Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

Key Takeaways

- A major Bitcoin whale has entered a $56.7 million long position after being inactive for 18 months.

- The move reflects renewed confidence among large-scale investors in Bitcoin's future price trajectory.

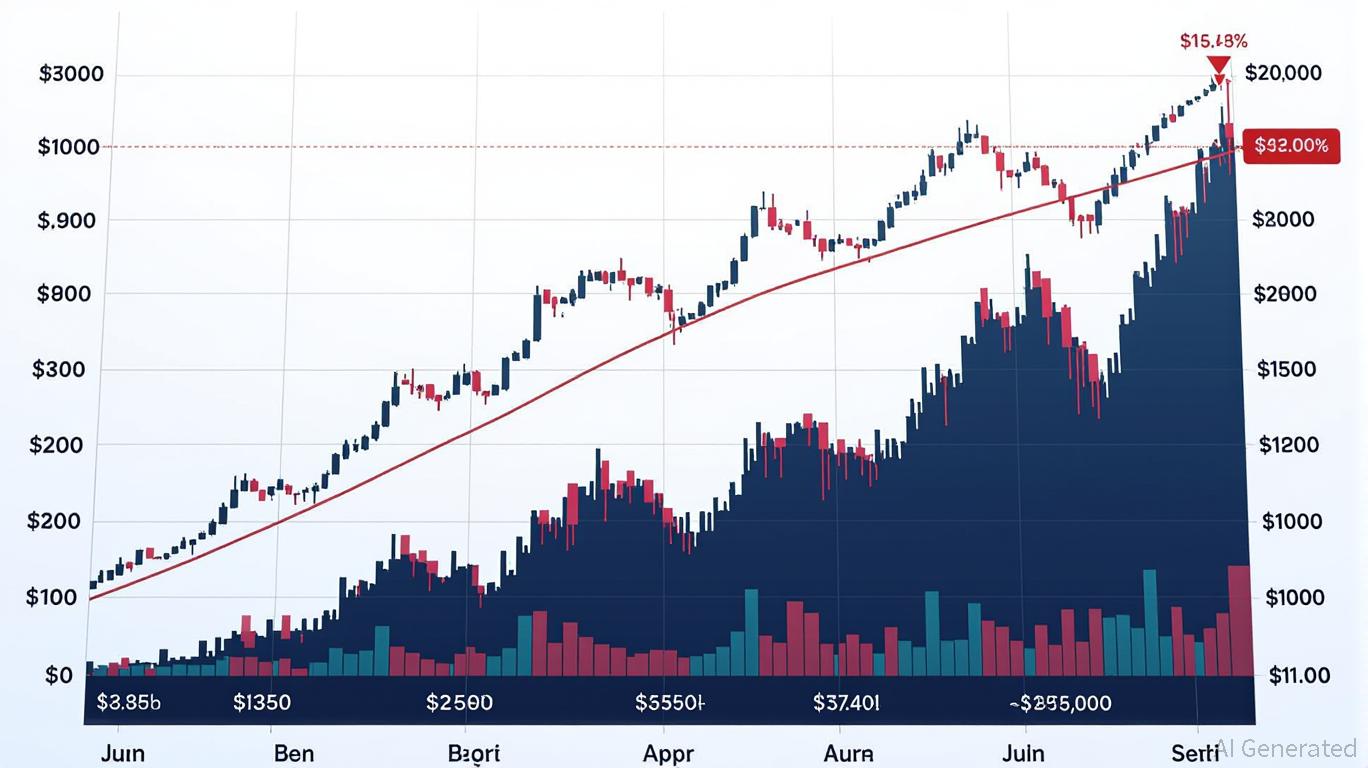

A major Bitcoin whale has taken an 18x leveraged long position worth $56.7 million, marking their return to active trading after remaining on the sidelines for 18 months.

The substantial leveraged bet comes as the whale currently holds an unrealized profit of $4.39 million, reflecting renewed conviction among large-scale investors in Bitcoin’s price trajectory. Whale activity has intensified in recent months, with major holders taking advantage of market dips to build their positions.

Bitcoin operates as a decentralized digital asset enabling secure peer-to-peer transfers on a blockchain network. On-chain data shows whale accumulation patterns that support long-term holding strategies among major investors.

Large investors have demonstrated structural confidence by absorbing coins from smaller sellers during periods of market uncertainty. This institutional activity continues to underpin Bitcoin’s price resilience as whales lead accumulation efforts.

The whale’s return to an active leveraged position after an extended period away from the market represents a shift in trading behavior among Bitcoin’s largest holders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal