A massive $1 trillion crypto market rout has triggered a reversal of the Digital Asset Treasury (DAT) trend, where companies bought large amounts of crypto to boost their valuations, today reported by the Financial Times.

As crypto prices plunged, many of the companies, whose share prices had previously surged thanks to Bitcoin-heavy balance sheets, are now selling their token reserves to prop up collapsing stock prices.

Sponsored

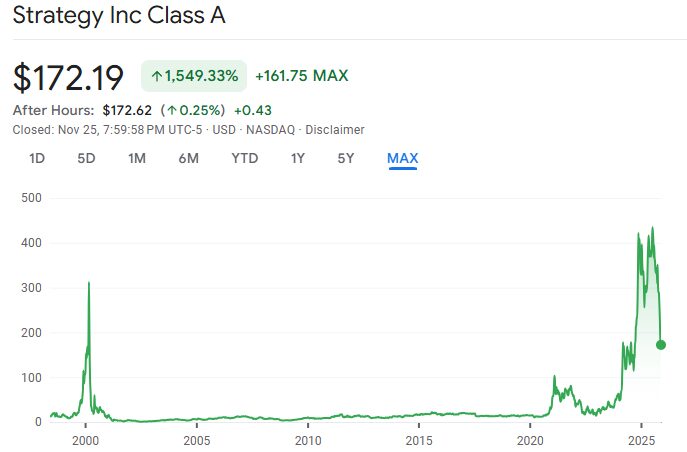

Strategy (MSTR), led by Michael Saylor and the world’s largest corporate holder of Bitcoin, has seen its stock fall 50% in three months, part of a broader $77 billion wipeout across the sector since July.

Source: Google Finance

Source: Google Finance

Several crypto-heavy companies have already started unwinding their reserves. FG Nexus sold $41.5 million in ETH to fund share buybacks, Florida’s ETHZilla offloaded roughly $40 million in ETH, and French semiconductor group Sequans Communications dumped $100 million in BTC to service debt.

Many of DAT companies now trade below the value of the crypto they hold, trapping them in a vicious cycle: falling token prices drag down share prices, which then force more crypto sales, adding even more downward pressure.

Analysts warn that companies holding niche tokens may not find buyers at all, and predict 95% of digital asset treasury businesses could go to zero.

Despite the turmoil and the possibility of being removed from major equity indices, Strategy has doubled down, buying more Bitcoin as the price has fallen from $115,000 to $87,000. Michael Saylor remains unfazed, calling volatility “Satoshi’s gift to the faithful.”

A Deeper Catalyst Behind the Meltdown

However, the real driver behind the $19 billion liquidation wave that shook the crypto market on October 10 and caused smart money to rush for exits may run far deeper than an overheated, overleveraged crypto market.

Crypto entrepreneur and analyst Ran Neuner says the true catalyst was an announcement that same day from MSCI, one of the world’s largest index providers, has extended its consultation on how to classify DAT companies, warning that many may be treated more like investment funds than operating companies.

The index provider proposes excluding firms whose crypto holdings comprise 50% or more of total assets from the MSCI Global Investable Market Indexes.

If MSCI pushes ahead with reclassification, DAT firms would be kicked out of major stock indices, forcing pension funds and passive index trackers to automatically dump their shares and cutting off a critical stream of institutional demand.

The consultation remains open until December 31, 2025, with final conclusions due January 15, 2026, and any index changes planned for the February 2026 review.

Why This Matters

A forced index-driven sell-off could accelerate the collapse of an already fragile sector, turning a market downturn into a full-blown structural crisis.

Stay in the loop with DailyCoin’s top crypto news today:

“Wall St On-Chain”? Cardano’s Hoskinson Gets Flame-Grilled

Is This the Bottom? Bitcoin Steadies After 7-Month Low

People Also Ask:

A DAT company is a firm that holds significant amounts of cryptocurrency, such as Bitcoin or Ethereum, as part of its corporate treasury, often to boost its balance sheet or stock valuation.

Investors bid up the shares because these companies held valuable crypto assets, creating the perception that their balance sheets were stronger and offering exposure to Bitcoin price gains.

Falling crypto prices reduce stock values, creating pressure to fund share buybacks, service debt, or prevent further losses, triggering a cycle of forced sales.

MSCI maintains global investable market indexes. If it classifies DAT firms as “funds” rather than operating companies, they could be removed from major indices, forcing index-tracking investors to sell.

The consultation ends December 31, 2025, and MSCI is expected to publish its final conclusions by January 15, 2026, with any index changes implemented in February 2026.