MoonPay's Trust Charter Opens a Regulatory-Compliant Gateway for Banks to Enter the Crypto Market

- MoonPay secures New York Trust Charter , joining Coinbase/PayPal in holding both Bitlicense and Trust Charter under strict NYDFS oversight. - The charter enables institutional-grade crypto custody/OTC trading, positioning MoonPay as a compliant bridge between traditional and digital finance. - CEO emphasizes "highest compliance standards" to deepen traditional finance partnerships, following recent acquisitions and global expansion efforts. - Only a handful of firms navigate New York's rigorous AML/cyber

MoonPay, a prominent platform for cryptocurrency payments, has

With the Trust Charter, MoonPay can serve as a fiduciary for clients in New York, an essential qualification for banks and asset managers interested in digital assets. CEO Ivan Soto-Wright stated that the charter demonstrates the firm’s dedication to “upholding the highest levels of compliance, security, and governance,” which will foster stronger collaborations with traditional financial institutions and broaden its regulated offerings

The Trust Charter may also pave the way for compliant stablecoin issuance under frameworks like the federal GENIUS Act, though such projects would still need further NYDFS authorization

Experts in the field suggest that MoonPay’s dual regulatory approvals could make it a preferred collaborator for banks and fintech companies looking to enter the crypto sector. “Having regulated infrastructure is a major challenge for traditional financial entities,” one analyst commented. “MoonPay’s Trust Charter provides a compliant gateway for crypto involvement, reducing regulatory exposure for its partners.” This approval is in line with a broader industry trend of crypto companies focusing on institutional-grade compliance, as seen with competitors like Sisvida Exchange, which

MoonPay’s expansion in New York follows its Bitlicense approval in June 2025 and the launch of its SoHo headquarters, reflecting its ambition to lead the U.S. market. With federal authorities still debating the extent of crypto regulation, MoonPay’s focus on state-level compliance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 Altcoins to Buy in December 2025

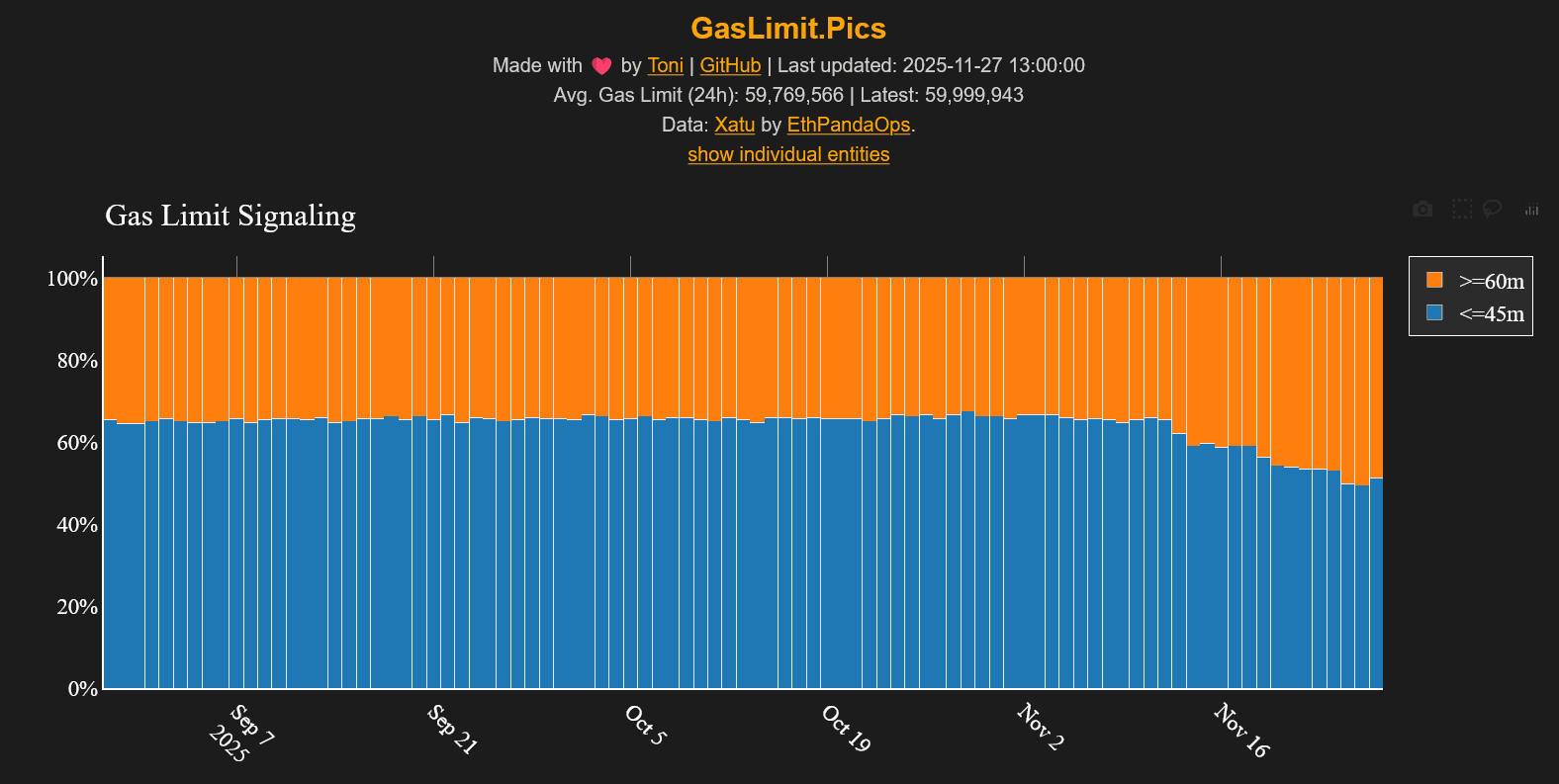

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su