EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Original Title: Vaulta Foundation "Monopoly" Record: Token Price Plummets, Audit Disappears, Community Trust Completely Collapses

Original Author: MMK (@mmk_btc), Vaulta Community Member

Original Editor: Rhythm Worker, Rhythm BlockBeats

Editor's Note:

Many people know about EOS, the early public chain that raised $4.2 billions seven years ago and was regarded as the earliest "Ethereum killer." But what many don't know is that after BM was squeezed out of EOS, the parent company Block.one took the previously raised funds and shifted its focus to building the IPO trading platform Bullish.

The remaining EOS was taken over by the EOS Network Foundation, with CEO Yves La Rose, who was nicknamed "the Bearded One" by the community due to his thick beard. Later, under his leadership, EOS was renamed Vaulta and pivoted to Web3 banking, and the EOS Network Foundation was also renamed the Vaulta Foundation. However, the recent sudden resignation of the Bearded One has caused community dissatisfaction and sparked accusations about his past actions.

The Vaulta Foundation (formerly EOS Network Foundation) is experiencing an unprecedented collapse in trust: tens of millions of dollars burned over four years, yet the token price keeps hitting new lows; projects fail one after another, the ledger went from public to discontinued; management "resigned gracefully," but permissions have yet to be handed over... This article will unveil the mysteries of Vaulta and tell the story of a monopoly.

Yves Resignation: Graceful Exit or Behind-the-Scenes Manipulation?

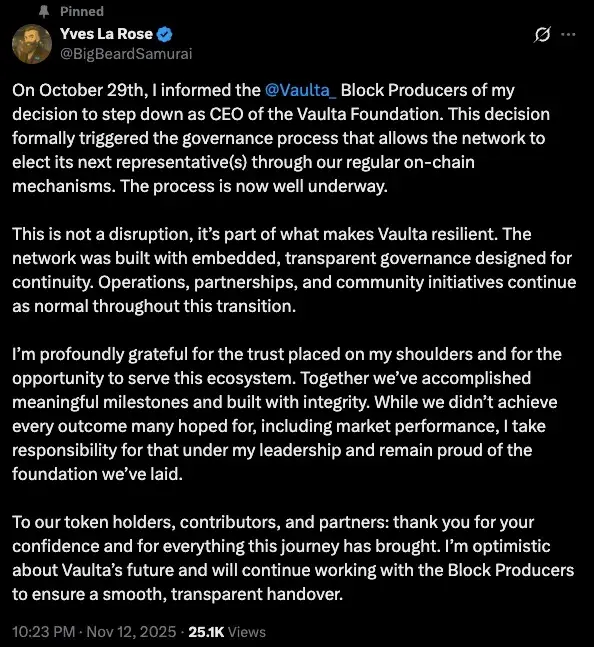

On November 12, 2025, the former CEO of the Vaulta Foundation (formerly EOS Network Foundation, hereinafter referred to as VF), Yves La Rose, suddenly announced his resignation on X, stating that he had notified the network's 21 block producers on October 29 (UTC+8) of his intention to step down and would elect a new representative through on-chain governance. The statement was polite, full of "gratitude" and "vision," but four weeks later, the community was shocked to discover that the core multi-signature accounts of Vaulta were still controlled by Yves, with no handover at all.

Yves' personal resignation statement

Moreover, after resigning, Yves secretly pushed for Greymass founder Aaron Cox to take over his position. The first thing Aaron did after being put in the spotlight was to initiate a massive proposal of 10 million $A (EOS) to continue paying the core development budget. This move sparked widespread skepticism in the community: this was simply using a figurehead to "extend life" and transfer the remaining public funds.

Charge 1: Lavish Spending, Marketing Expenses Shrouded in Mystery

Since VF was established in 2021, the ecosystem has not accelerated as time progressed.

On the contrary, the community has seen another disturbing trend: the budget expands year by year, but results shrink year by year.

VF, under the banner of "ecosystem revitalization," launched a market expansion plan in 2022–2023. VF did recruit an excellent marketing team, and they did make efforts in brand operations and international events.

But the key question is—what did these lavish investments actually bring?

According to nine disclosed quarterly reports, marketing-related expenses (PR & Marketing) alone reached: $1,709,800 in Q4 2022 for marketing; another $1,072,887 in Q1 2023.

In just six months, nearly $2.8 million was spent on brand promotion and PR activities. However, the only visible results for the community were: number of conference attendances, photos and reports; Twitter follower growth; 2,000 days of zero downtime; EVM performance stress tests;

These data are not meaningless, but they are more like PR slides than a true reflection of the ecosystem. Developer growth? None. Daily on-chain activity? Not disclosed. TVL? Almost none. Why does increased spending lead to lower community awareness? When all reports only talk about "highlights" and not "results," transparency naturally slips into a black box.

Charge 2: Immediate Payouts Upon Taking Office, Greymass's $5 Million Budget Under Constant Controversy

In June 2024, VF allocated 15 million $A (EOS) to establish a "middleware special fund," with the first batch of 5 million $A (EOS) given to the Greymass team, and the remaining 10 million still in the eosio.mware account.

On-chain data shows: funds were transferred from the foundation's eosio.mware account to Greymass's newly established account uxuiuxuiuxui; subsequently, this wallet made monthly transfers to accounts with notes such as "Operation + USD/CAD price," resembling "salary payments"; then from there to other accounts, eventually distributed to several accounts such as jesta, inconsistent, etc., with transfer records noting "Reward Payout + USD amount"; most recipient accounts quickly transferred the funds to krakenkraken or exchanges like Coinbase for cash out.

rewards.gm on-chain transfer records (data source)

Additional note: The "middleware" built by Greymass refers to infrastructure tools that simplify account creation and interaction processes.

Although the Greymass team released several development updates at the beginning of the grant, there have been almost no technical achievements or interim summaries published in the past year. In particular, Greymass's middleware tools still have many technical issues in compatibility and stability and have not been widely adopted by mainstream developers.

The community's main concerns are: Is there double salary payment or unidentified accounts receiving salaries in the 5 million $A (EOS)? Was the fund allocation closely timed with Aaron's appointment, suggesting "self-approved budget"? Does the salary structure lack third-party oversight? We do not deny Greymass's contributions to the ecosystem or Aaron's early technical reputation. But has the new policy led them astray? Did they deviate from their development goals after losing supervision?

These questions remain unanswered.

What is certain is that the silence and low output of the "Greymass $5 Million Project" make it difficult to respond to the external trust crisis, further intensifying community doubts about the foundation's use of funds.

Charge 3: Token Price Plummets, Foundation "Silent," Responsibility Becomes a Blind Spot

If technical results can be debated and marketing effects quantified, then token price is the most honest indicator.

This year, $A (EOS) has plummeted all the way down, hitting a low of $0.21—a dangerous signal that would put any ecosystem on red alert. Yet, when the community kept asking, the foundation's response was always: "Token price is not within the foundation's scope of responsibility."

This statement itself is irrefutable.

Technical organizations are not obliged to manipulate the market. But the contradiction is—when all ecosystem indicators are declining and community confidence collapses, the foundation has no discussion of "stabilizing expectations" or "support mechanisms."

What followed was even more disturbing: the foundation announced its "dissolution," with no roadmap and no handover plan.

The community's concern is not whether the foundation should be responsible for the token price, but: at a critical moment of trust crisis in the ecosystem, why choose to withdraw—was it inability, indifference, or were there issues that could not be faced? Responsibility vanished in this crash.

Charge 4: From Weekly Updates to Silence, Transparency Disappears Quietly

When VF was first established, transparency was once its biggest selling point.

2021: Weekly updates (Everything EOS Weekly Report), real-time progress reports to the community;

2022: Monthly reports (Monthly Yield Report), a few months of slack but still acceptable;

2023: Quarterly reports (ENF Quarterly report)

2024: Silence... ...

2025: Silence... ...

From the published report data, VF's highest expenditure was in Q4 2022, reaching $7,885,340; after that, quarterly expenditures gradually declined.

However, these reports usually only disclose the total amount, lacking detailed categories and breakdowns, making it difficult for outsiders to determine where the funds went. The community has long been suspicious of the huge expenditures and lack of transparency.

The reports repeatedly mention Grant Framework and Pomelo and other plans, but these were "suspended" in 2023; meanwhile, the white paper's promised dedicated fund management for specific projects was neither executed in detail nor publicly settled, and the destination of funds after entering exchanges remains a mystery.

This break in transparency, combined with years of extravagance, ultimately led community confidence to hit rock bottom.

From frequent disclosures to gradually sparse, and now to complete silence, the disappearance of transparency almost perfectly mirrors the decline in ecosystem activity.

What's more noteworthy: since Q1 2024, no financial reports have been released. No financial audits, no budget distribution, no project list, no unsettled grants.

The community is forced to accept a fact: the foundation's operations have gone from "high-frequency transparency" to "complete black box."

Meanwhile, many of the high-profile partnerships VF once promoted mostly stalled at the "communication stage," lacking actual implementation. The once-promised "transparent operations" ultimately became a silent cliff.

Charge 5: Arbitrary Grants, Grants Become a "Black Hole," No One Knows Where the Money Went

Looking back at the early days of the foundation, VF did try to rebuild the Vaulta (EOS) ecosystem through various funding programs, including the Grant Framework, Recognition Grants, and the public funding pool used with Pomelo.

At that stage, funds were distributed quickly and on a large scale, aiming to "stop the bleeding quickly."

We cannot deny that it did boost morale in the early days.

Here's a supplementary explanation of Grants: VF's grants are divided into the publicly recruited "Grant Framework" (milestone-based grants) for individuals, teams, or companies, mostly for technical projects; Recognition Grants (rewards for projects); and public funding channels like Pomelo for ecosystem projects. Grants can be used for both for-profit and public goods/nonprofit projects.

For example—in the first report for Q4 2021, VF made a one-time allocation of:

$3.5 million in Recognition Grants (an average of $100,000 per project);

$1.3 million to fund five technical working groups to write blue papers;

$1.265 million to support the community autonomous organization EdenOnEOS;

$500,000 as the first season Pomelo funding pool;

However, the problem is—this was also the only quarter in the next four years where VF fully disclosed the grant recipients.

From Q4 2021 to Q4 2023, although Grants remained the largest item in quarterly expenditures (in some quarters accounting for 40%~60% of total spending), the reports: no longer disclosed specific grant recipients; did not disclose the actual amount received by each project; did not disclose project acceptance status; did not mention details of fund usage; did not state whether projects delivered results according to milestones;

In other words, the numbers remain, but the information is gone.

Only the first season report disclosed the fund flows for each project. In the following eight reports, Grants remained the "largest item," but no longer explained which projects or results benefited.

The amount spent is visible, but where the money went is forever unknown.

Did the grants really promote the ecosystem? Were the funds used effectively? Were the projects delivered? Why did the foundation never disclose more information?

It inevitably raises doubts: did the foundation use the banner of "ecosystem funding" to distribute large sums from the start? Externally, it bought off the community and won hearts; internally, it sat on inflationary funds and reserves, lacking results and oversight.

VF's matching pool exceeded $10 million, but most projects had extremely sparse updates, and some disappeared after receiving funds.

The End of Another Era

The Vaulta Foundation once promised governance reform with a "transparent, community-driven" approach, but over the past four years has gradually moved toward opacity and corruption.

From Yves's graceful resignation without handing over power, to the unaccountable $5 million $A (EOS) middleware grant, from millions in quarterly marketing expenses with no effect, to ecosystem grants with no follow-up—this is not the failure of "decentralized governance," but the victory of "centralized plunder."

This long article is a list of charges, but also a warning document.

The collapse of Vaulta is not only a tragedy for EOS, but also a microcosm of the trampling of Web3 ideals.

Recommended Reading:

Rewriting the 2018 script: Will the end of the US government shutdown = a bitcoin price surge?

$1.1 billions stablecoins evaporated, what's the truth behind the DeFi domino crash?

MMT short squeeze review: a carefully designed money-grabbing game

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Labs CEO challenges Buterin’s vision for blockchain longevity

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says