XRP Latest Updates: XRP ETFs Enhance Market Liquidity, Large Holder Sell-Offs Postpone Price Increases to 2026

- XRP ETFs launched in late 2025 (e.g., Grayscale's GXRP) expanded institutional access, but whale sales delayed price gains until 2026. - XRP traded near $2.12 as 41.5% of its supply remains in loss, with whale-driven volatility and structural supply imbalances persisting. - Ripple secured $500M institutional backing for XRP Ledger infrastructure, while projects like XRP Tundra accelerated tokenization plans. - XRP trails Ethereum in market cap ($129B vs. $373B) due to lack of smart-contract capabilities,

XRP's price trajectory continues to draw attention within the crypto sphere as the asset experiences a transformative phase shaped by ETF introductions, growing institutional engagement, and evolving market structures. Despite recent price swings, both analysts and traders maintain a guarded optimism for long-term appreciation, though questions remain about the speed at which these factors will drive sustained upward momentum.

The introduction of several

The XRP network is also gaining more validation from major financial players.

A central debate in the market is whether XRP could realistically rival

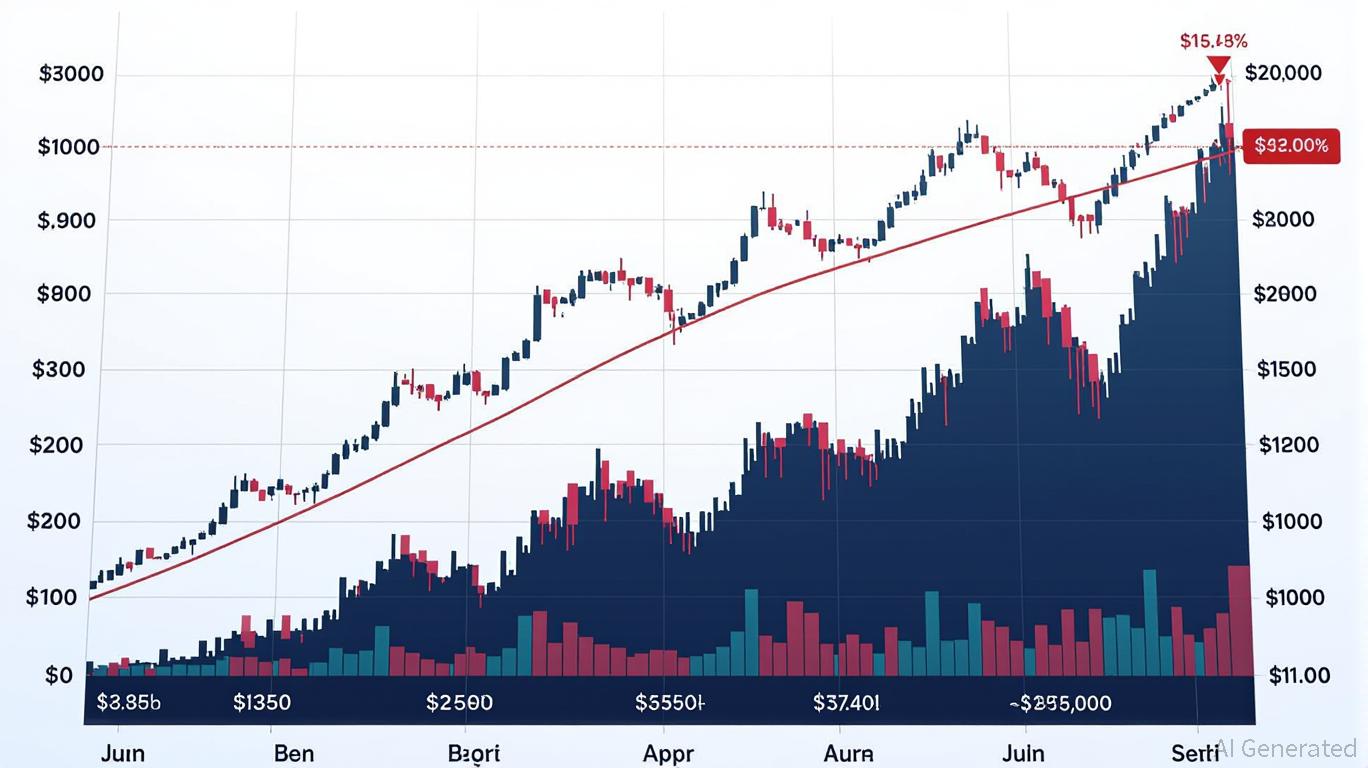

From a technical perspective, XRP is currently

To conclude, XRP's journey toward lasting growth depends on managing immediate structural vulnerabilities while fostering long-term institutional participation. Although the ETF narrative has fueled renewed optimism, whether this translates into enduring price strength will hinge on demand outpacing sell-offs and XRP's ability to meet institutional requirements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal