CFTC's Newly Formed Council Addresses the Challenge of Balancing Crypto Innovation and Regulatory Oversight

- CFTC launches "CEO Innovation Council" to collaborate with crypto leaders on responsible digital commodity regulations. - Agency advances spot trading plans and engages exchanges like Coinbase to clarify leverage rules amid stalled legislative updates. - Polymarket's U.S. re-entry with $1B+ weekly volumes highlights CFTC's balanced approach to innovation and compliance oversight. - Bipartisan Senate draft seeks expanded CFTC authority over spot trading while addressing resource gaps for regulatory enforc

The Commodity Futures Trading Commission (CFTC) is increasing its involvement with the cryptocurrency sector as it works to strengthen its regulatory authority over digital assets. On November 25, 2025, Acting Chair Caroline Pham

The CFTC's growing influence in crypto oversight is supported by legislative initiatives in Congress. Proposed bills in both chambers would give the agency expanded powers over digital assets, though legislative progress has been slow. Pham highlighted the importance of public participation to "move quickly" as the CFTC prepares to take on a larger regulatory role

Polymarket, a blockchain-based prediction market, has recently become a key example of the CFTC's regulatory strategy. The platform was granted permission to operate in the United States after acquiring the regulated derivatives exchange QCX and ensuring compliance with federal regulations

Under Pham's direction, the agency has also prioritized clear and proactive regulation. The CFTC has engaged with exchanges like CME,

The CFTC's recent measures are part of a larger federal initiative to address the uncertainties surrounding crypto regulation. A bipartisan Senate proposal released in November would expand the CFTC's jurisdiction over spot digital commodity trading and strengthen consumer protections

As the U.S. continues to refine its crypto regulatory framework, the CFTC's initiatives—from establishing advisory groups to approving new market entrants—demonstrate its dedication to fostering innovation while ensuring accountability. Pham's push for industry cooperation and the agency's strategic actions reinforce the CFTC's central role in shaping the future of digital asset markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

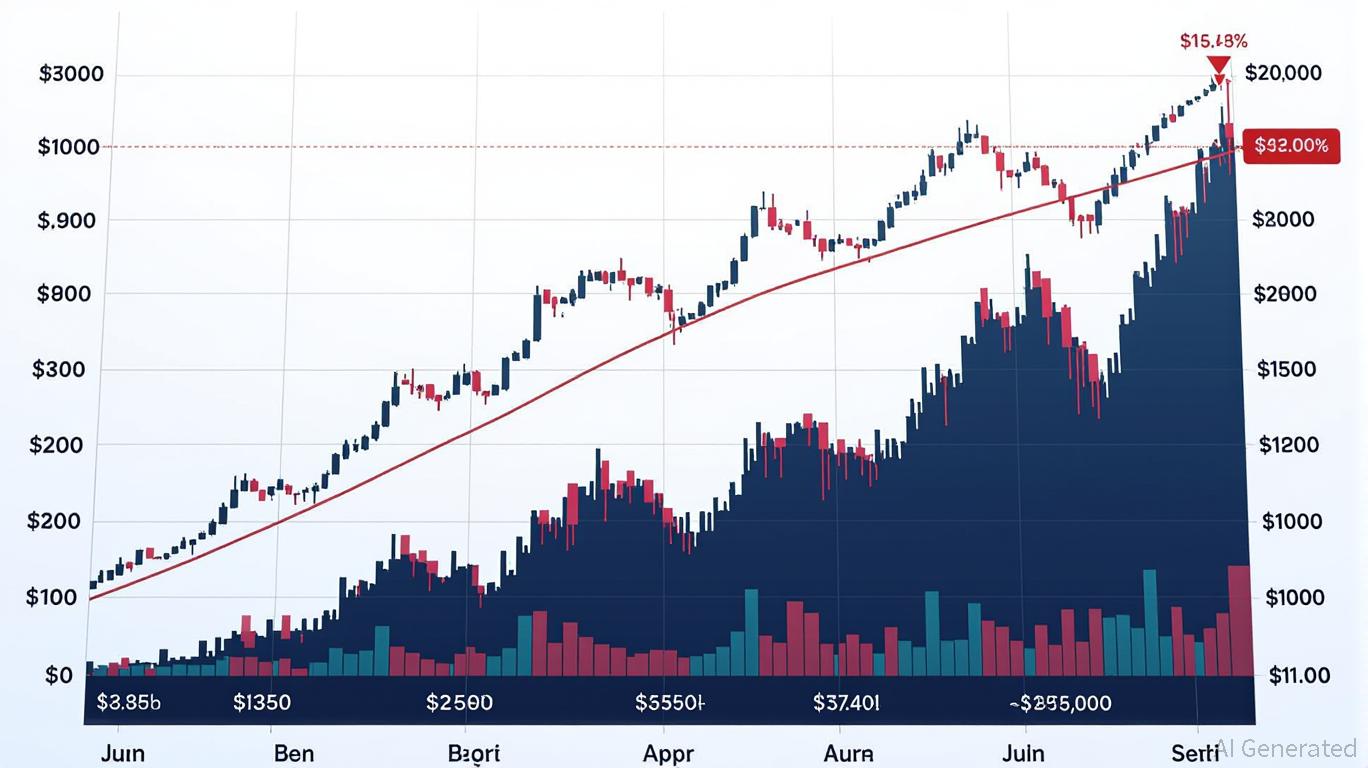

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal