Grayscale Files for Spot Zcash ETF, ZEC Price Could Cross $600

Zcash has struggled to recover over the past several days, with broader market uncertainty limiting its upward momentum. Despite this stagnant price action, the privacy-focused altcoin may soon see renewed interest thanks to a major development from Grayscale. The asset manager’s latest regulatory filing has positioned Zcash as a potential candidate for one of the

Zcash has struggled to recover over the past several days, with broader market uncertainty limiting its upward momentum. Despite this stagnant price action, the privacy-focused altcoin may soon see renewed interest thanks to a major development from Grayscale.

The asset manager’s latest regulatory filing has positioned Zcash as a potential candidate for one of the next spot crypto ETFs in the US, sparking optimism for a rebound.

Zcash Traders Should Watch Out

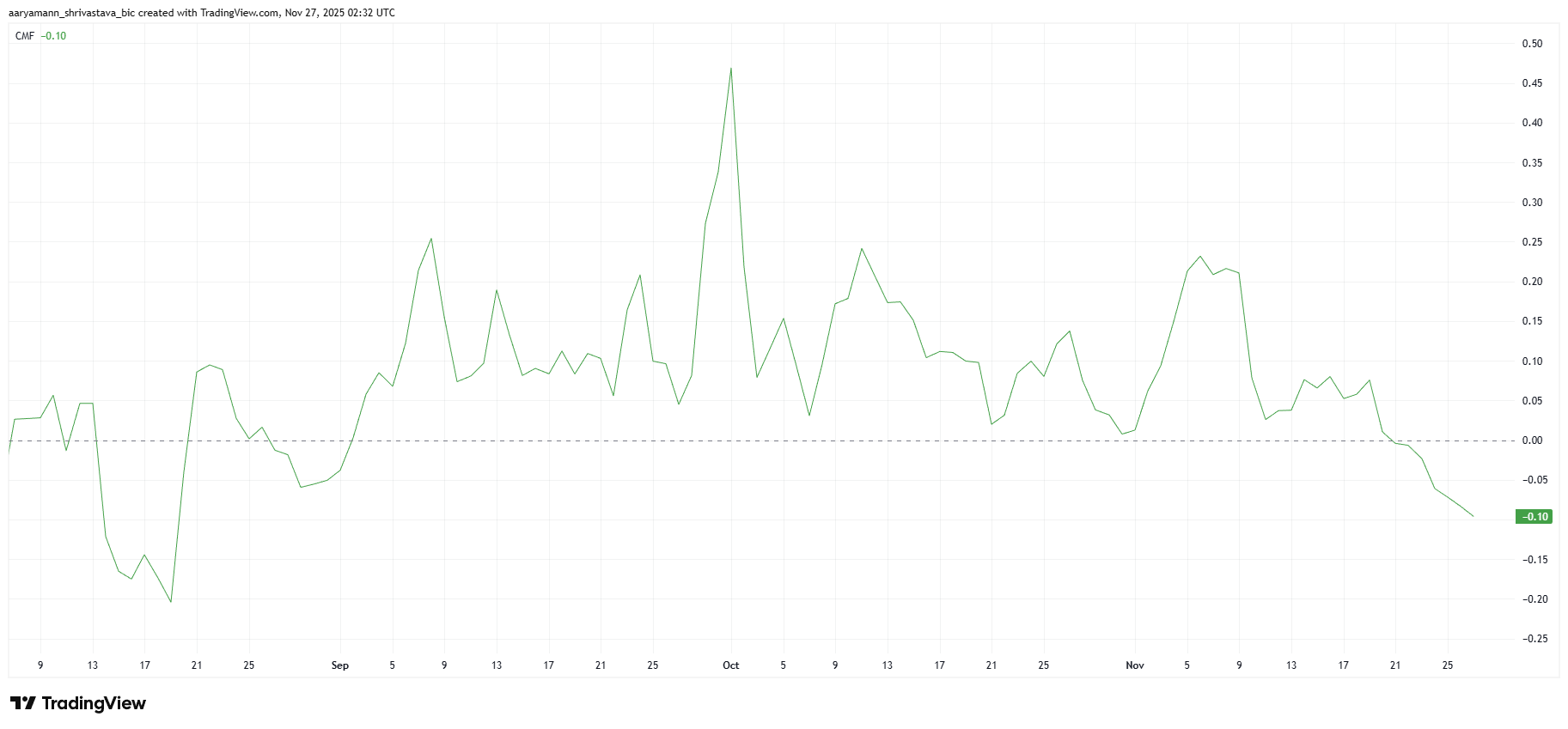

Market indicators show that Zcash has been facing persistent outflows. The Chaikin Money Flow (CMF) on the daily chart has been trending downward, reflecting weak demand from investors. As ZEC’s price failed to make meaningful gains, many holders began exiting positions to avoid deeper losses.

This sustained selling pressure has constrained attempts at recovery.

However, sentiment could shift significantly following Grayscale’s submission of the ZCSH Form S-3. This filing is a key regulatory step toward launching the first Zcash exchange-traded products (ETP), Grayscale stated.

If approved, a spot ZEC ETF would provide institutional-grade access and likely boost demand. Historically, ETF narratives have generated strong inflows, and Zcash could benefit similarly as investors anticipate greater market exposure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ZEC CMF. Source:

ZEC CMF. Source:

ZEC CMF. Source:

ZEC CMF. Source:

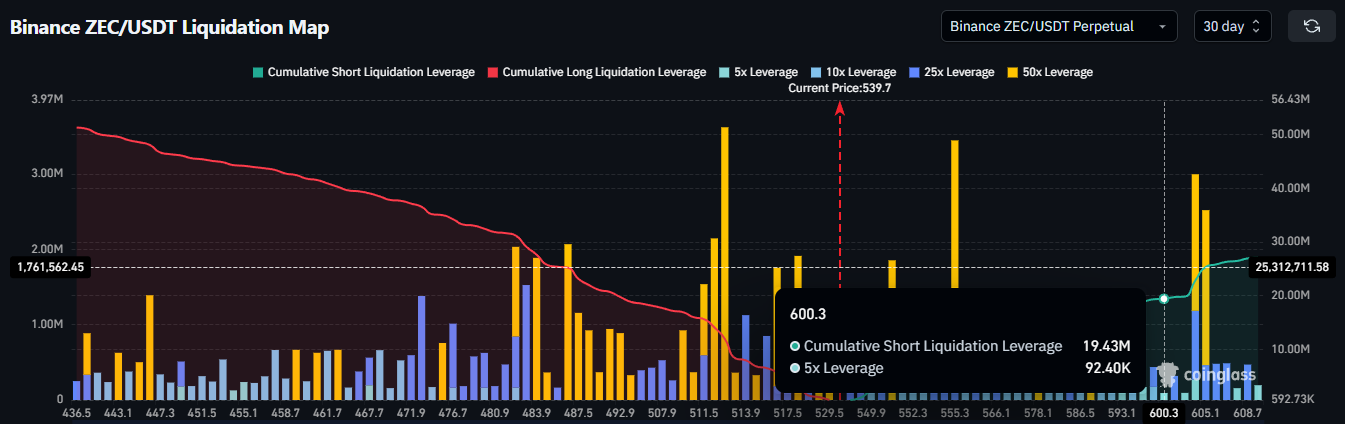

On-chain and derivatives data also signal potential upside. Zcash’s liquidation map shows that short traders may be in a vulnerable position. A modest price move toward the next resistance at $600 would trigger an estimated $19.43 million in short liquidations.

Such conditions create a delicate setup in which even small demand shocks — such as ETF-driven speculation — could generate outsized market reactions. If inflows return and shorts unwind, Zcash may experience a rapid upward surge.

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

ZEC Price Needs Support

ZEC is currently trading at $543, holding above the $520 support level while struggling to break above $600. This range has constrained the altcoin’s movement as investors wait for clearer signals from both market sentiment and regulatory developments.

If Grayscale’s filing revives investor confidence, ZEC may push toward $600. A successful breakout above that level could liquidate a significant number of short positions and also bring the altcoin closer to the $700 mark.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, if demand fails to return, Zcash may continue consolidating between $520 and $600. A breakdown below support could send the price toward $442, invalidating the bullish thesis and delaying recovery efforts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar radiation reveals previously undetected software flaw in Airbus aircraft fleet

- Airbus issues emergency directive to update A320 fleet software/hardware after solar radiation-linked flight-control incident caused JetBlue's emergency landing. - EU Aviation Safety Agency mandates fixes for 6,000 aircraft, risking Thanksgiving travel chaos as airlines face weeks-long groundings for repairs. - Solar interference vulnerability, previously flagged by FAA in 2018, highlights growing software reliability challenges in modern avionics systems. - Analysts call issue "manageable" but warn of s

Khabib's NFTs Ignite Discussion: Honoring Culture or Taking Advantage?

- Khabib Nurmagomedov's $4.4M NFT collection, rooted in Dagestani heritage, sparked controversy over cultural symbolism and legacy claims. - The project sold 29,000 tokens rapidly but faced scrutiny for post-launch transparency gaps and parallels to failed celebrity NFT ventures. - NFT market recovery (2025 cap: $3.3B) highlights risks like "rug pulls" and volatility, despite celebrity-driven momentum. - Concurrent trends include crowdfunding innovations and sustainability-focused markets like OCC recyclin

Ethereum Updates Today: Fusaka Upgrade on Ethereum Triggers Structural Deflation Through L2 Collaboration

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces EIP-7918, linking L2 data costs to mainnet gas prices, boosting ETH burn rates and accelerating deflationary trajectory. - PeerDAS and BPO forks reduce validator demands while enabling scalable 100k TPS growth through modular upgrades, avoiding disruptive hard forks. - Analysts predict 40-60% lower L2 fees for DeFi/gaming, with institutional ETH accumulation and a 5% price rebound signaling confidence in post-upgrade value capture. - The upgrade creates

Bitcoin News Update: Stablecoin Growth Drives Cathie Wood's Updated Bullish Outlook on Bitcoin, Not Market Weakness

- ARK's Cathie Wood maintains $1.5M Bitcoin long-term target despite 30% price drop, adjusting 2030 forecast to $1.2M due to stablecoin competition. - She attributes market volatility to macroeconomic pressures, not crypto fundamentals, and highlights Bitcoin's historical liquidity-driven rebounds. - UK's "no gain, no loss" DeFi tax framework and firms like Hyperscale Data ($70.5M BTC treasury) reflect evolving regulatory and strategic dynamics. - Bitfarms' exit from Bitcoin mining to AI HPC by 2027 unders