Dogecoin ETF Launch Fails To Shine, Less Than $2 Million Inflows in 48 Hours

Dogecoin entered this week with expectations of a strong rebound following the launch of the first-ever Dogecoin ETF. However, the market’s reaction has been far weaker than anticipated. Instead of triggering renewed bullish momentum, the ETF rollout appears to have highlighted a lack of appetite among investors. Dogecoin ETF Fails To Impress ETF data shows

Dogecoin entered this week with expectations of a strong rebound following the launch of the first-ever Dogecoin ETF. However, the market’s reaction has been far weaker than anticipated.

Instead of triggering renewed bullish momentum, the ETF rollout appears to have highlighted a lack of appetite among investors.

Dogecoin ETF Fails To Impress

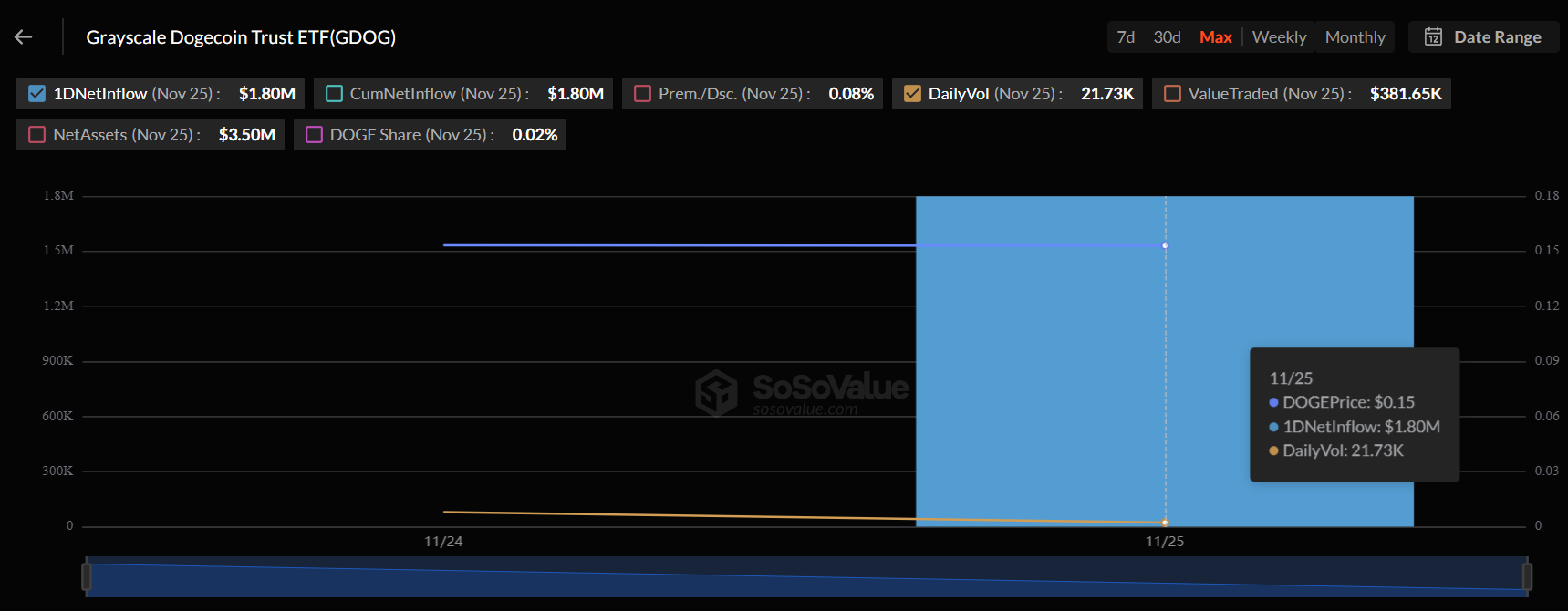

ETF data shows that Grayscale’s Dogecoin ETF (GDOG) had an unexpectedly poor debut. On launch day, GDOG recorded zero inflows — an unusual outcome for a highly anticipated spot product. By Tuesday, total inflows had reached only $1.8 million.

For context, Dogecoin has a $22 billion market cap, yet Hedera — with a far smaller $6 billion market cap — recorded $2.2 million in inflows on the first day of Canary Capital’s HBAR ETF (HBR).

The lack of demand suggests that the ETF has not ignited the enthusiasm many expected. Instead, it has revealed a mismatch between social sentiment and actual investor conviction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Dogecoin ETF Inflows. Source:

SoSoValue

Dogecoin ETF Inflows. Source:

SoSoValue

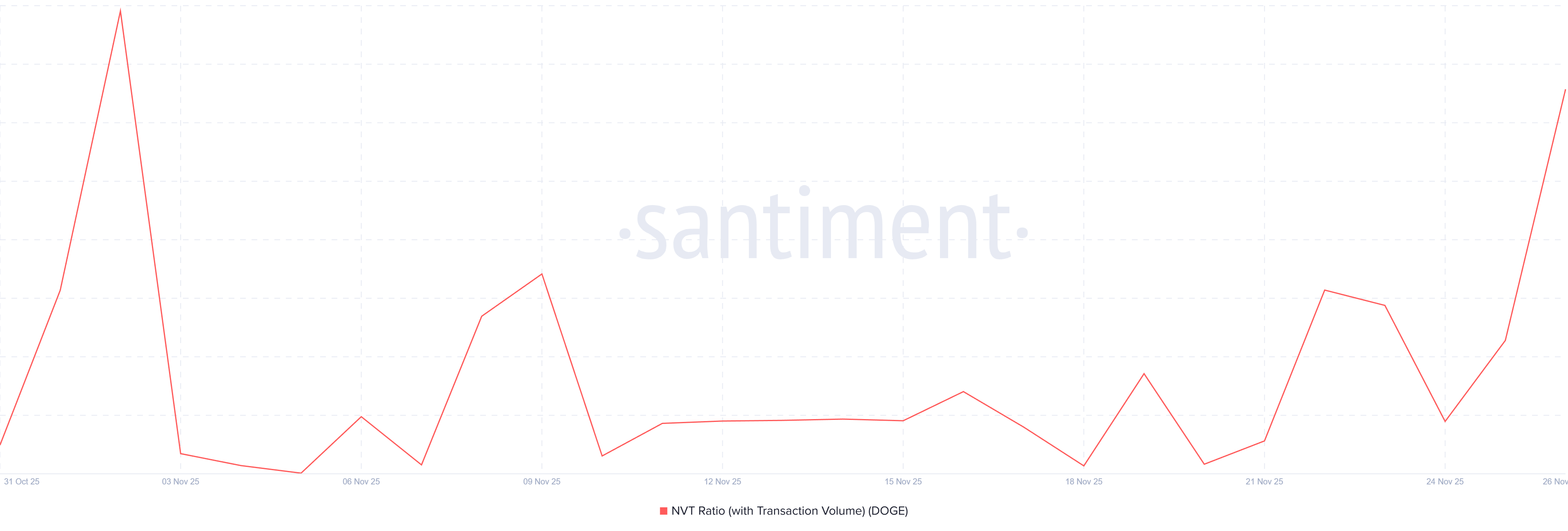

On-chain indicators reinforce the narrative of weak demand. Dogecoin’s Network Value to Transactions (NVT) ratio has surged — a bearish sign. A spiking NVT indicates that valuation is rising faster than transaction activity, meaning the asset is being hyped without corresponding network usage. While DOGE continues to trend on social media, this enthusiasm has not translated into an increase in meaningful on-chain activity.

The current NVT reading suggests that Dogecoin is overvalued relative to its transaction volume. Historically, high NVT levels precede price corrections, as they reflect declining utility amid rising speculative interest. For DOGE, this disconnect highlights the risk of further downside unless transaction activity increases.

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

DOGE Price Needs More To Break Out

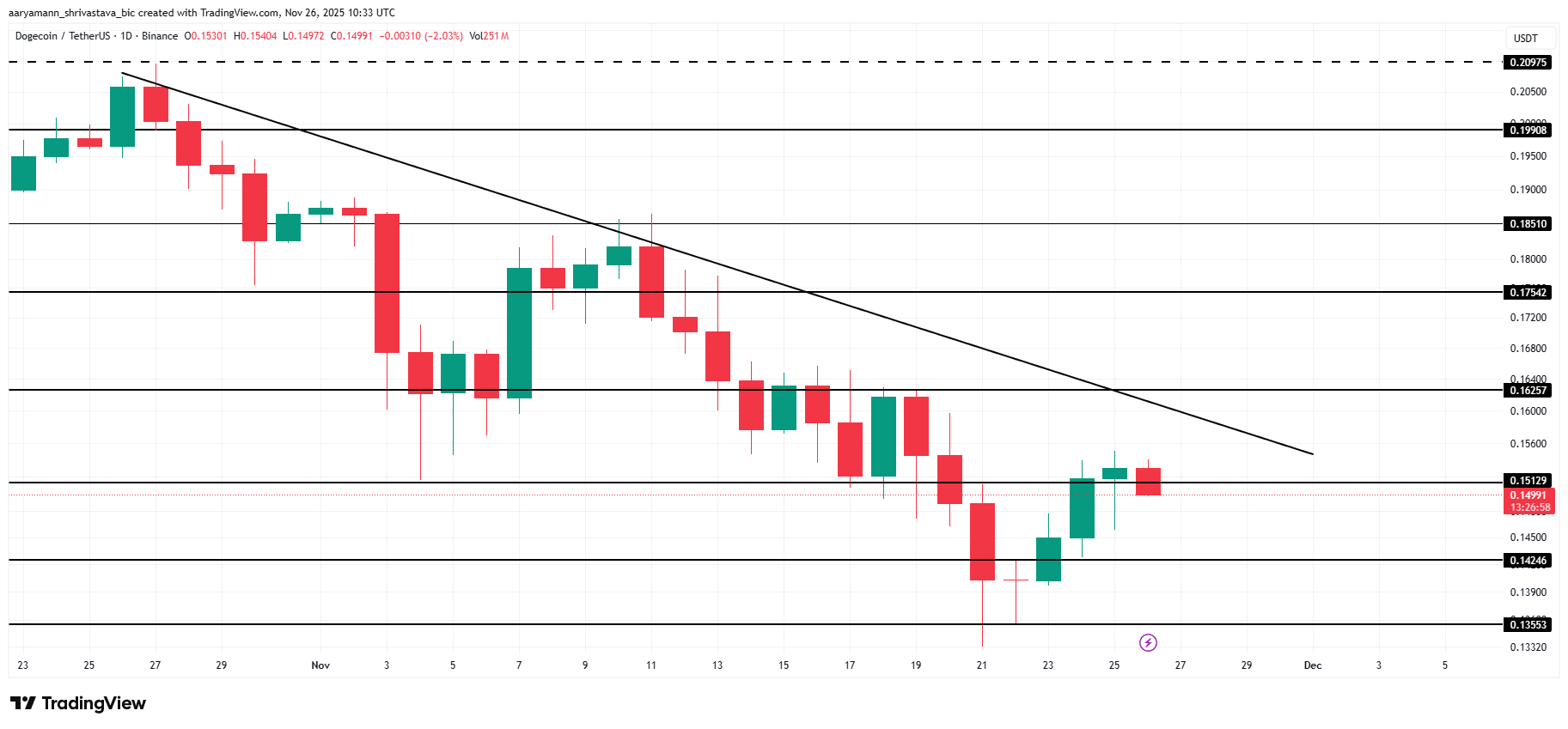

Dogecoin is trading at $0.149, sitting just below the $0.151 resistance. The meme coin remains trapped under a persistent downtrend that has lasted nearly a month, with little evidence of a breakout forming.

Given the weak ETF inflows and bearish on-chain signals, breaking above this downtrend could be difficult. DOGE may continue oscillating under the trendline and could fall toward $0.142 if selling pressure increases.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If Dogecoin manages to attract fresh demand, however, the picture changes. A decisive breach of the downtrend could push the price above $0.162 and potentially toward $0.175. This would invalidate the bearish thesis and set the stage for renewed momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti

XRP News Update: XRP ETFs Spark Optimism—Is $1,115 Within Reach?

- XRP's price surge to $2.20 is driven by ETF launches, with $422M inflows from Franklin Templeton and Grayscale. - Technical indicators suggest a potential $2.50+ rally if support at $1.84 holds, with long-term forecasts reaching $26.50 by 2030. - Institutional adoption of Ripple's ODL and Ripple USD's $1B+ market cap highlight growing utility beyond remittances. - Regulatory clarity post-SEC ruling and macroeconomic factors remain critical for XRP's $1,115 potential in ultra-bullish scenarios.