Thailand’s Bitkub Eyes $200 Million Initial Public Offering (IPO) In Hong Kong

Bitkub, Thailand’s top cryptocurrency exchange, is considering a $200 million initial public offering in Hong Kong as early as 2026. This strategic shift highlights both the challenges facing Thai capital markets and Hong Kong’s emergence as a digital asset hub. From Bangkok to Hong Kong: Bitkub‘s Strategic Pivot According to reports from Bloomberg, Bitkub had

Bitkub, Thailand’s top cryptocurrency exchange, is considering a $200 million initial public offering in Hong Kong as early as 2026.

This strategic shift highlights both the challenges facing Thai capital markets and Hong Kong’s emergence as a digital asset hub.

From Bangkok to Hong Kong: Bitkub‘s Strategic Pivot

According to reports from Bloomberg, Bitkub had originally planned a domestic listing, as mentioned in a 2023 shareholder letter. By April 2024, it was in the process of hiring financial advisers for a 2025 IPO on the Stock Exchange of Thailand.

“We are actively preparing for IPO filings, paving the way for further growth and access to capital. This exciting step will allow us to scale our impact, unlock even greater value for our shareholders, and further solidify our position as a global leader in fintech. We are considering listing our company first in Thailand, as we aim to become a pioneering Thai-nationality tech company. This strategic move aligns with our commitment to democratised Thailand’s value to everyone,” the exchange said in 2023.

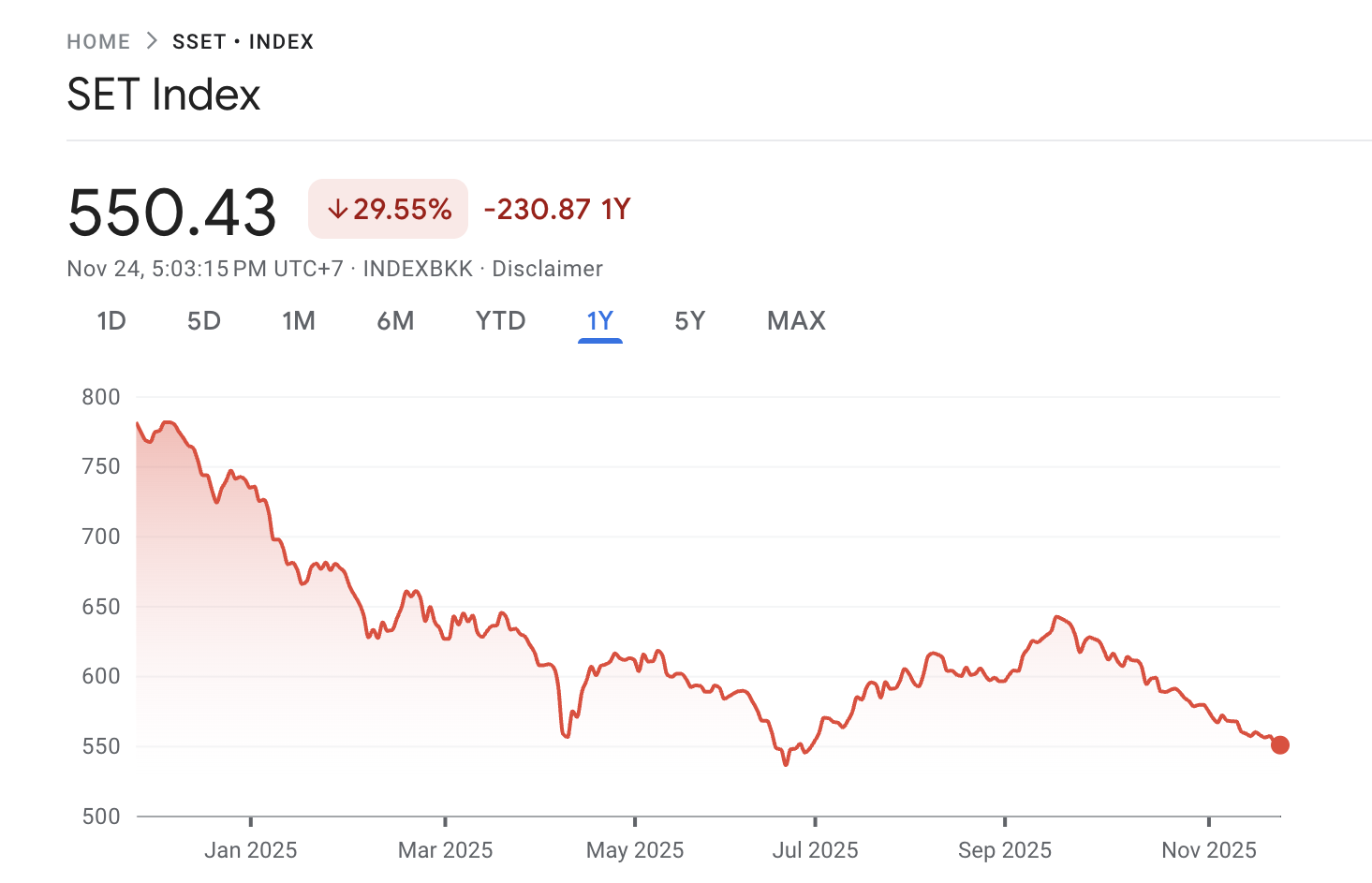

However, these plans were disrupted as Thailand’s stock market slumped. The SET Index, the country’s main equity gauge, has dropped nearly 30% this year to 550.43 points, making it one of the worst-performing markets in 2025. Thai listings have also faced a weighted average decline of more than 12%.

SET Index Performance. Source:

Google Finance

SET Index Performance. Source:

Google Finance

Amid this volatility, Bitkub has started considering international options instead. Bloomberg noted that discussions are still underway and the final direction may shift, according to people familiar with the matter.

Founded in 2018, Bitkub remains Thailand’s leading centralized crypto exchange. It offers 237 coins and 240 trading pairs. The exchange’s 24-hour trading volume is $66.3 million, with USDT/THB as its most active pair. Bitkub’s total assets stand at over $800 million, and the platform has a Trust Score of 7 out of 10 on CoinGecko.

With this latest move, Bitkub would join HashKey Group in pursuing a public listing in Hong Kong. Bloomberg noted that in October, the firm, which operates the city’s leading licensed cryptocurrency exchange, reportedly submitted paperwork for its own listing. The firm aims to raise around $500 million, with plans for an IPO as soon as this year.

Hong Kong is a booming crypto market. In the first half of 2025, total bank transactions in digital asset-related products and tokenized assets reached $26.1 billion Hong Kong dollars. This marked a 233% increase over the same period last year and already exceeded the full-year total of last year.

Thailand is not behind when it comes to crypto adoption. Despite challenges in equity markets, Thailand is moving towards establishing a favorable regulatory space for digital assets.

The Ministry of Finance suspended capital gains tax on cryptocurrency sales from January 1, 2025, through December 31, 2029. This five-year exemption only applies to trades conducted via Thai SEC-licensed platforms.

“This is a key step in boosting Thailand’s economic potential and a major opportunity for Thai entrepreneurs to thrive on the global stage,” Deputy Finance Minister Julapun Amornvivat stated.

The ministry added that this measure could generate approximately $1 billion in annual revenue by increasing activity and consumption.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti

XRP News Update: XRP ETFs Spark Optimism—Is $1,115 Within Reach?

- XRP's price surge to $2.20 is driven by ETF launches, with $422M inflows from Franklin Templeton and Grayscale. - Technical indicators suggest a potential $2.50+ rally if support at $1.84 holds, with long-term forecasts reaching $26.50 by 2030. - Institutional adoption of Ripple's ODL and Ripple USD's $1B+ market cap highlight growing utility beyond remittances. - Regulatory clarity post-SEC ruling and macroeconomic factors remain critical for XRP's $1,115 potential in ultra-bullish scenarios.