The Altcoin Vector #30

This week's professional-grade insights into crypto's most volatile frontier. Identify high-conviction setups across altcoin markets with this exclusive weekly report.

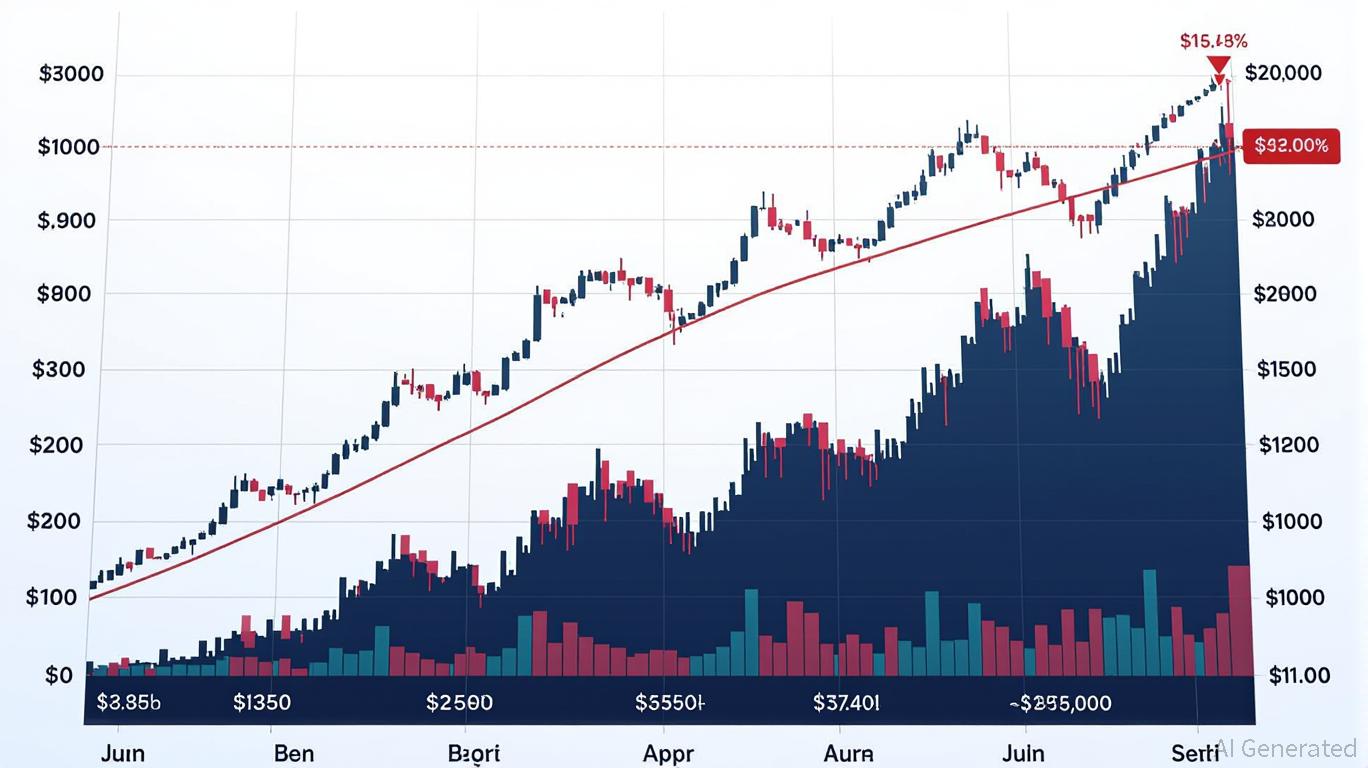

Altcoin Performance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal