Monad Token Defies Market Rout With Sharp Post-Launch Rally

Monad’s MON token surged more than 35% on launch day, breaking the industry’s usual post-airdrop decline. The move stands out in a harsh November downturn, with MON outperforming even as broader crypto sentiment hits extreme fear.

Monad’s MON token surged more than 35% within 24 hours of launch, defying both a cold airdrop market and a deep November sell-off across digital assets.

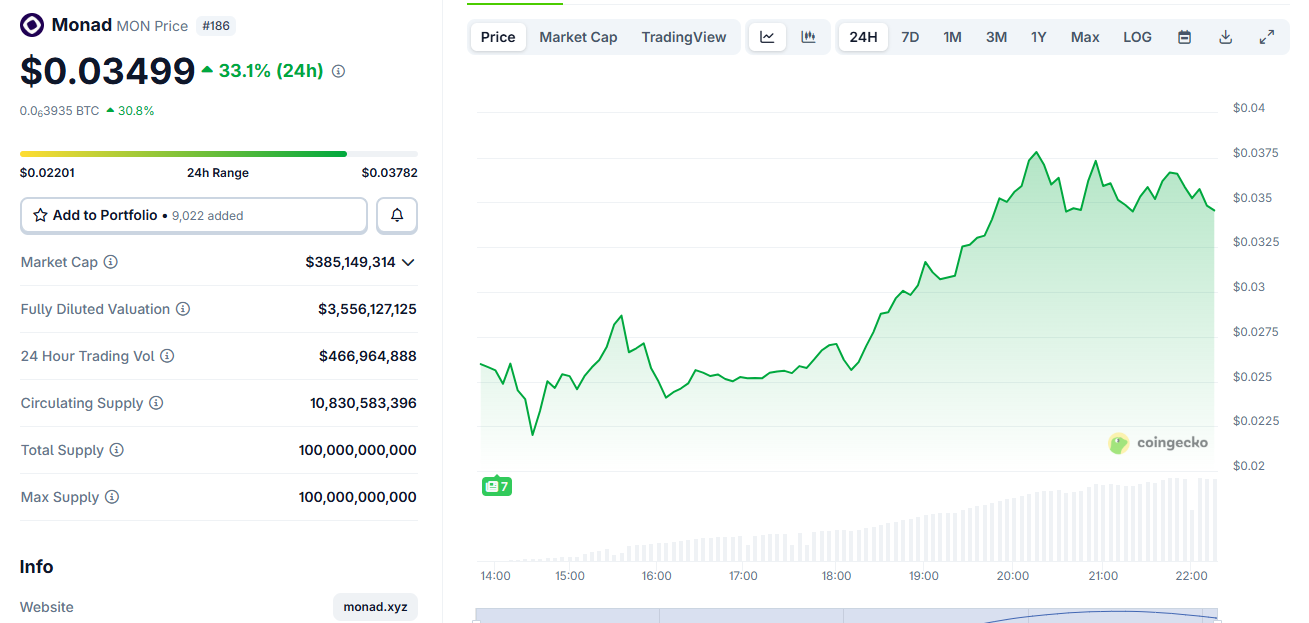

MON traded around $0.035 on Monday, rising from an early range near $0.025 as liquidity spread across major exchanges.

Monad Shines Bright Amid the Bear Market

The move stands out against a market where most airdrops have struggled. Recent industry research shows nearly 90% of airdropped tokens decline within days, driven by thin liquidity, high FDVs, and aggressive selling from recipients.

MON instead climbed strongly despite more than 10.8 billion tokens entering circulation from airdrop claims and a public token sale.

$MON TGE today.Simplest Monad airdrop play is still liquid staking. Stake and forget while farming points.If Monad does well, one of the $MON LSTs will be Lido of ETH and Jupiter for Solana.Question is which.I look for:– Exclusive to Monad– No TGEd yet– Already…

— Ignas | DeFi November 24, 2025

The token launched on November 24 alongside Monad’s mainnet. Around 76,000 wallets claimed 3.33 billion MON from a 4.73 billion-token airdrop, while 7.5 billion more unlocked from Coinbase’s token sale.

Monad Price Chart. Source:

CoinGecko

Monad Price Chart. Source:

CoinGecko

The airdrop alone was valued near $105 million at early trading prices.

MON’s performance also contrasts with the broader market downturn. Bitcoin fell below $90,000 last week after long-term holders sold more than 815,000 BTC over 30 days.

Total crypto market value has dropped by over $1 trillion since October, and sentiment sits in extreme fear territory.

However, MON’s trading demand remained resilient. Its price recovered from initial selling pressure and climbed steadily through the afternoon session.

Most large exchanges listed the token at launch, including Coinbase, Kraken, Bybit, KuCoin, Bitget, Gate.io, and Upbit, supporting deeper liquidity.

Analysts attribute the move to pent-up interest in Monad’s high-performance L1 design and a launch structure that avoided the steep inflation seen in other airdrops this year.

People really gravedancing on Monad right before a 4 hour 50% up candle at the most obvious support on planet earthMan I love this game

— DonAlt November 24, 2025

The project delivered one of 2025’s largest distributions but kept real circulating supply focused on early users and public sale participants rather than speculative farmers.

MON’s rally comes as a rare outlier in November’s bear cycle. Its early strength now positions the token as one of the few airdrops this year to post immediate gains instead of sharp declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Despite Bitcoin’s Drop, Positive Indicators Emerge—Could a Recovery Be Near?

- Bitcoin fell to $82,000, but a hidden bullish divergence on weekly charts suggests easing selling pressure and potential rebound. - Institutional outflows ($1.45B in ETFs) and surging on-chain losses ($523M/day) highlight deteriorating market conditions and panic selling. - Mid-sized investors (100-1,000 BTC) are accumulating while whales (1,000-10,000 BTC) distribute, signaling supply redistribution. - Key support at $80,000 and $85,389 could trigger stabilization, but sustained buying from institutions

The Underlying Cause of the Latest BTC Plunge: Changes in Regulations or Shifting Market Mood?

- The 2025 Bitcoin crash erased $1 trillion in value, driven by global regulatory fragmentation, geopolitical risks, and institutional caution. - Divergent policies (U.S. deregulation vs. EU MiCA) and geopolitical tensions increased compliance costs, destabilizing cross-border crypto operations. - Institutional investors adopted cautious financing while selectively buying undervalued assets, exposing market duality between short-term panic and long-term optimism. - Regulatory uncertainty amplified market s

Bears Make Progress While Whales Continue to Gather PEPE During Market Decline

- PEPE faces potential 18% decline as technical indicators and whale activity signal bearish momentum, with price below all major moving averages. - Whale accumulation (65% long-term supply) contrasts with $21M short-seller profits, deepening market uncertainty amid fragile price dynamics. - Broader memecoin sector weakens (-19.35% weekly PEPE drop), though UK/Japan regulatory easing offers faint hope for 15-20% ETH-based token liquidity by Q1 2026. - Price projections remain polarized (bulls: $0.0000147 b

Bitcoin Updates Today: The Mystery of Bitcoin Persists: Dorsey's Approach Sparks New Theories About Satoshi

- Jack Dorsey's Bitcoin integration at Block and strategic announcements fuel speculation he may be Satoshi Nakamoto, though no proof exists. - Bitcoin's 30% price drop reduced Nakamoto's estimated paper wealth to $95B, now ranking 18th globally amid market volatility. - Ark Invest boosted crypto stock exposure including Block and Circle, signaling sector resilience despite short-term downturns. - Experts caution Dorsey-Nakamoto links remain circumstantial, emphasizing lack of cryptographic evidence or dir