Tom Lee’s Prediction Lifts BMNR Price Hopes, but the Rebound Still Faces a Key Test

BMNR price dropped almost 22.7% this week, hitting fresh lows under $26. The fall looks sharp, but the stock is still up more than 160% over the past six months. Now, a small rebound looks likely on a daily chart. Traders would want to know whether this is only a bounce or the start of

BMNR price dropped almost 22.7% this week, hitting fresh lows under $26. The fall looks sharp, but the stock is still up more than 160% over the past six months. Now, a small rebound looks likely on a daily chart. Traders would want to know whether this is only a bounce or the start of a larger BitMine recovery.

Tom Lee’s latest call on Ethereum adds fuel to the discussion, but the chart shows a key test ahead.

Buying Pressure Returns, but Trend Signals Stay Weak

BMNR’s long slide continues to show stress across major moving averages. The 20-day EMA already crossed under the 100-day on November 14. That crossover lined up with a sharp sell-off, and the 50-day EMA is now closing in on the 100-day as well. If that second bearish crossover completes, it signals more downside risk.

Bearish Crossover Risks:

Bearish Crossover Risks:

But a few positives are surfacing beneath the price.

On-Balance Volume (OBV) tracks whether real volume is entering or leaving. Between August 4 and November 21, the price made a fresh lower low. OBV, however, made a higher low. This long-term bullish divergence means real buyers have been accumulating while the BitMine stock keeps falling. It creates room for a short-term rebound even when the broader trend stays weak.

Volume Keeps Rising:

Volume Keeps Rising:

The Chaikin Money Flow (CMF) tells the same story.

CMF also made a higher low over the same period and has now broken above its falling trend line. That break usually signals that larger wallets are stepping in again. Do note that between November 20 and November 21, the BMNR price made a lower low while the CMF flashed another higher low. Another bullish divergence.

BMNR CMF Rising:

BMNR CMF Rising:

A CMF trendline break often appears before price bottoms because it reflects large-wallet interest returning.

This CMF angle matters more for BMNR than for most stocks.

Tom Lee has pointed out that when institutions build large BMNR positions, the capital is often used to buy Ethereum. Rising CMF, therefore, hints at two things happening together: large buyers accumulating BMNR and potential ETH demand returning through BMNR exposure. That could also be good news for the standalone BMNR stock price.

Short term, this gives BMNR enough strength for a rebound attempt. But the trend flip isn’t confirmed yet.

BMNR Price Levels: The Test That Decides the Next Move

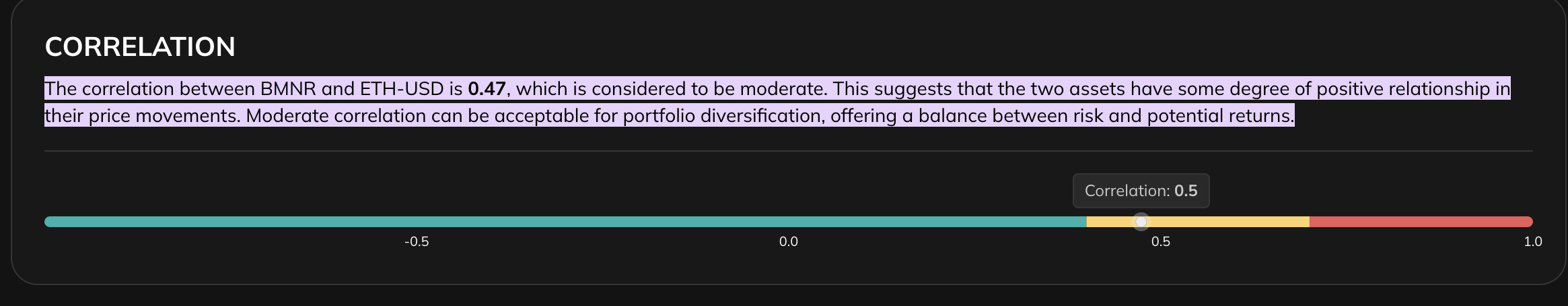

Short-term charts still support a rebound idea, but the move depends on what happens next with Ethereum. BMNR and ETH carry a 0.47 correlation, which means they move in the same direction at a moderate rate.

ETH-BMNR Correlation:

ETH-BMNR Correlation:

When ETH stabilizes or rises, BMNR usually follows. When ETH weakens, BMNR struggles to hold any bounce. This matters because Tom Lee has already predicted the ETH price rise to $7,000. If that prediction holds even marginally, the BMNR price could attempt a bounce.

The first upside barrier sits at $32.58. Clearing this level with CMF still rising, possibly above the zero line, would confirm the rebound and open room toward $36.88. If ETH picks up momentum at the same time, the move can extend toward $43.82, which is the larger retracement zone tied to the last breakdown.

BMNR Price Analysis:

BMNR Price Analysis:

This is where the $7,000 ETH outlook becomes relevant — only an ETH recovery can turn BMNR from a rebound into a trend.

But the risk remains. If BitMine (BMNR) loses $25.63, the next support stands near $20.69, almost 20% lower. That drop lines up with previous corrections triggered by EMA crossovers, and the same risk sits in front of the stock now as the 50-day EMA closes in on the 100-day. If that crossover completes while ETH stays weak, the bounce fades and the downtrend continues.

This is the key test: the BMNR price must reclaim $32.58 with improving CMF and at least some ETH stability. Without that, the rebound remains temporary and the $20.69 stays in play.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Abu Dhabi’s Green Light Establishes UAE as a Pioneer in Stablecoin Development

- Ripple's RLUSD stablecoin gains Abu Dhabi regulatory approval as UAE advances digital finance leadership. - ADGM's "Accepted Fiat-Referenced Token" designation enables institutional use for lending and cross-border payments. - RLUSD's $1.2B market cap growth reflects institutional demand, backed by USD reserves and dual blockchain operations. - UAE's ADGM-DIFC regulatory synergy attracts global fintechs , with Ripple expanding partnerships across Africa and Asia. - Regulatory milestones position RLUSD to

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti