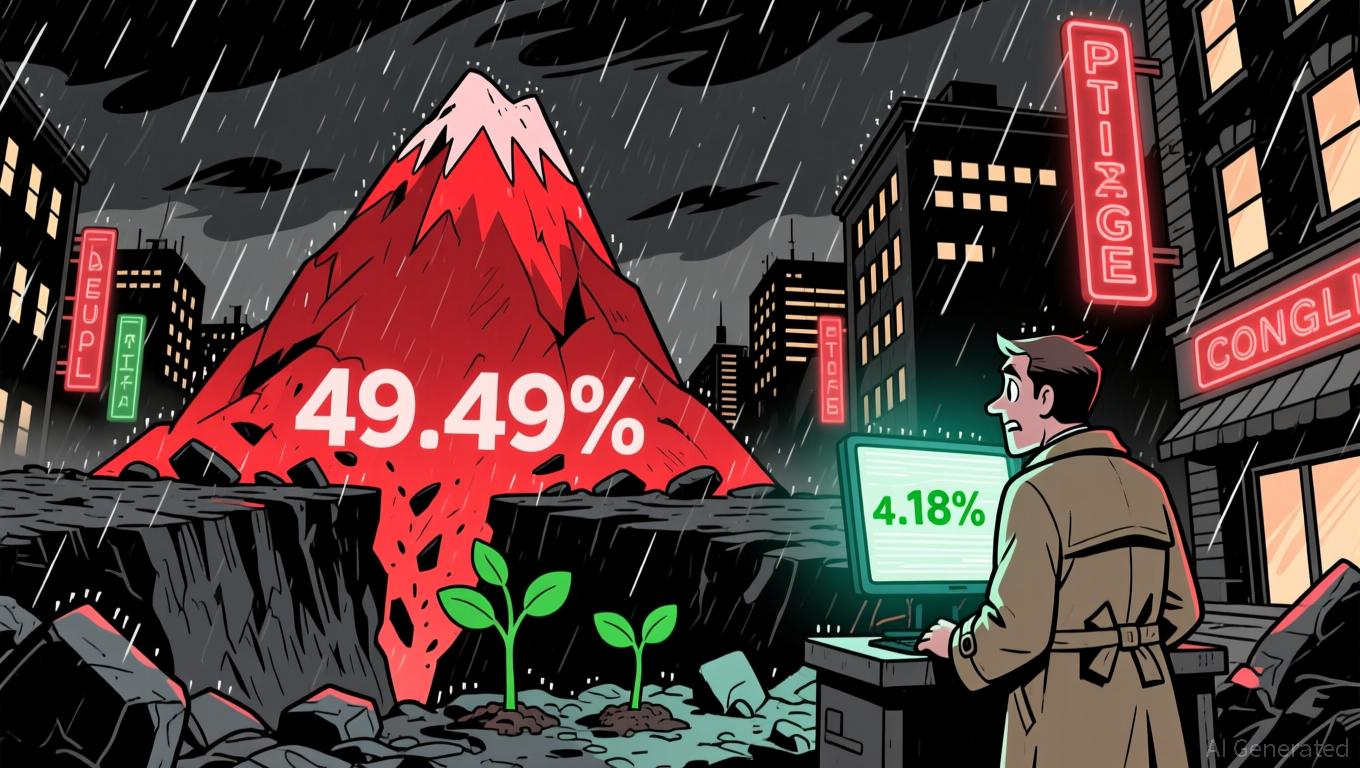

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

On November 24, 2025, YFI (yearly interest factor) saw its value climb by 1.18% in the past 24 hours, bringing its price to $4,036. Despite this brief upward movement, the overall trend remains negative: in the last seven days, YFI has fallen by 9.16%, and over the previous 30 days, it has lost 14.24%. Most notably, the asset has suffered a 49.49% decrease over the past year, highlighting a persistent bearish pattern even with the recent short-term rise.

This activity highlights the continued instability within the

The recent changes in YFI’s price mirror the broader sense of unpredictability in the market. Short-lived gains can often be attributed to shifts in liquidity, economic indicators, or speculative trades. However, since there have been no notable news or events linked to YFI, this movement likely stems from general market forces. Traders are watching closely for any signs of stabilization, but the prevailing downward trend continues to dominate.

Given the asset’s performance over the past year, investors should approach with caution, as it remains highly responsive to economic shifts and changing market sentiment. While the latest increase is encouraging, it does not necessarily signal a reversal of the broader trend. Uncertainty is still being factored into the market, and only a sustained period of growth could indicate a potential change in direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Buterin Moves ETH to Safeguard Privacy Against Major Financial Players and Quantum Threats

- Ethereum co-founder Vitalik Buterin donated 128 ETH ($760,000) to privacy-focused apps Session and SimpleX Chat, emphasizing decentralized metadata protection and user-friendly access. - Recent 1,009 ETH transfer to Railgun protocol sparked speculation about asset reallocation, though control remains with Buterin amid mixed Ethereum price trends. - Buterin warns of existential risks: 10.4% institutional Ether ownership and quantum computing threats by 2028, advocating layered security for Ethereum's desi

The Psychological Factors Influencing Retail Investors’ Actions in Cryptocurrency Markets

- Crypto markets are shaped by behavioral finance, where retail investors drive volatility through FOMO, herd behavior, and overconfidence. - The PENGU token exemplifies this dynamic, surging 480% in July 2025 but plummeting 28.5% by October due to emotional trading cycles. - Social media amplifies emotional contagion, with traders checking prices 14.5 times daily, while financial literacy mitigates bias susceptibility. - Personality traits like neuroticism increase cognitive biases, and speculative narrat

Bitcoin News Today: Bitcoin's Unstable Holiday Periods Hide Average Gains of 6%

- Bitcoin's Thanksgiving-to-Christmas performance shows equal odds of rising or falling, with a 6% average seasonal return despite volatility. - Historical extremes include a 50% 2020 rally and 2022's 3.62% drop post-FTX collapse, amid a $2.49-to-$91,600 long-term surge since 2011. - 2025's $91,600 price reflects ongoing recovery from 2024's $95,531 peak, with institutional crypto adoption and macroeconomic factors shaping future trajectories. - Analysts advise dollar-cost averaging for retail investors, w

Australia Strikes a Balance Between Fostering Crypto Innovation and Safeguarding Investors with Updated Regulations

- Australia introduces 2025 Digital Assets Framework Bill to regulate crypto platforms under ASIC, creating "digital asset platform" and "tokenized custody platform" licenses. - The framework mandates custody standards, transparency requirements, and lighter regulations for small operators (<$5k per customer) to balance innovation with investor protection. - Global alignment with UAE and EU crypto regulations is emphasized, while addressing risks from past failures like FTX through stricter enforcement and