Satoshi Nakamoto Loses $43 Billion as Bitcoin Price Falls Over 30%

Satoshi Nakamoto’s legendary Bitcoin fortune has dropped by an estimated $41 billion, as BTC’s price slid more than 30% from its all-time high. The pseudonymous creator’s 1.1 million Bitcoin, tracked using the Patoshi mining pattern, fell from $138 billion in October to about $96 billion as of this writing. This sharp decline moved Satoshi from

Satoshi Nakamoto’s legendary Bitcoin fortune has dropped by an estimated $41 billion, as BTC’s price slid more than 30% from its all-time high.

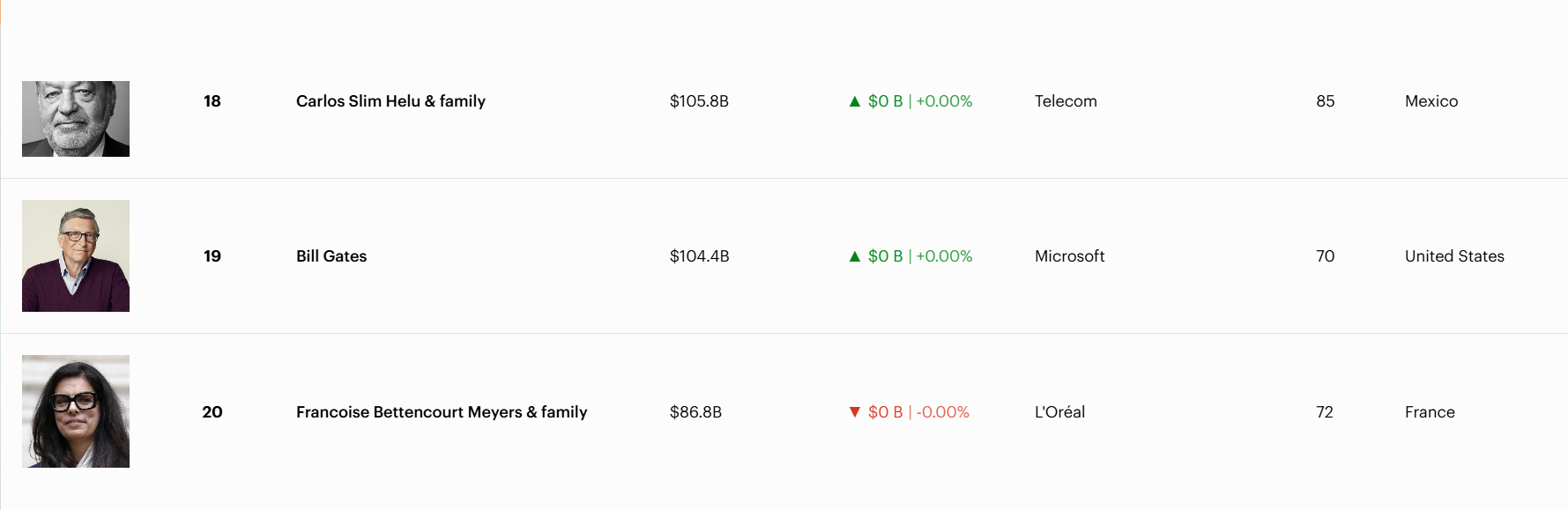

The pseudonymous creator’s 1.1 million Bitcoin, tracked using the Patoshi mining pattern, fell from $138 billion in October to about $96 billion as of this writing. This sharp decline moved Satoshi from 11th to around 20th among the world’s wealthiest people, now just below Bill Gates.

BTC Price Crashed, But What Happened to Satoshi’s Bitcoin Stash

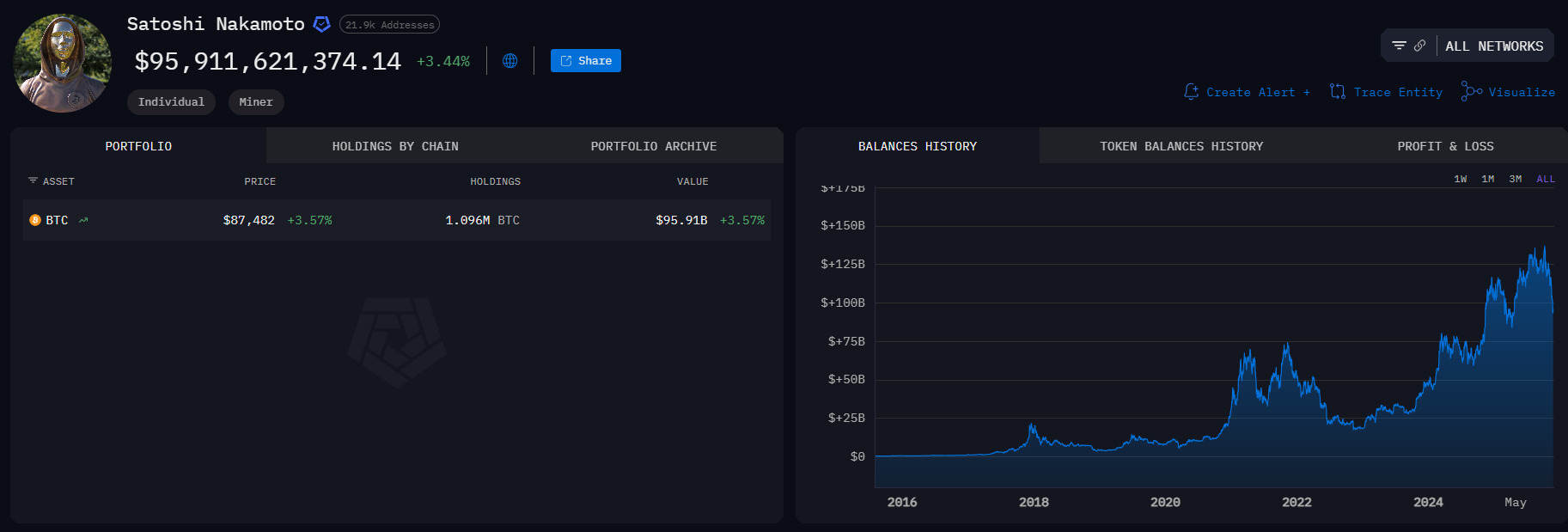

Arkham Intelligence, a blockchain analytics firm, estimates Satoshi’s Bitcoin using mining analysis and on-chain forensics.

The “Patoshi Pattern,” discovered by Sergio Lerner, identifies more than 22,000 early addresses likely controlled by one entity, widely believed to be Satoshi Nakamoto. These coins, untouched for over a decade, continue to fuel intense speculation.

As of October 6, 2025, when the pioneer crypto established an all-time high of $126,296, Satoshi’s Bitcoin stash was valued at $138.92 billion. However , Bitcoin’s price has since dropped by over 30% to trade for $87,390 as of this writing.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

With this drop, Satoshi’s Bitcoin stash has shrunk to $96.129 billion, meaning $42.79 billion of this fortune disappeared in weeks.

If Forbes listed Satoshi among the list of the world’s richest people, the Bitcoin founder would rank just below Bill Gates and right above Françoise Bettencourt Meyers & family at position 20.

Satoshi’s Place Among Richest People in the World. Source:

Satoshi’s Place Among Richest People in the World. Source:

Despite the vast scale of Satoshi’s holdings, Forbes and other wealth trackers do not count the Bitcoin founder in their official billionaire lists. The reasons include Satoshi’s unverified legal status and the fact that the assets have remained dormant, leaving ownership questions unresolved.

“Forbes does not include Satoshi Nakamoto on our Billionaire rankings because we have not been able to verify whether he or she is a living person, or one person vs. a collective group of people,” the magazine told BeInCrypto.

Ironically, Satoshi’s coins remain among the most visible fortunes due to the blockchain’s transparency.

Satoshi’s Bitcoin Holdings. Source:

Satoshi’s Bitcoin Holdings. Source:

Some experts suggest Forbes and others should consider including pseudonymous crypto wallets in their lists, even though ownership is anonymous.

Nonetheless, the long-term dormancy has also led to speculation that the fortune could be lost, inaccessible, or deliberately abandoned, an unusual scenario among billionaires.

Quantum Threats and Satoshi’s Secret

Elsewhere, the rise of quantum computing has renewed debate about Satoshi’s future and potential identity. Because quantum computers might one day break early Bitcoin cryptography, some experts propose freezing Satoshi’s coins or forking the network before a possible “Q-Day.” If these risks emerge, the controller of these coins may need to surface.

Important not to scaremonger here about quantum timelines.Running Shor's algorithm is not the same thing as breaking an actual 256-bit ECC key. You can use Shor's algorithm to factor a number—that will be impressive—but will take a huge degree of scaling and engineering to…

— Haseeb >|< (@hosseeb) November 18, 2025

Nakamoto’s enigma will reach a global audience in 2026 with “Killing Satoshi,” a film exploring the mystery and geopolitical implications of dormant Bitcoin wealth.

Until these coins are moved or declared lost, Satoshi’s fortune remains a symbol of Bitcoin’s origins and its greatest secret.

If Bitcoin surges to $320,000–$370,000, Satoshi could become the world’s richest person. For now, the fortune remains unchanged for over 15 years, highly visible, but untouched.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su

Bitcoin Updates: Crypto ETPs Signal Market Growth as Leverage Shares Debuts on SIX

- Leverage Shares launched the world's first 3x leveraged and -3x inverse Bitcoin/Ethereum ETPs on SIX Swiss Exchange, expanding its crypto product range to 452 offerings. - The EUR/USD-traded ETPs target sophisticated investors seeking directional exposure, aligning with SIX's 19% YoY crypto ETP turnover growth to CHF 3.83 billion. - Market timing raises concerns as Bitcoin/Ethereum fell 21%/26% in November 2025, with experts warning leveraged products could amplify losses during volatility. - SIX's regul

Ethereum Updates Today: Buterin Moves ETH to Safeguard Privacy Against Major Financial Players and Quantum Threats

- Ethereum co-founder Vitalik Buterin donated 128 ETH ($760,000) to privacy-focused apps Session and SimpleX Chat, emphasizing decentralized metadata protection and user-friendly access. - Recent 1,009 ETH transfer to Railgun protocol sparked speculation about asset reallocation, though control remains with Buterin amid mixed Ethereum price trends. - Buterin warns of existential risks: 10.4% institutional Ether ownership and quantum computing threats by 2028, advocating layered security for Ethereum's desi