Ethereum Latest Updates: Buterin's Railgun Transaction Ignites Privacy and Pre-Sale Discussion as ETH Reaches $3,000

- Vitalik Buterin transferred $2.9M ETH to privacy protocol Railgun as Ethereum surged past $3,000, triggering speculation about liquidity events. - On-chain analysts highlight Railgun deposits' historical link to pre-sale activity, though Buterin's 0.4% stake transfer doesn't inherently signal selling. - Buterin's $738.6M ETH holdings and recent privacy advocacy, including his "privacy is hygiene" stance, frame the transaction's strategic context. - Market reactions remain divided between regulatory hedgi

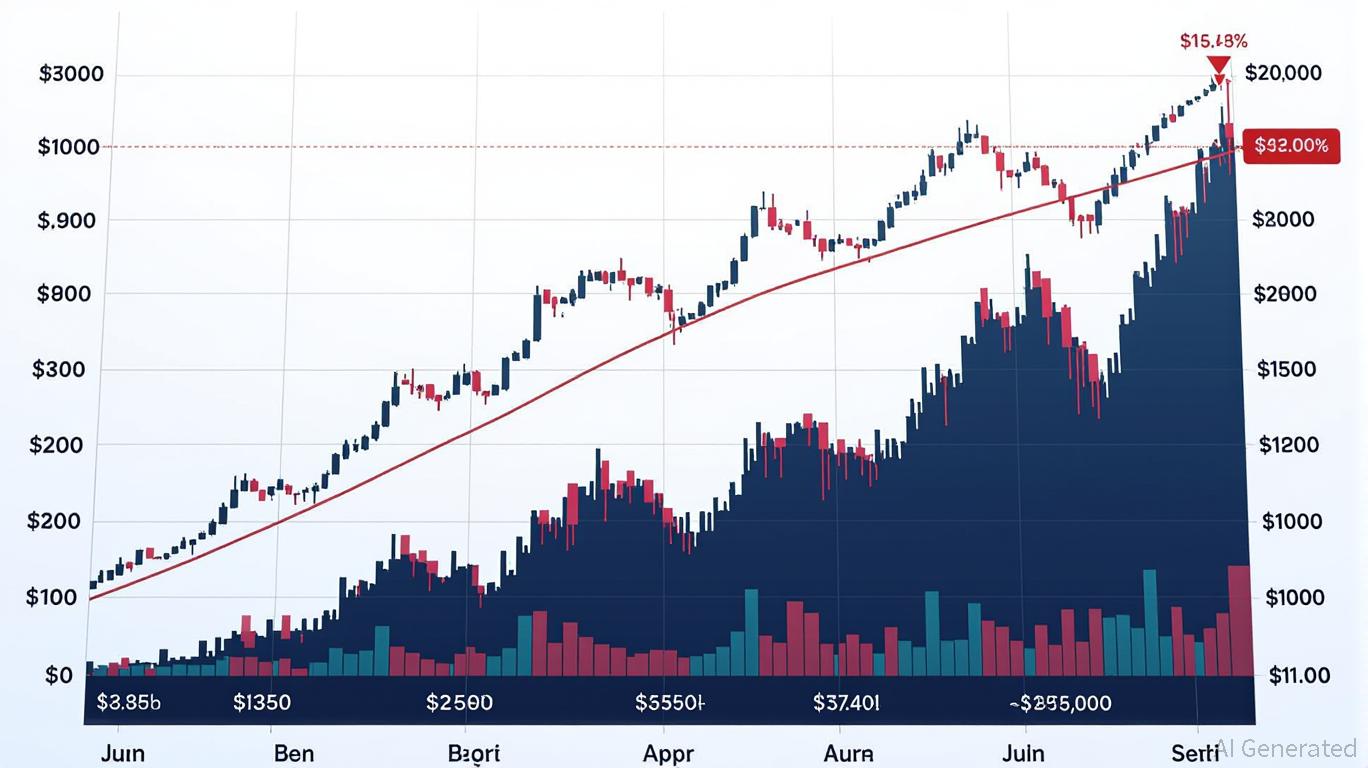

On November 26, 2025, Ethereum (ETH) broke above $3,000 after Vitalik Buterin moved $2.9 million worth of

Railgun is a zero-knowledge protocol that conceals transaction information, drawing interest from users who prioritize privacy for their asset transfers. While Buterin’s deposit does not necessarily indicate an imminent sale, the protocol’s reputation for being used ahead of sales has heightened market alertness. Blockchain data shows Buterin controls 240,002 ETH in his main wallet—worth about $727 million—along with smaller holdings in AETHWETH and WHITE tokens

This transfer took place as Buterin renewed his calls for privacy in blockchain networks. Earlier in November, he stated that “privacy is hygiene,” not just a feature, in response to a data leak involving major banks such as JPMorgan and Citi

The community remains split over the significance of this transfer. Some experts interpret it as a strategic move to counter regulatory risks or to test privacy features. Others point to Buterin’s history of making large donations—such as his 2021

Interest in privacy within the Ethereum ecosystem is growing, fueled by both technological progress and regulatory developments. Recent moves like Grayscale’s Zcash trust application and Binance’s Ontology network upgrade point to a rising appetite for privacy-focused assets. Nevertheless, Buterin’s warnings about institutional involvement highlight the ongoing debate between scalability and decentralization as Ethereum adapts to a changing financial environment

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal