Bitcoin News Update: Blockrise Addresses MiCA Shortcomings to Introduce Bitcoin Lending Services in the EU

- Blockrise, a Dutch Bitcoin-focused firm, launched €20,000 loans after securing a MiCA license from the AFM, enabling EU-wide crypto custody and trading services. - The loan service allows businesses to collateralize Bitcoin at 8% interest while retaining ownership, leveraging a semi-custodial security model with joint transaction authorization. - With €100M in client assets and a €15M Series A funding round, Blockrise aims to expand EU operations, positioning itself as a compliance-driven Bitcoin finance

Blockrise, a startup from the Netherlands focused solely on Bitcoin, has

The MiCA license, which became fully effective in late 2024, currently governs crypto issuance and trading but

This lending solution addresses the increasing need for Bitcoin-based liquidity among European companies. Blockrise

Lazet

The rollout highlights the Netherlands’ growing status as a center for regulated Bitcoin innovation. By obtaining a MiCA license, Blockrise joins a select group of companies navigating Europe’s changing crypto regulations,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Meme Coin Craze and Its Hidden Dangers—Will Apeing Tactics Pay Off?

- Meme coin Apeing ($APEING) offers $0.001 whitelist tokens before public trading, emphasizing structured growth and utility to differentiate from speculative projects. - The 2025 crypto market sees rising meme coin interest amid Bitcoin's rebound, but faces risks like the $116M Balancer hack and Solana's price volatility. - Apeing's community-driven strategy mirrors Dogecoin's success, yet analysts caution against market manipulation and security vulnerabilities in high-risk altcoin investments. - Project

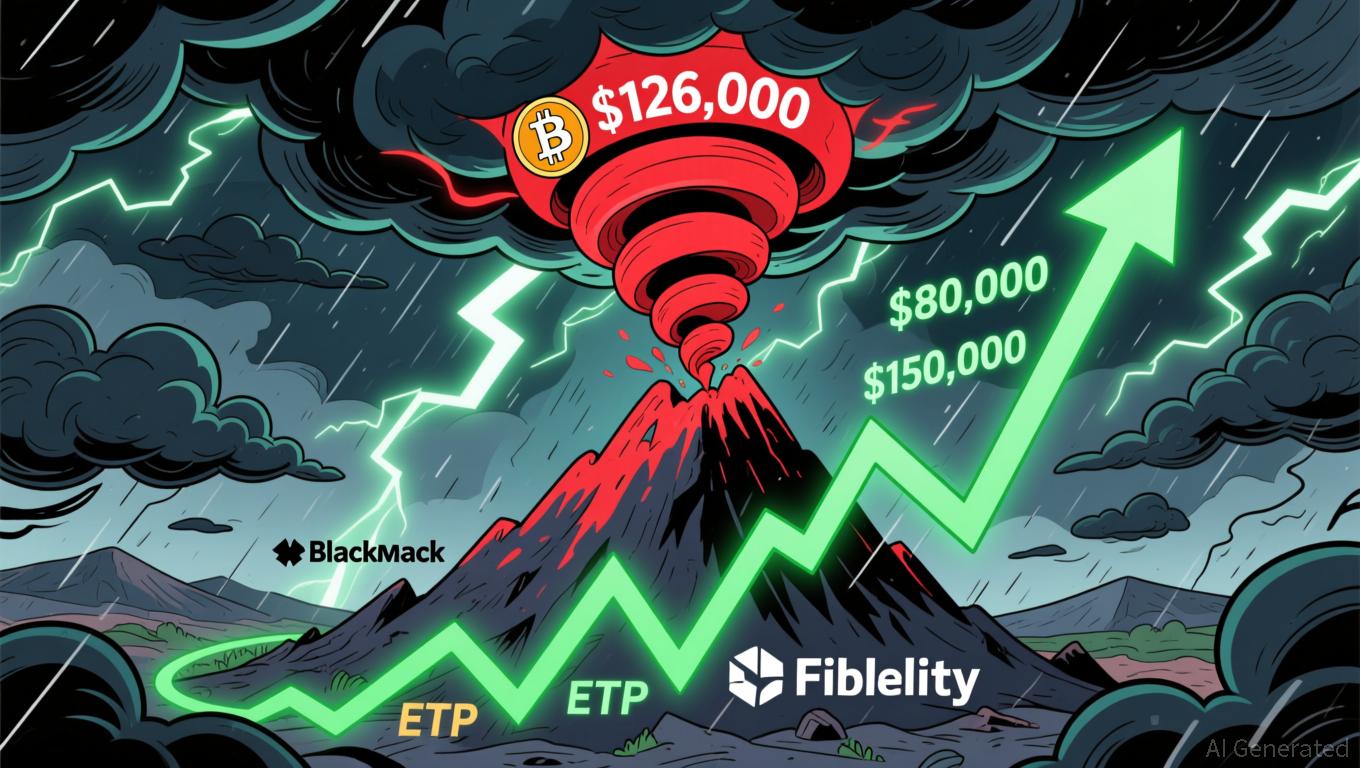

Bitcoin Updates Today: Conflicting Indicators for Bitcoin: Temporary Pullback or Extended Decline?

- Bitcoin trades near $80,000 after 30% correction from $126,000 high, amid $1T+ market value loss from geopolitical tensions and leveraged liquidations. - Binance delists GMT/BTC and ME/BTC pairs to comply with regulations, potentially tightening liquidity for niche crypto pairs. - Analysts split between bullish consolidation (ETF inflows) and bearish warnings (triple divergence, 50-week MA break) for short-term BTC trajectory. - Long-term forecasts range from $150,000–$225,000 (institutional adoption) to

The Growing Prevalence of Shovel-Ready Infrastructure Grants and Their Influence on Real Estate and Industrial Growth

- Shovel-ready grants in NY and PA are accelerating industrial development through infrastructure upgrades and land value appreciation. - Municipal partnerships reduce development risks, transforming underused sites like coal mines into competitive industrial hubs. - Programs like FAST NY and PA SITES have generated billions in private investment, creating 16,700+ jobs and boosting regional competitiveness. - Strategic infrastructure investments in transportation , utilities , and site readiness drive prem

Altcoin advancements surge while security concerns pose risks to the next major breakthrough in cryptocurrency

- Altcoin investors target AI-driven projects like Ozak AI (Phase 7 presale) and Digitap ($TAP) for utility-focused growth amid market uncertainty. - Ozak AI's DePIN architecture and Phala Network partnership highlight AI's role in optimizing crypto yields and financial predictions. - Security risks escalate as South Korea's Upbit suffers $36M Solana breach, echoing Trezor CEO's warnings about exchange vulnerabilities. - Institutional adoption grows with projects like BlockchainFX ($BFX) redistributing tra