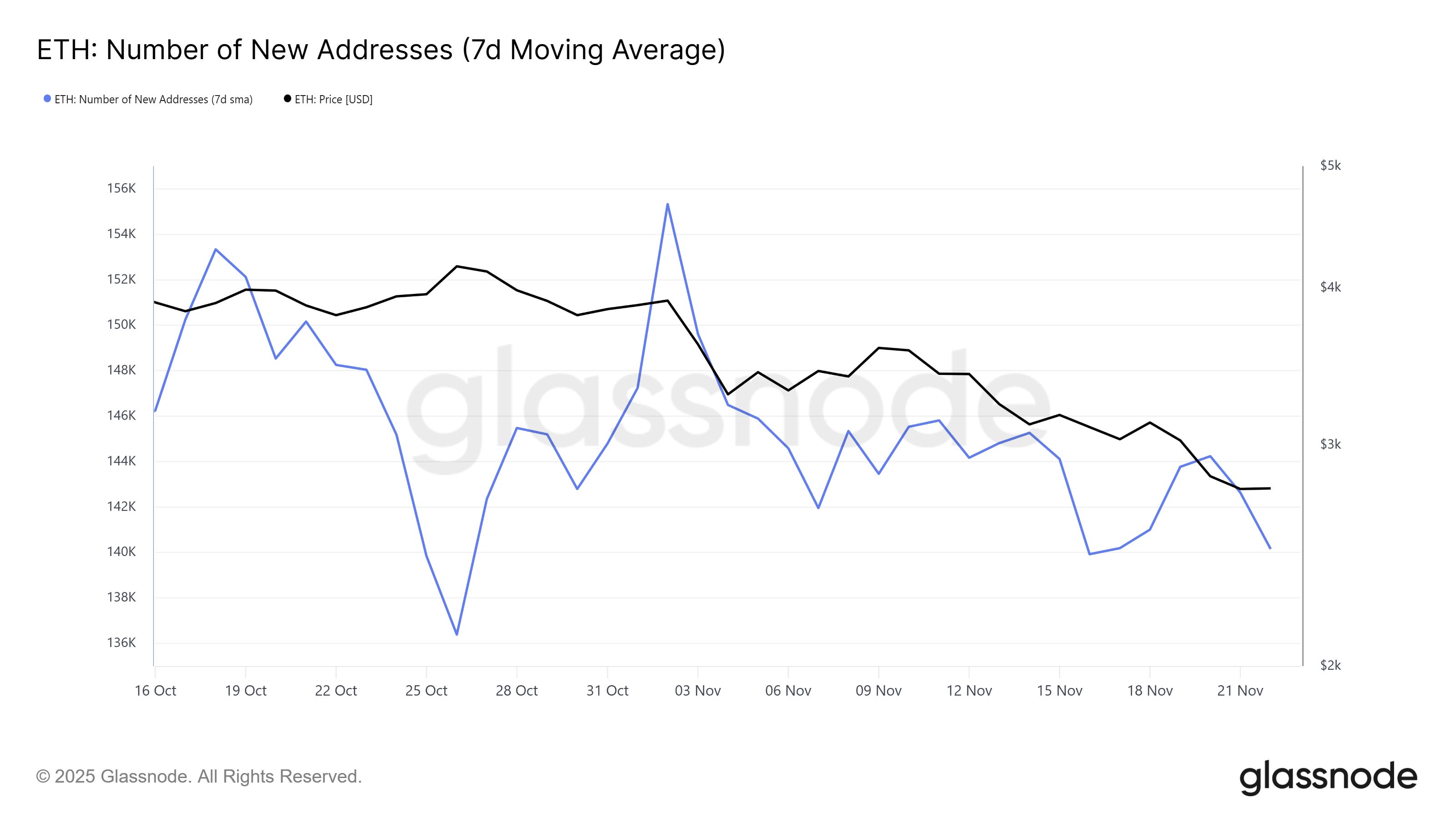

Despite improving sentiment from long-term holders, broader macro momentum remains mixed. The number of new Ethereum addresses is moving sideways, indicating weak interest from potential new investors.

This stagnation is concerning because fresh demand is a critical component of sustained price recovery.

Without an increase in new market participants, inflows may not be strong enough to propel ETH toward the $3,000 mark. Even with solid support from existing holders, a lack of external capital could delay or weaken any meaningful rally.

Ethereum New Addresses. Source:

Glassnode

Ethereum New Addresses. Source:

Glassnode

ETH Price Needs To Recover

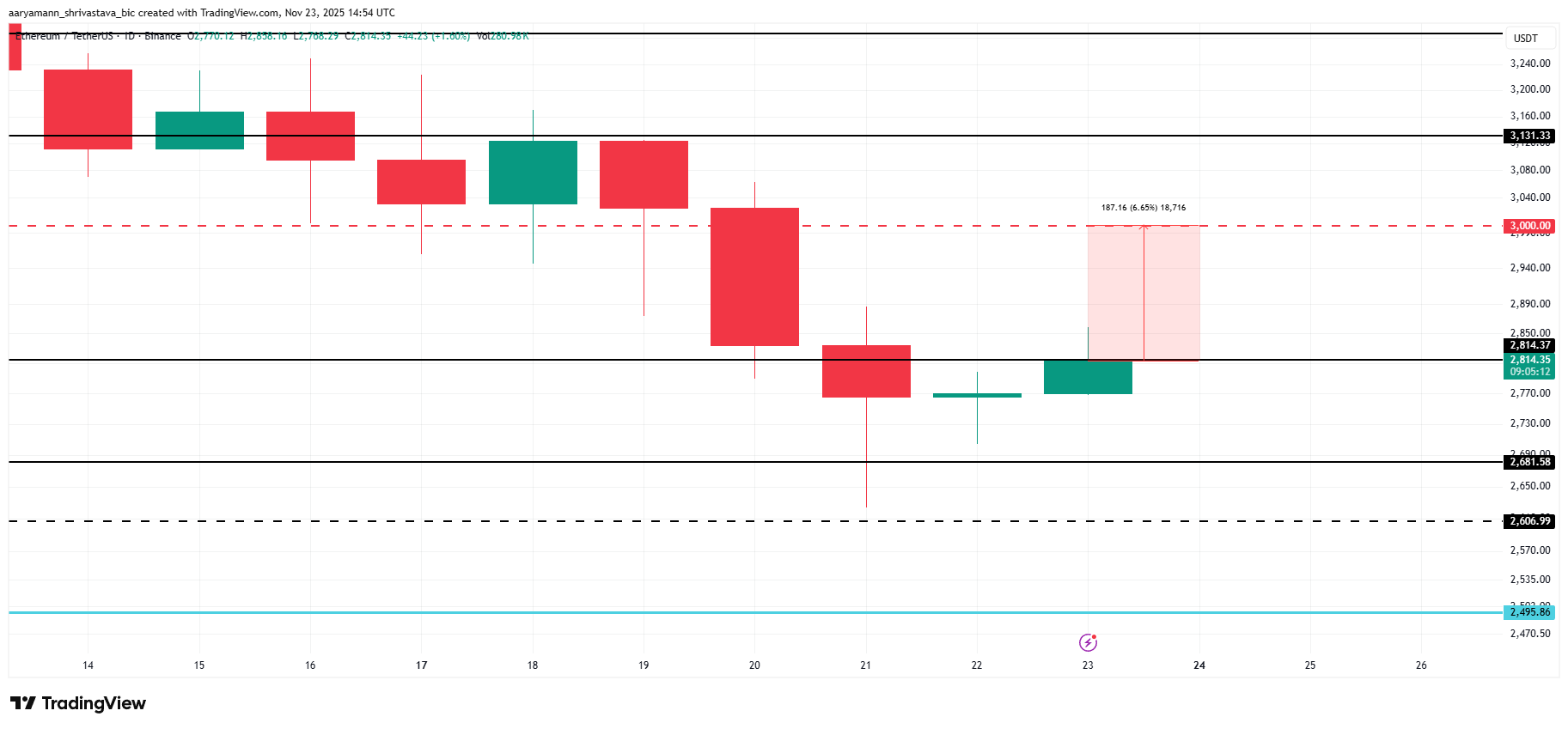

Ethereum is trading at $2,814, sitting directly beneath a key resistance level. At this distance, ETH is just 6.6% away from reclaiming $3,000, a psychologically significant barrier for both traders and long-term investors.

For Ethereum to reach this threshold, support from new investors is essential. If new demand remains weak, ETH may consolidate below $3,000 as existing capital alone may not be sufficient to drive an extended rally. The altcoin king needs broader participation to sustain a breakout.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If inflows improve and new investors re-engage, Ethereum could rally to $3,000 and attempt to flip the level into support. Successfully reclaiming this zone may pave the way for $3,131 or higher. This would invalidate the bearish outlook and restore bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Update: Bearish Pattern and Weakening Support Point to Solana's $99 Challenge

- Solana's SOL price faces bearish pressure, with technical indicators and on-chain metrics suggesting a potential drop to $99 if key support levels fail. - ETF inflows remain uneven, with Bitwise's BSOL ETF dominating 89% of assets but recent outflows signaling institutional caution amid weak retail demand. - The Upbit hot wallet breach triggered liquidity disruptions, while Nansen data shows 20% monthly declines in TVL, active addresses, and network fees. - Technical analysis highlights a bear flag patte

Crypto Market Caught Between Surrender and Careful Buying as Underlying Fear Dynamics Change

- Crypto Fear & Greed Index rose to 19/100 from 15/100, remaining in "extreme fear" despite broader equity market pessimism. - Structural downturn driven by leverage, liquidations, and retail capitulation, with social media bullish sentiment at 2-year lows. - Unverified $15B Bitcoin breach and institutional moves (Grayscale ETF, Bybit India) highlight safety concerns and long-term confidence. - KAS, FLR, SKY show modest gains amid "altcoin season," but isolated rallies contrast with fragile market-wide cau

Solana News Update: Changing Risk Preferences Lead to Outflows from Solana ETFs

- Solana ETFs recorded first outflows since launch, with 21Shares TSOL losing $34.37M in single-day withdrawals. - Price held near $141 despite bearish technical indicators and 20% drop in network TVL to $9.1B. - Institutional holdings remain strong at 6.83M tokens ($964M), but Upbit hack amplified short-term volatility. - Market recovery hinges on Fed's December rate decision and Solana's ability to stabilize key metrics.

Bitcoin News Update: Optimistic Long Positions and Pessimistic Shorts Clash, Intensifying Cryptocurrency Market Fluctuations

- Hyperwhale shorted 1,000 BTC at $89,765 with 3x leverage, earning $10.6M but facing $1.16M losses as BTC trades at $106,443. - Aggressive bullish bets on Hyperliquid include a 20x $30M BTC long and $92.87M in leveraged longs, contrasting with $343.89M in 24-hour short liquidations. - BTC's RSI at 66 and 15/1 buy/sell signals reinforce short-term bullishness, while $5M POPCAT manipulation risks highlight exchange vulnerabilities. - LeverageShares' 3x BTC/ETH ETFs and compounding risks in products like UDO