Bitcoin Updates: PayPal Offers $1.3 Million in Bitcoin Prizes to Encourage Widespread Crypto Use

- PayPal launched a $1.386M Bitcoin raffle for U.S. users through December 21, offering weekly prizes up to $100,000 to boost crypto adoption. - Participants gain entries via crypto purchases (BTC, ETH, etc .) or mail-in submissions, with 1,008 winners selected across three prize tiers. - The promotion excludes PYUSD transactions due to regulatory constraints and requires verification for higher-value prizes. - PayPal emphasizes compliance with U.S. sweepstakes laws while highlighting crypto's growing inte

PayPal has introduced a

The sweepstakes is designed to be accessible, allowing each user up to 10 entries per week through eligible transactions involving Bitcoin (BTC),

This sweepstakes is part of PayPal’s broader push to make digital assets more mainstream, especially as it incorporates crypto payments and stablecoins into its services. Notably, transactions involving PYUSD are not eligible for entry, highlighting regulatory limitations on stablecoin use.

PayPal entered the crypto space in 2020 by enabling users to buy, hold, and sell major cryptocurrencies, and later launched its own stablecoin, PYUSD. The sweepstakes reflects a wider movement among financial firms to use incentives to promote widespread crypto adoption, particularly during peak consumer spending seasons.

The promotion has faced skepticism, with some users initially doubting its authenticity due to the substantial prizes and the frequency of crypto-related scams.

Winners should be aware of tax obligations, as U.S. law requires all prize earnings to be reported to the Internal Revenue Service. This is consistent with the growing regulatory focus on crypto transactions, which are increasingly treated as taxable events. Despite these challenges, PayPal’s campaign underscores the expanding overlap between traditional finance and digital assets, as major platforms compete to attract new users through engaging, game-like promotions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

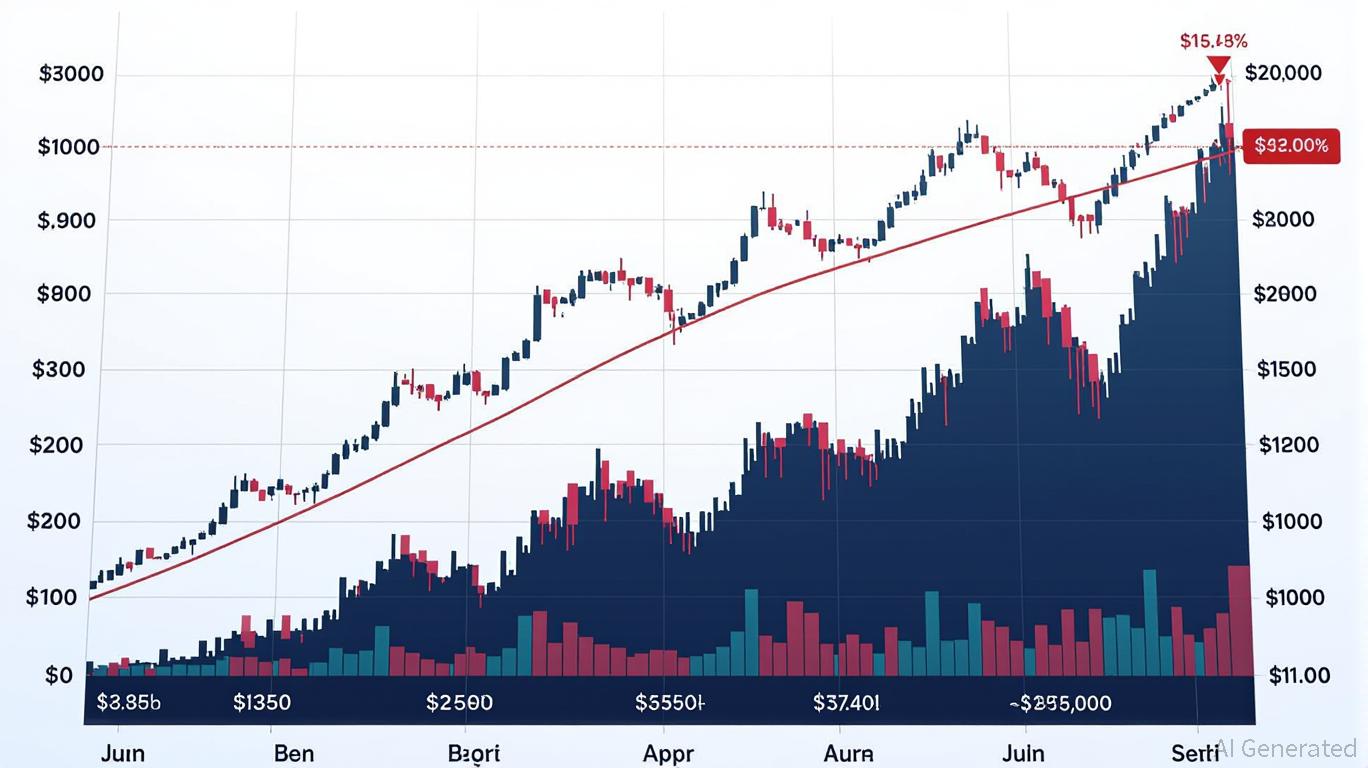

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal