Date: Fri, Nov 21, 2025 | 07:56 AM GMT

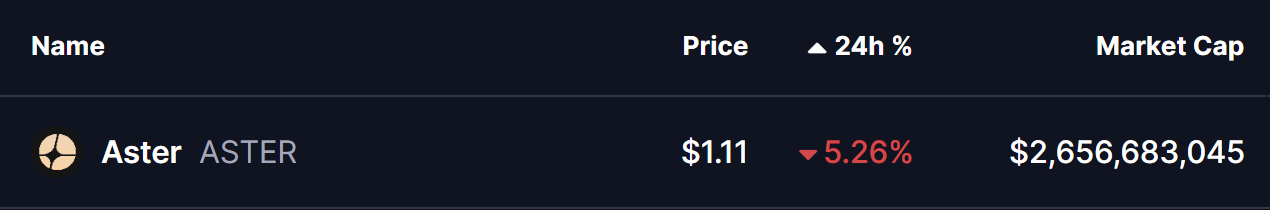

The cryptocurrency market is attempting a recovery at the start of the new week after last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2624 before bouncing back above $2800. However, while major assets show relief, the DEX token Aster (ASTER) appears to be losing bullish momentum.

The token is currently down over 5%, and its technical structure is signalling the possibility of further decline.

Source: Coinmarketcap

Source: Coinmarketcap

Head and Shoulders Breakdown

On the 4H chart, ASTER completed a classic head and shoulders pattern, which is widely known as a reliable bearish reversal formation. The left shoulder and head structure formed between 15–19 November, with the peak at around $1.4068 marking the top. After the right shoulder failed to push higher and lost momentum, selling pressure increased and the neckline support began weakening.

The neckline at approximately $1.1464 acted as a multi-week base, but the chart clearly shows that price broke beneath this level with strong bearish force, confirming a structural breakdown. Following the break, ASTER dropped to $1.0682 before attempting a retest today.

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

The retest faced strong rejection from the $1.1576 zone, which also aligns with the 100-moving average resistance. This rejection strengthened the bearish signal, pushing the price back down toward $1.11, confirming the breakdown continuation.

What’s Next for ASTER?

As long as ASTER remains below the neckline and the 100-MA barrier, the structure continues to favour sellers. A move below $1.0682 would likely accelerate downward momentum, potentially opening a slide toward $0.99 as the next key downside target.

However, if buyers unexpectedly regain control and push the price back above the 100-moving average at $1.1611, the bearish head and shoulders formation could become invalidated and shift the trend back toward temporary recovery attempts.