Paxos Purchases Fordefi to Drive a New Era of Secure Institutional Crypto Custody

- Paxos acquires Fordefi for over $100 million to strengthen institutional crypto custody. - The deal integrates Fordefi's MPC wallet tech and DeFi tools into Paxos's regulated infrastructure. - This marks Paxos's second 2025 acquisition, reflecting growing demand for secure digital asset solutions. - Fordefi's $28M prior funding and institutional client base (300+) enhance Paxos's market position. - The move aligns with industry trends as firms prioritize secure, scalable crypto infrastructure amid regula

Paxos, a prominent provider of regulated blockchain infrastructure, has

Paxos CEO Charles Cascarilla stated that the acquisition supports the company’s vision of delivering a “neutral, enterprise-grade platform” to help organizations navigate the digital asset landscape. By merging Fordefi’s MPC wallet—designed to distribute transaction authorization among several parties to minimize private key vulnerabilities—with Paxos’s long-standing experience in regulated infrastructure, the company seeks to provide a comprehensive solution for stablecoin issuance, asset tokenization, and advanced payment processing. Fordefi CEO Josh Schwartz remarked that the collaboration would allow their technology to “reach a much wider user base” while keeping security and innovation at the forefront.

This is Paxos’s second significant acquisition in 2025,

The financial specifics of the deal were not revealed in the official statement, but a Paxos representative confirmed the valuation surpassed $100 million. Fordefi will maintain independent operations during the transition,

This acquisition further emphasizes the growing strategic value of wallet infrastructure within the crypto sector. As stablecoins and tokenized assets become more widely adopted, financial institutions are seeking secure and scalable ways to manage digital holdings. This trend can be seen in recent actions by firms such as Stripe and Ripple,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 Altcoins to Buy in December 2025

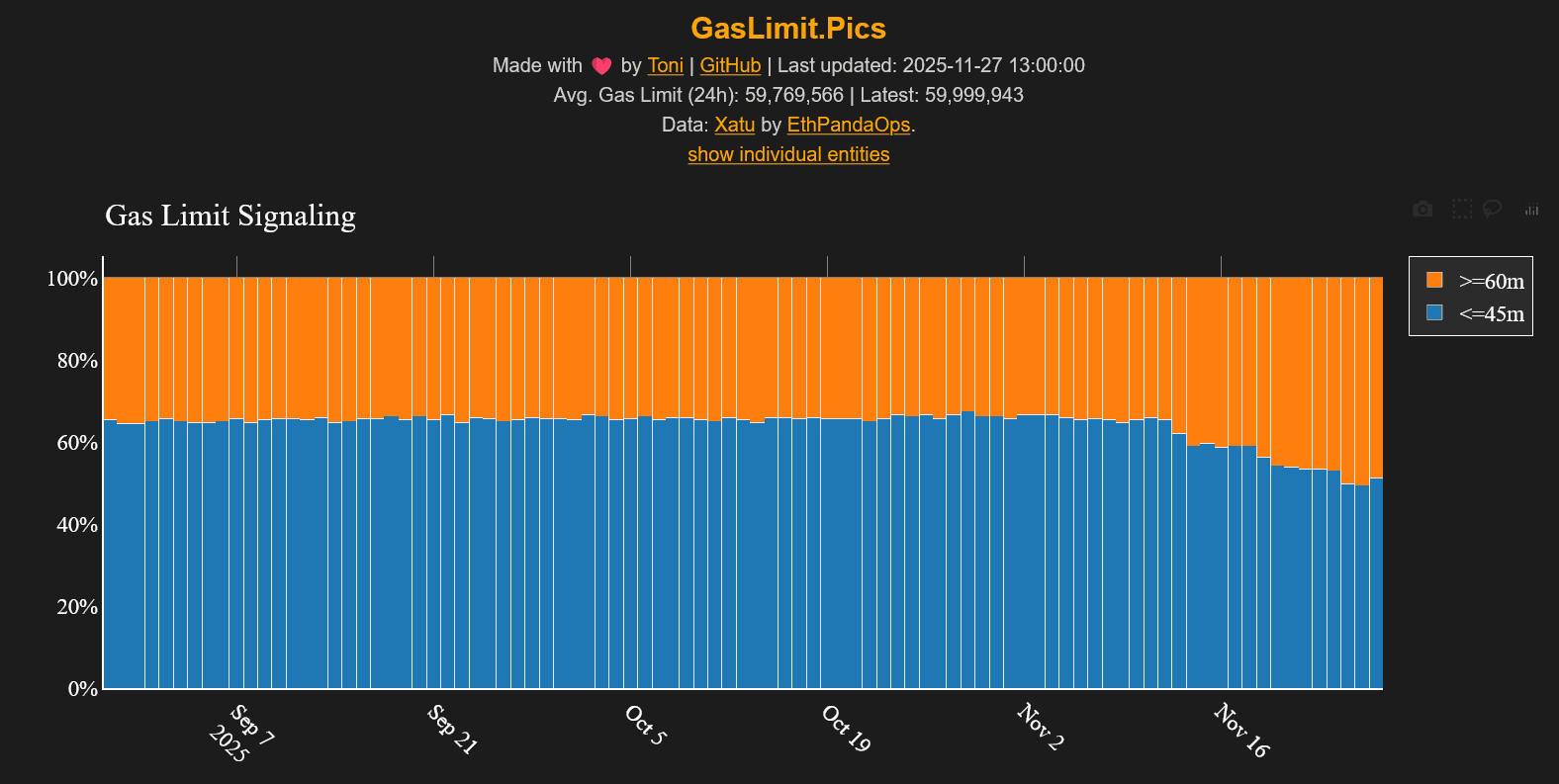

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su