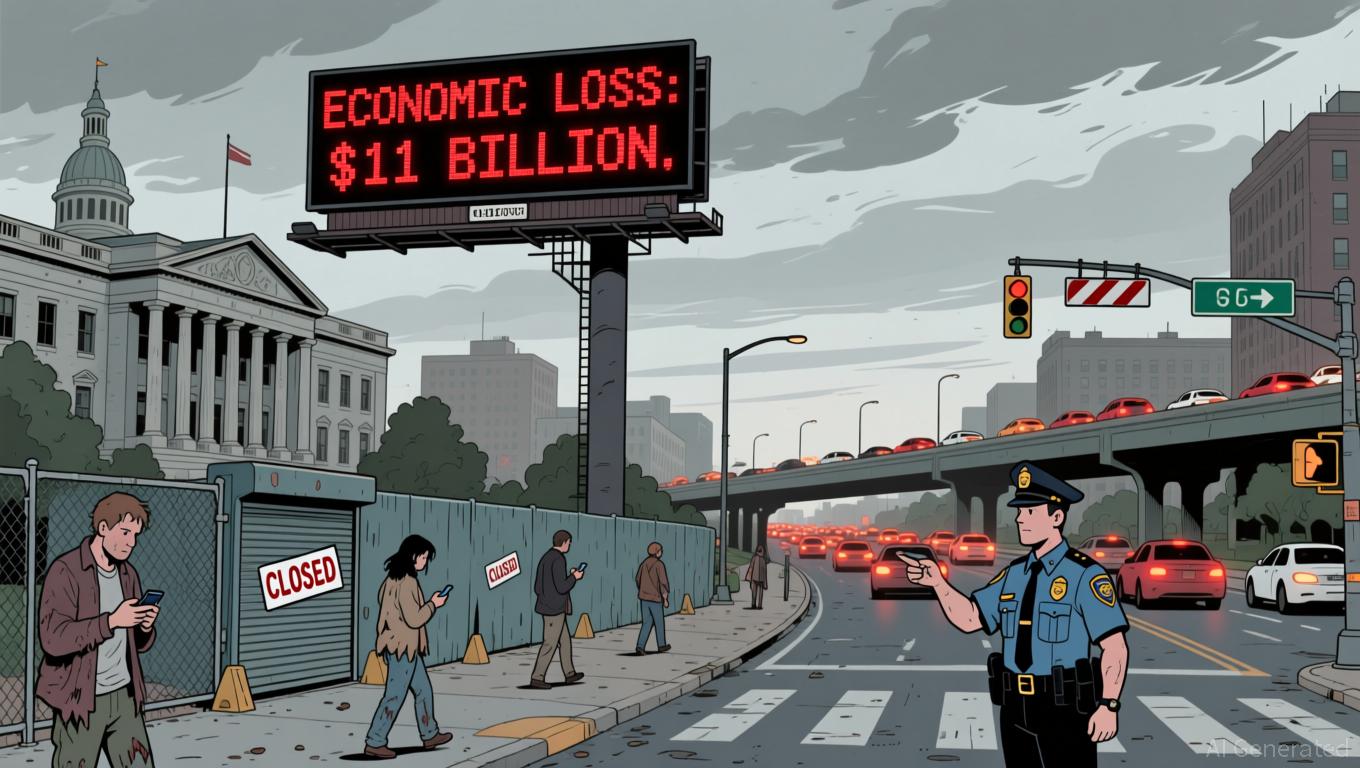

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s $17B Open Interest Crash: What It Really Means

Bitcoin's open interest plunged from $45B to $28B. Is this a bearish sign or just a leverage reset? Here's what you need to know.Not a Bear Market, Just a ResetWhat This Means for Bitcoin Traders

XRP, ETH, and BTC ETFs See Inflows, SOL Dips

Spot ETFs for BTC, ETH, and XRP saw inflows on Nov. 26, while SOL recorded its first net outflow since launch.ETH Leads with Strong Institutional DemandSolana Faces Its First Pullback

Upbit Halts Withdrawals After $38.5M Solana Outflow

Upbit suspends deposits and withdrawals following a $38.5M abnormal outflow on the Solana network.Upbit Promises to Cover All LossesWhat’s Next for Upbit and Solana Users?

Monad Overtakes Ethereum in Stablecoin Supply Shift

Monad surpasses Ethereum in 24-hour stablecoin supply changes with a $3.8B surge.What’s Driving the $3.8B Surge?Implications for the Crypto Ecosystem