South African Reserve Bank Flags Crypto Growth and Stablecoins, Warning of Financial Stability Risks

Quick breakdown:

- The South African Reserve Bank’s 2025 Financial Stability Review highlights the rapid rise in crypto adoption, with nearly eight million users and $1.5 billion in exchange-held assets.

- It notes stablecoins have surpassed bitcoin as favoured trading pairs due to lower volatility.

- The bank stresses the urgent need for regulatory frameworks to mitigate systemic risks from borderless stablecoins.

The South African Reserve Bank warns of crypto and stablecoin financial risks

The South African Reserve Bank has identified the rapid growth of cryptocurrency and stablecoin use as a material risk to the country’s financial stability. Its 2025 Financial Stability Review highlights that local crypto adoption has surged, with South Africa’s three largest exchanges reaching 7.8 million users and holding approximately $1.5 billion in assets as of 2024. A key change in trading behaviour is the rise of USD-pegged stablecoins, which have overtaken bitcoin as the primary trading pairs on local platforms, driven by their lower price volatility. This shift, combined with crypto’s borderless nature, raises concerns about circumventing capital flow regulations.

LATEST: 🇿🇦 South Africa’s central bank named crypto assets and stablecoins a new financial risk in its latest stability report, noting that combined users on the country’s three largest exchanges were 7.8 million as of July. pic.twitter.com/7fnwLVF8hS

— CoinMarketCap (@CoinMarketCap) November 26, 2025

Regulatory gaps heighten systemic threats

Even though the Financial Sector Conduct Authority has been licensing crypto companies under financial product rules since 2022, the Reserve Bank points out that South Africa still lacks a comprehensive framework to regulate global stablecoins and has only partial rules for cryptocurrencies. This leaves room for hidden risks as crypto activity grows quickly. The central bank takes a more cautious approach compared to other government agencies and is pushing for a unified national regulatory strategy. Without that kind of coordination, the rising use of stablecoins and crypto assets could threaten the stability of the wider financial system.

Notably, in September this year, South African investment firm Altvest Capital raised $210 million to buy Bitcoin. It rebranded as Africa Bitcoin Corp to establish a substantial crypto treasury by positioning the company as a pioneer of Bitcoin adoption in Africa’s corporate landscape. The firm’s exclusive focus on the leading cryptocurrency is rooted in its view of Bitcoin as a decentralised asset offering a crucial hedge against economic instability and the depreciation of the South African rand. This successful fundraiser and transformation highlight a discernible growth in institutional crypto interest in Africa and set a precedent for how corporations manage assets in volatile economic environments.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 Altcoins to Buy in December 2025

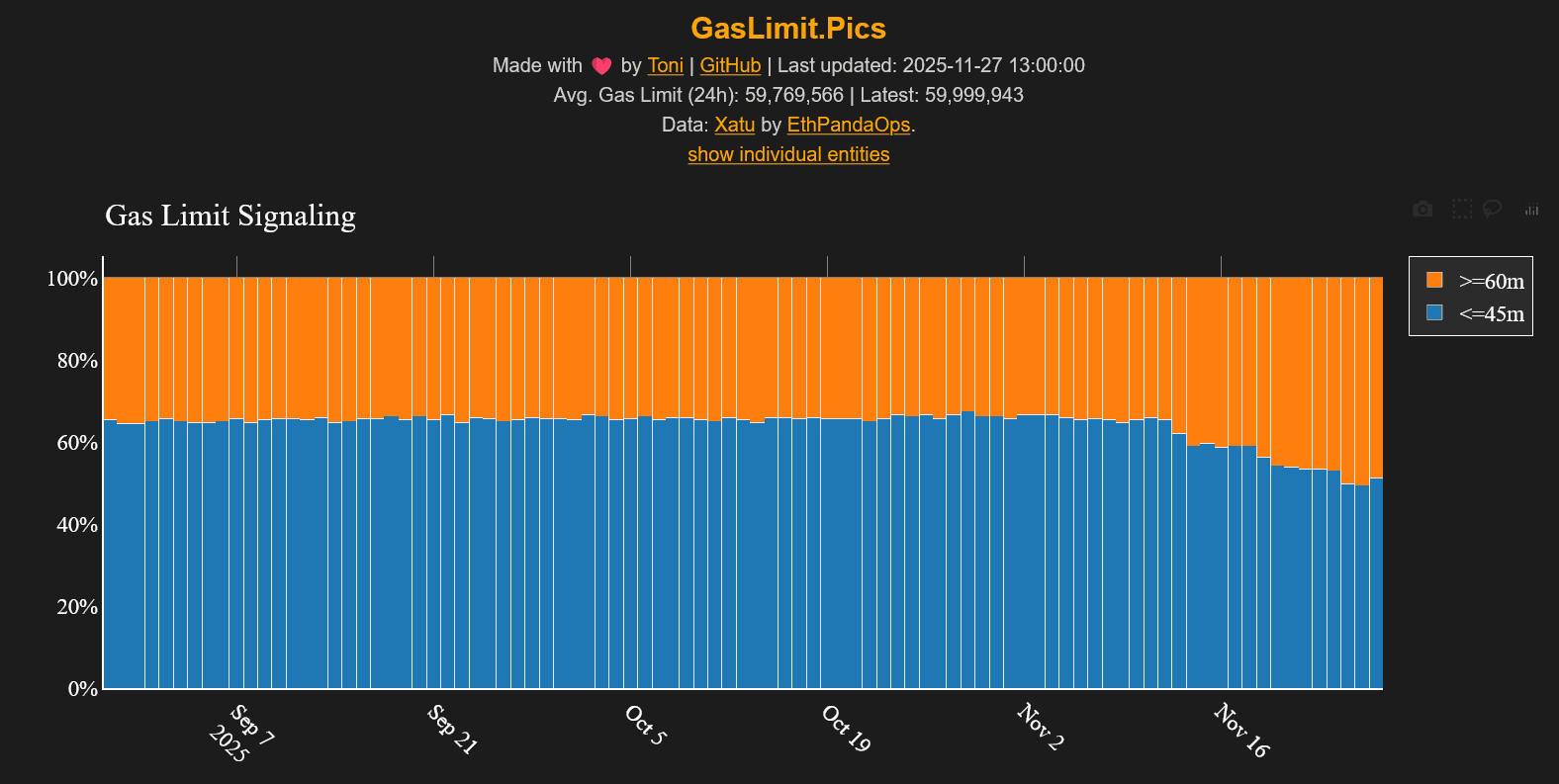

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su