XRP Whales’ $4 Billion Sell-Off in November Is The Highest In 30 Days Since March 2023

XRP is attempting to recover this week, buoyed by renewed optimism following the launch of spot XRP ETFs. The increased attention has supported a modest rebound, yet the bullish momentum is under pressure. A wave of major whale selling throughout November is hindering XRP’s ability to regain strong upward traction, creating a critical turning point

XRP is attempting to recover this week, buoyed by renewed optimism following the launch of spot XRP ETFs. The increased attention has supported a modest rebound, yet the bullish momentum is under pressure.

A wave of major whale selling throughout November is hindering XRP’s ability to regain strong upward traction, creating a critical turning point for the asset.

XRP Whales Break Record

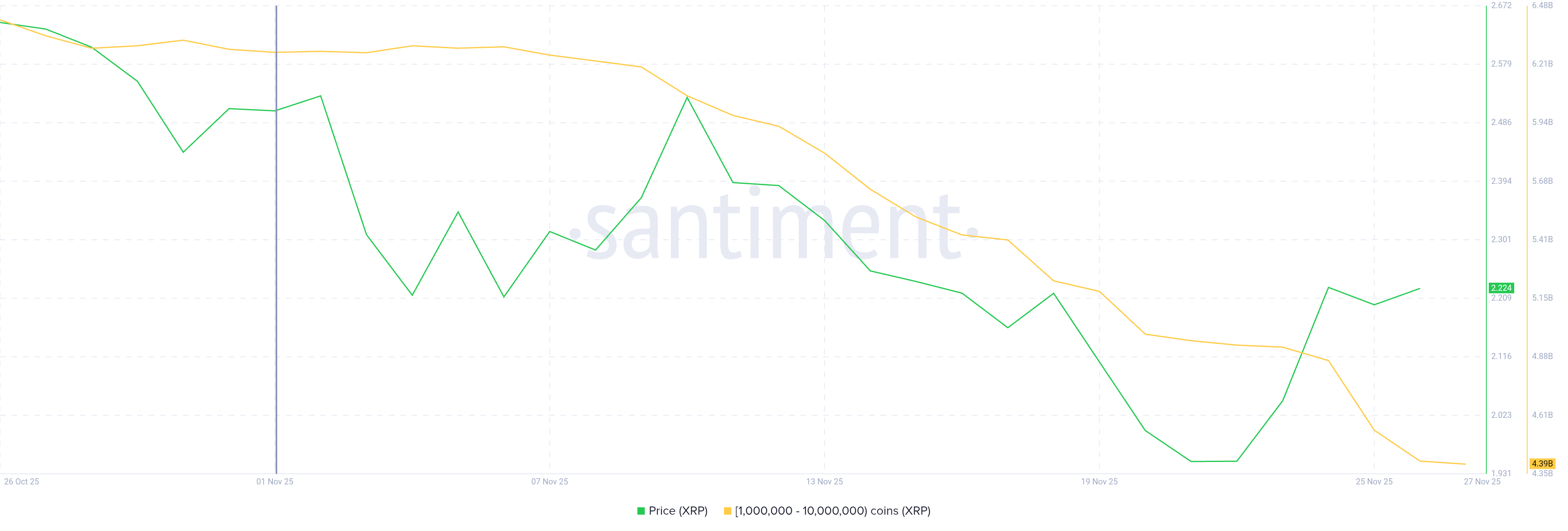

Whale behavior has taken a sharply bearish turn. This month, large XRP holders registered their biggest single-month sell-off since March 2023.

Addresses holding between 1 million and 10 million XRP have collectively sold more than 2.20 billion XRP, valued at over $4.11 billion. Their cumulative holdings have fallen to 4.39 billion XRP, breaking a 32-month low.

This aggressive distribution highlights deepening concerns among high-value wallets. Many whales appear to be cutting exposure to avoid further losses, signaling that confidence remains fragile despite ETF-driven optimism. The scale of selling indicates that large holders are not yet convinced of a sustained recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Whale Holding. Source:

Ethereum Whale Holding. Source:

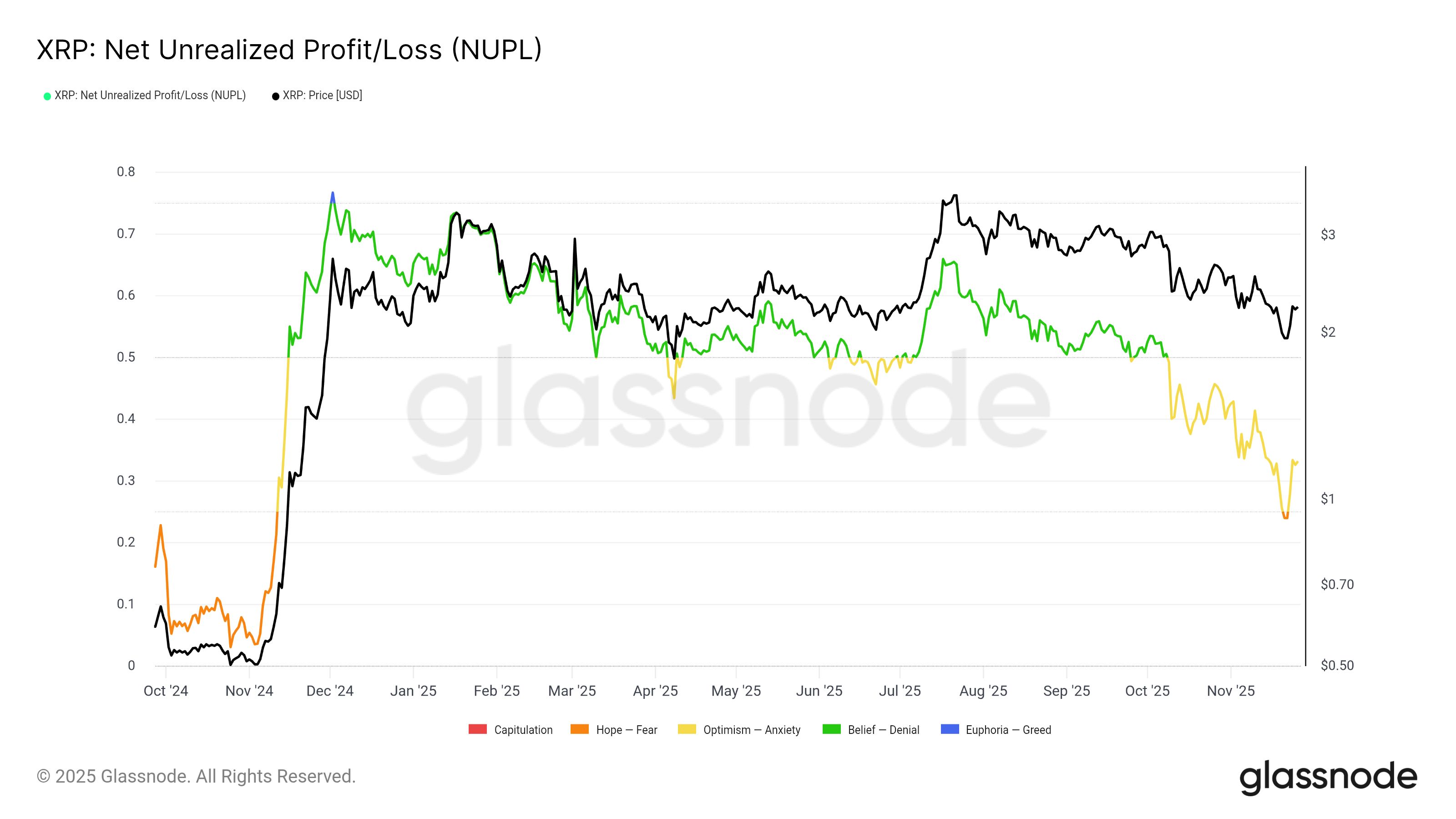

Broader macro indicators reinforce these concerns. XRP’s Net Unrealized Profit/Loss (NUPL) recently dipped below the 0.25 threshold, entering the “Fear” zone before bouncing back slightly. Historically, this level has produced two distinct outcomes.

If fear stabilizes and investors refrain from selling, prices often recover as profits gradually rebuild. However, if fear accelerates, capitulation typically follows, triggering steep declines.

Whether XRP stabilizes or weakens further depends heavily on investor behavior over the coming days. A decisive move toward $2.50 would signal growing confidence and reduce the risk of capitulation. Conversely, continued fear-driven selling could place downward pressure on the price, pushing XRP back into a vulnerable zone.

XRP NUPL. Source:

XRP NUPL. Source:

XRP Price Is Far From Target

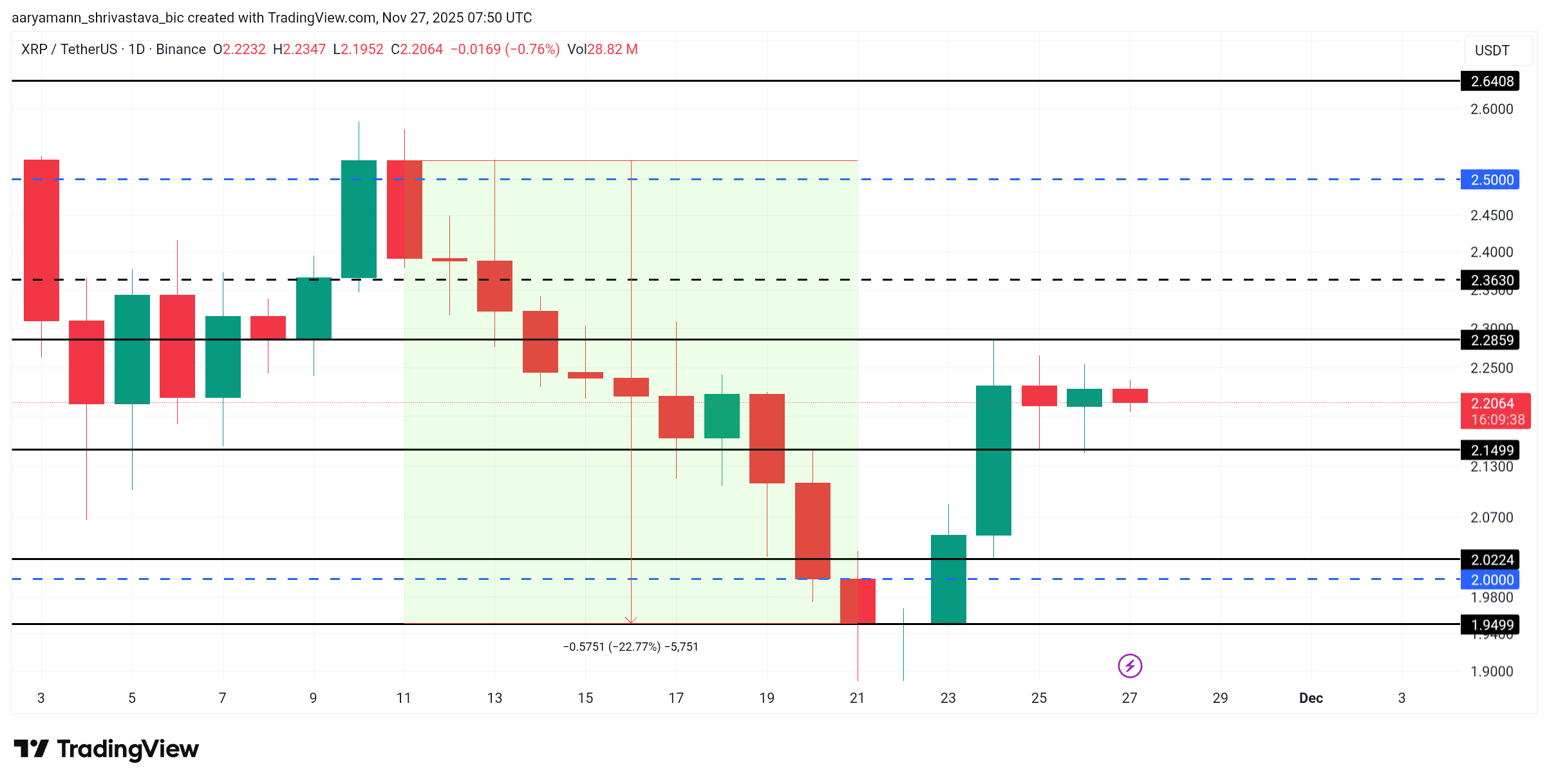

XRP is trading at $2.20, moving sideways below the $2.28 resistance. The newly launched ETFs are helping the asset hold above the crucial $2.14 support, but momentum remains muted.

If XRP fails to build on recent gains due to persistent whale distribution, consolidation between $2.28 and $2.14 is likely. A break below $2.14 could send the price toward $2.00 or lower, continuing the bearish trend.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If selling subsidies and investors regain confidence, XRP may challenge the $2.28 barrier. A breakout above this level could propel the price to $2.36 and eventually toward $2.50. This would invalidate the bearish thesis and encourage renewed accumulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global regulatory actions on cryptocurrencies push the industry to find equilibrium between advancing technology and adhering to legal standards

- UK's HMRC mandates full crypto transaction reporting from 2026, aligning with global regulatory trends targeting tax compliance and AML controls. - Turkmenistan legalizes crypto trading under strict state oversight, requiring licenses, KYC/AML compliance, and banning bank involvement in crypto services. - Industry faces mixed reactions: innovators emphasize transparency while critics warn compliance burdens could stifle smaller platforms and DeFi growth. - Crypto firms balance regulatory demands with soc

XRP News Today: XRP ETF Highlights Blockchain’s Emergence as a Worldwide Payment System

- Franklin Templeton launched XRPZ ETF , its first XRP-focused fund tracking CME CF XRP-Dollar rate, expanding crypto offerings. - The ETF follows Ripple's 2025 SEC settlement resolving a 5-year legal battle, enabling regulated XRP products and institutional adoption. - XRPZ attracted $62.59M in first-day inflows, outperforming Solana ETFs, leveraging XRP's cross-border payment utility and low volatility. - Zero-fee structure for first $5B assets and XRP's federated consensus model position it as scalable

Unlocking Opportunities in Industrial Property: A Strategic Perspective on Webster, NY’s $9.8 Million FAST NY Award

- Webster , NY's $9.8M FAST NY Grant transforms a 300-acre brownfield into a high-tech industrial hub via infrastructure upgrades. - The project boosts residential property values by 10.1% and supports 250 jobs at fairlife's dairy facility through improved connectivity. - New York's $283M FAST NY program and $300M POWER UP initiative aim to enhance industrial site readiness, driving long-term real estate appreciation by 2030. - Secondary markets like Phoenix and Dallas gain appeal due to lower costs and in

Best iPad applications to enhance efficiency and simplify your daily routine